I had to run an errand to & just returned to my desk to find a somewhat surprisingly strong rally in the market. I haven’t had a chance to scour the headlines but at quick glance, all I see are abysmal earnings from the world’s largest bank, JPM, with profits tumbling 69% and another TBTF bank, WFC, with earnings plunging 98%. I must be missing something so I’ll post another update after I’ve caught up on the charts & any headlines that might account for a 2.35% broad-based rally in the S&P 500 & more importantly, what I must be missing that would account for the Nasdaq 100 rallying 3% to come within 12% of its all-time high from Feb 19th.

I understand that generally speaking, tech companies tend to carry lower levels of debt & are less impacted by the social distancing & stay at home orders but the last time I checked, the Nasdaq 100 & tech stocks, in general, have always fallen in lock-step, if not more, than the broad market during recessions as their business model is every bit, if not more, sensitive to consumer spending & the business cycle as the most of the sectors & stocks within the S&P 500.

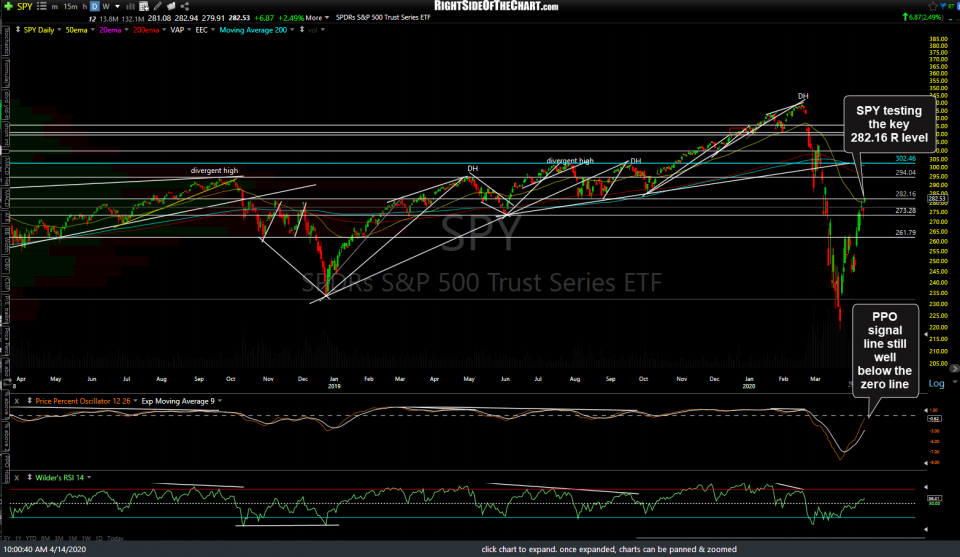

We could be looking at a buying climax although it’s too early to say just yet. As of now, SPY is testing the key 282.16 resistance level while still well below both the key 200-day exponential & simple moving averages with nearly all of my trend indicators, from long-term to short-term, still bearish.

The tech-heavy QQQ has regained the cluster of key moving averages (200-day EMA, SMA + the 50-day EMA) and is currently testing the 61.8% Fibonacci retracement level.

Why might that be significant, you might ask? Great question: The first major bear market rally in the 2007-2009 bear market was capped at the 61.8% Fibonacci retracement level, followed by another 51% drop from there. Not to mention that the first minor bear market (~9% rally in Nov/Dec 2017) was also stopped cold at the 61.8% Fib retracement level. The first minor bear market rally during this bear market (Feb/March), was capped around the 50% Fib & was good for a 10.8% bounce. This first major bear market rally at the 61.8% Fib has accounted for a 27% gain so far with that first major bear market rally from late March to early June 2008 posting a gain of just over 23%, which meshes with my “Super-Size” bull market/bear market theory (the bigger the preceding bull, the bigger the corrections within that bull as well as the waves within the subsequent bear market).

Okay, but comparing the end-points of current first minor & major bear market rallies to the first minor & major bear market rallies of the previous bear market could just be chalked up to coincidence, right? Maybe, however, the first major bear market rally in QQQ during the 2000-2002 bear market was also capped at the 61.8% Fibonacci retracement level, twice, with QQQ plunging another 81% from there. History doesn’t always repeat… but it often rhymes.