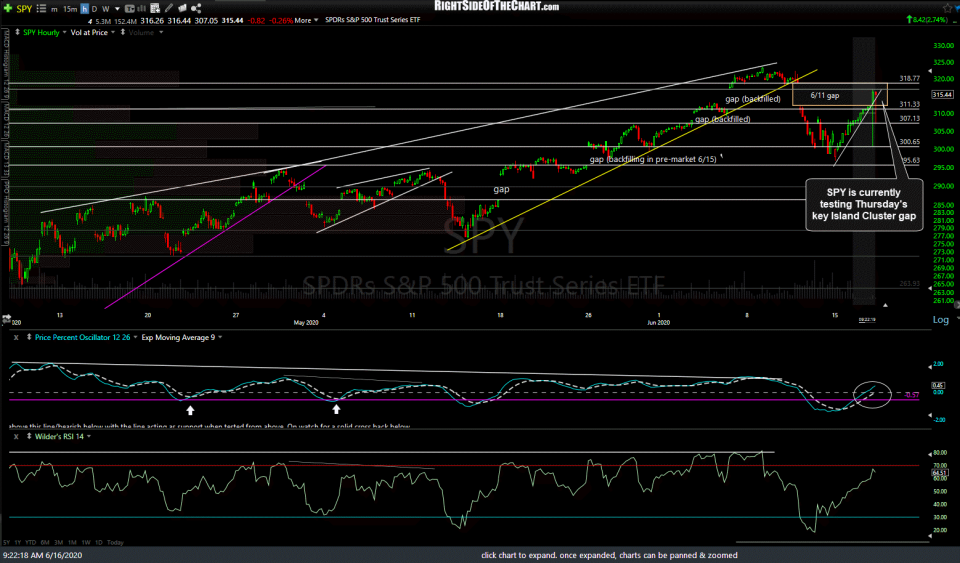

SPY is currently testing Thursday’s key Island Cluster gap in pre-market trading with any solid move back above the recent Island Cluster Top pattern to invalidate that as a reversal pattern although SPY remains solidly below the uptrend line off the May 14th lows for now. 60-minute chart below.

QQQ is testing Thursday’s gap, still pending a sell signal on a break below the blue uptrend line as well as confirmation via breakdowns on the FAAMG stocks. In addition to the recent successful test & reversal off the uptrend line generated off the early April lows, QQQ also made a successful backtest of the -0.55 bullish/bearish trend delineation level by the PPO signal line (9-ema) with the PPO signal line still in bullish territory. As such, the story remains the same: Until & unless the market-leading FAAMGs stocks & tech sector break down, last Thursday’s sell signals remain questionable although still intact as of now. 60-minute chart below.

/ES has rallied to within 0.6% of the 3175 R level with small divergences on the PPO while both SPY tests the significant gap from Thursday’s sell signal/Island Cluster top.

/NQ took out the 9795 resistance level, remaining above the uptrend line, & is currently testing the 10000ish resistance level with negative divergences in place for the first time since the divergent low that was the technical catalyst for this rally. Although the current negative divergences are small, the current uptrend line is very steep & as such, a failure here at resistance followed by a solid breakdown below the trendline is likely to spark a fairly swift drop & trigger the next sell signal on the tech-heavy $NDX as well as the broad market.

Bottom line: This is a key battleground between bulls & bears here as the sell signals from Thursday still remain intact for now although would begin to be called into question, should the market continue to advance much from here.