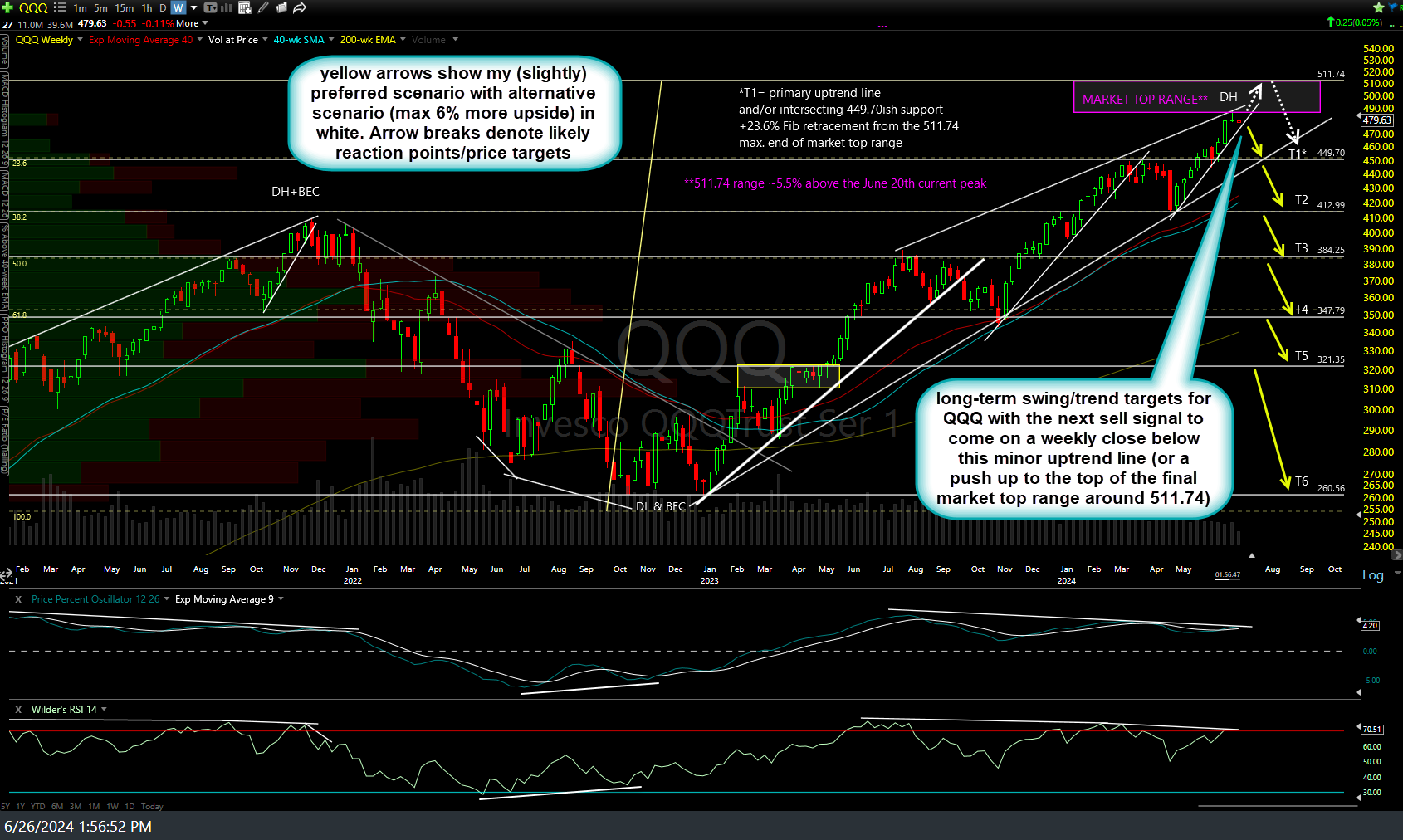

As covered in one of the videos earlier this week, I have identified a potential & likely end point for the uptrend off the Oct 2022 lows using a combination of last Thursday’s bearish engulfing candlesticks on the daily charts of SPY, QQQ, NVDA, & SOXX along with Fibonacci retracement & projection tools as well other indicators & technical tools, with the highs of last Thursday marking a potential end of the bull run and the bottom of my relatively small “topping range” which runs about another 4½% above Thursday’s highs on QQQ and about 6% higher on SPY.

Only time will tell if these relatively tight ranges will prove to be the starting point of the next major leg down although I do believe there is and has been a growing mountain of both technical & fundamental evidence to help support that case. Either way, here are my current long-term swing/trend price targets for SPY, QQQ, & NVDA with my (slightly) preferred scenarios in yellow & my alternative showing slightly more upside before topping.

QQQ, SPY, & NVDA all have well-defined near-term uptrend lines on these weekly charts, with sell signals to come on weekly closes below all three although we still have the (shorter time frame) sell signals from last week’s bearish engulfing candlesticks on the daily charts (as well divergent highs on all three).

Bottom line: With less than 5% upside potential on my preferred index to short, the Nasdaq 100 (/NQ futures, QQQ +1x ETF, PSQ -1x, QID -2x, SQQQ -3x, etc..) compared to downside potential of nearly 50% to my current final target, coupled with the recent technical evidence & developments, I think the R/R is favorable to being scaling into a long-term swing or trend short position or, with the recent resiliency of the small but very significant handful of over-weighted big tech stocks, one could wait for a solid break and/or weekly close below those near-term uptrend lines off the April lows (which is also the preferred swing targets for the most recent short trade on the $NDX triggered last week… a level likely to produce a bounce on the initial tag, if & when hit).

As far as timing, should SPY and/or QQQ continue up to the top of those potential market top ranges, my best guess would be that might only take a week or so, based on the recent momentum. However, if/when THE final top is in place, history has shown us time & time again that stocks tend to fall much faster than they rise during bear markets, often wiping out the previous months or even years of gains in mere weeks or months, as a cursory glance of the long-term charts will clearly illustrate.