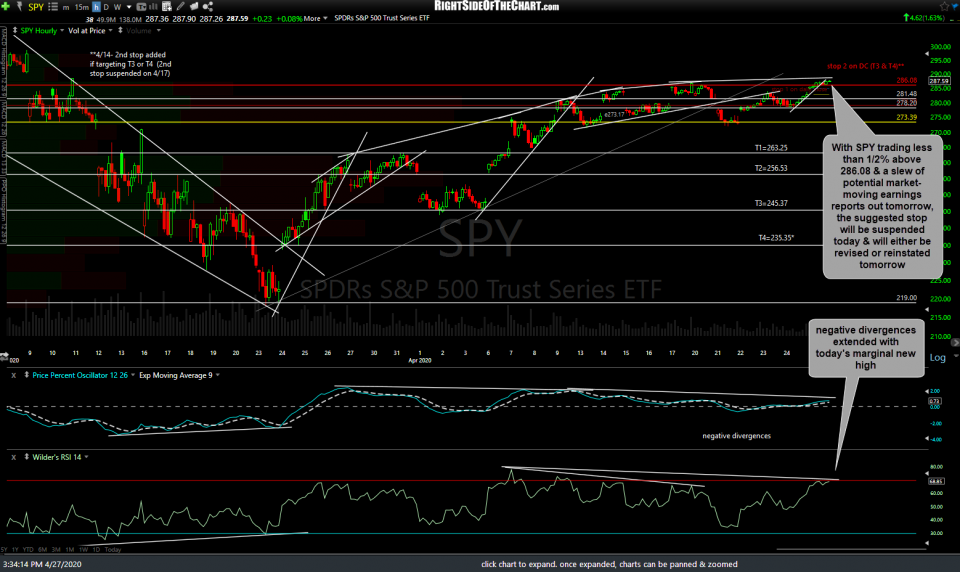

With SPY trading less than ½% above 286.08 & a slew of potential market-moving earnings reports out tomorrow, the suggested stop will be suspended today & will either be revised or reinstated tomorrow. 60-minute chart below.

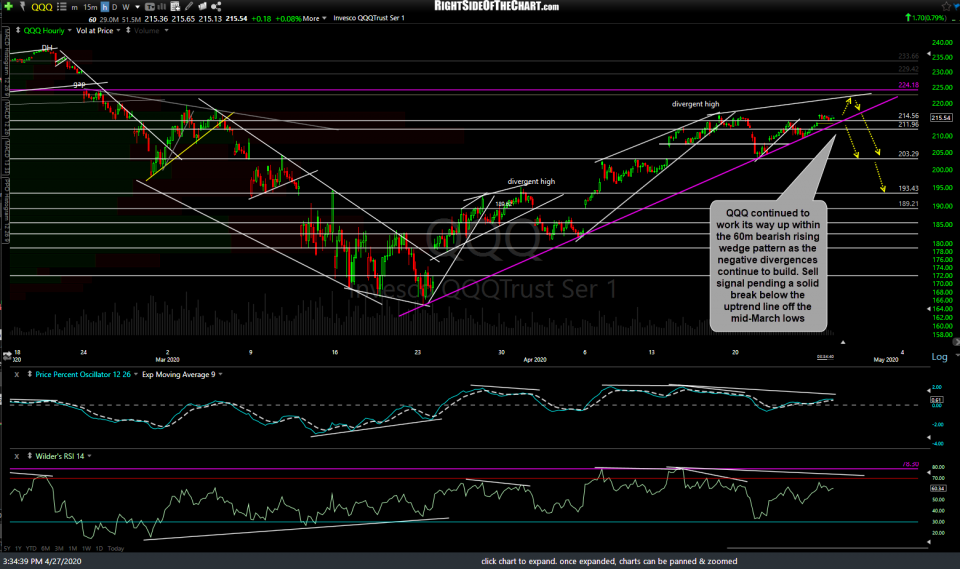

QQQ continues to work its way up within the 60-minute bearish rising wedge pattern as the negative divergences continue to build. Sell signal pending a solid break below the uptrend line off the mid-March lows.

Another reason for giving the SPY short trade a little more room is the recent divergence between the credit market, particularly LQD, JNK, & HYG (investment & below-investment-grade bond ETFs), which have been moving lower recently while equities drift higher. Up until the recent divergence, they had moved in near lock-step with the stock market. 60-minute charts below.

- LQD 60m April 27th

- HYG 60m April 27th

- JNK 60m April 27th