Today would be a good day for a video but unfortunately, my wife brought home the gift of ‘rona or the flu from a biz trip she returned from on Friday & it came on for me like a ton of bricks yesterday with a bad cough to boot. As such, this will be the first of several updates with chart screenshots, then back to bed.

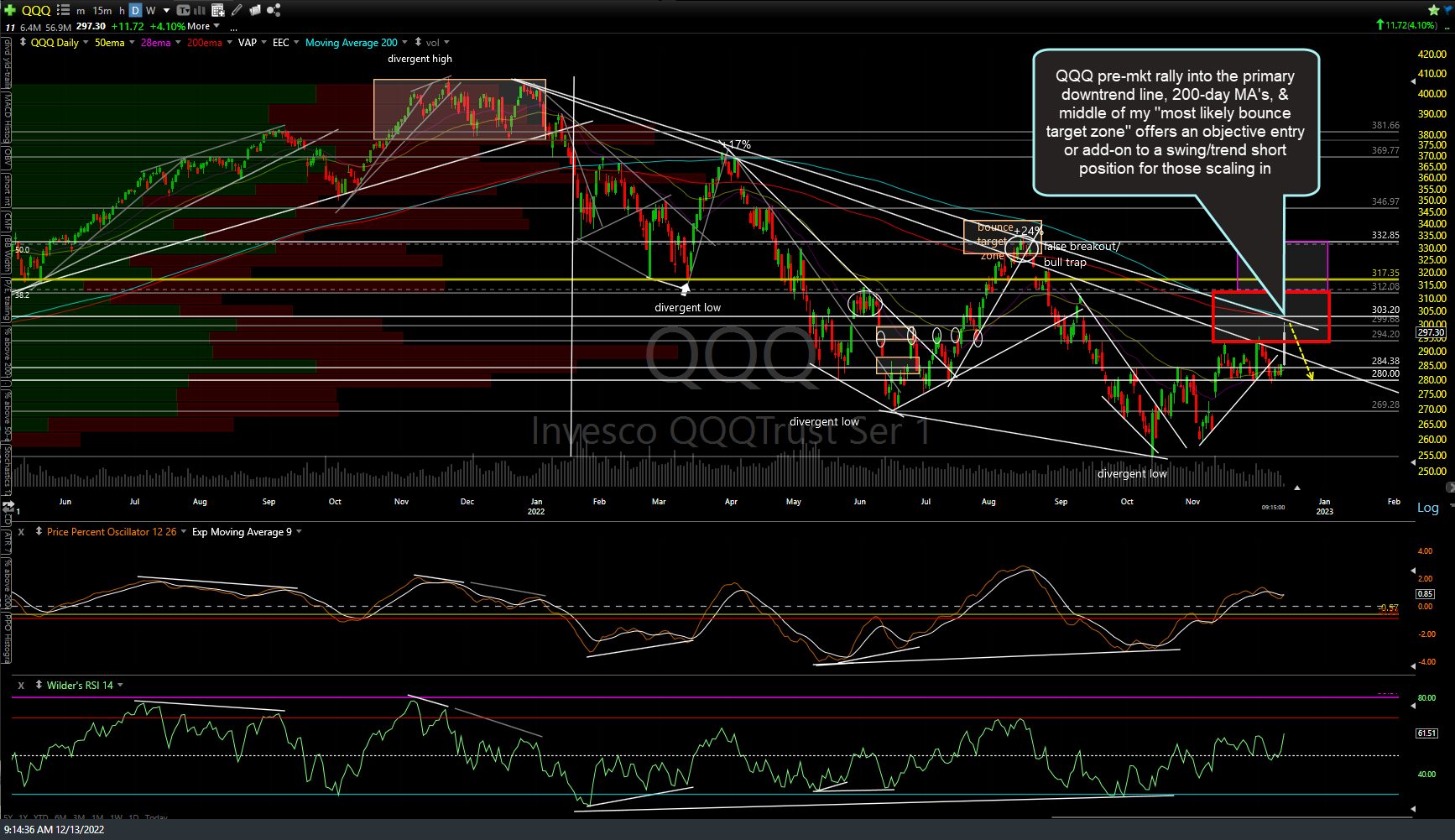

In the wake of the cooler-than-expected CPI, QQQ has made a pre-market rally into the primary downtrend line, 200-day MA’s, & middle of my “most likely bounce target zone” offers an objective entry or add-on to a swing/trend short position for those scaling in. Of course, we still have the much-anticipated & potentially market-moving FOMC rate decision tomorrow at 2 pm so expect continued volatility & increased chance of whipsaws through tomorrow. Daily chart below.

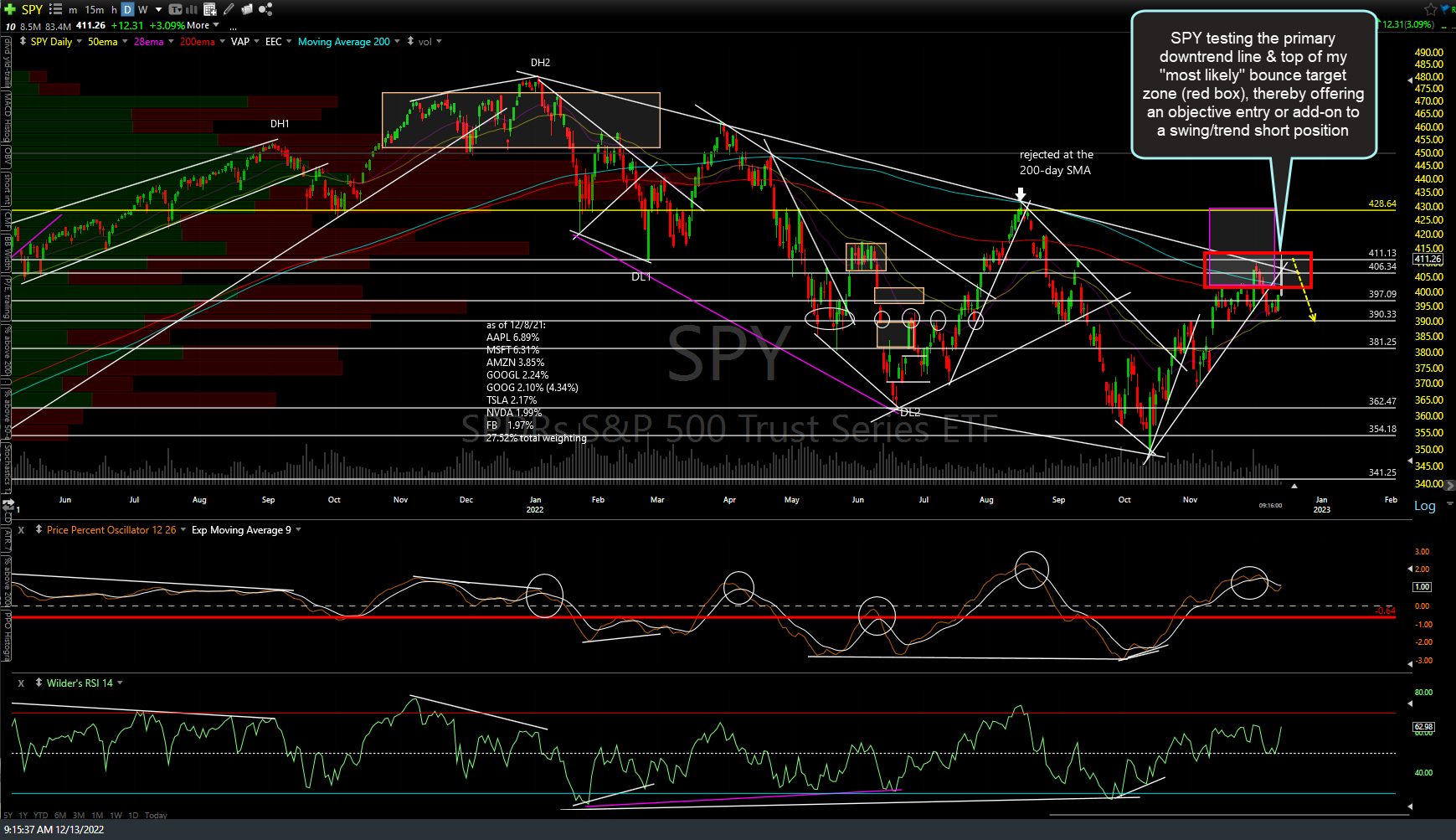

SPY is also testing the primary downtrend line & top of my “most likely” bounce target zone (red box), thereby offering an objective entry or add-on to a swing/trend short position.I think this is also an objective level for active traders to fade the gap with a pre-market short of stock futures or ETFs for a quick pullback trade. Daily chart below.