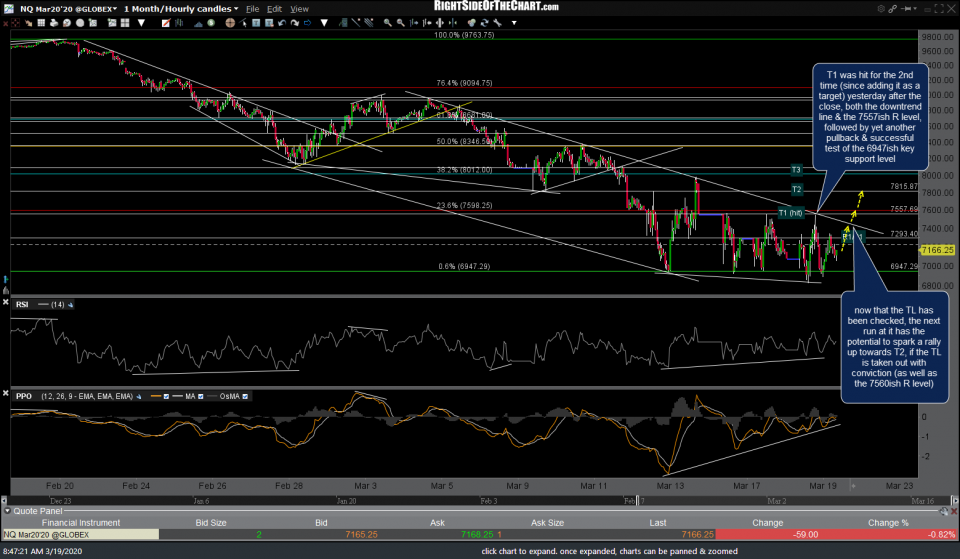

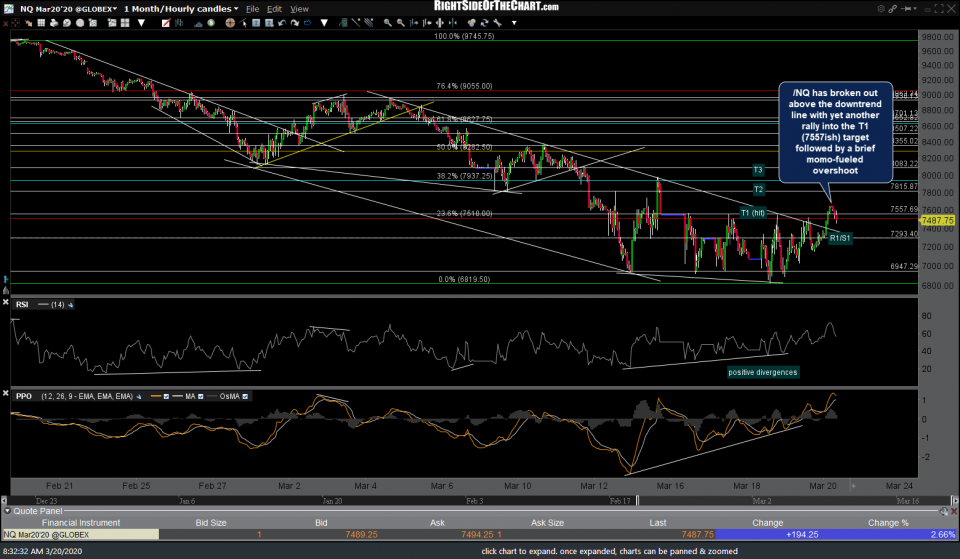

/NQ (Nasdaq 100 futures) has broken out above the downtrend line with yet another rally into the T1 (7557ish) target followed by a brief momo-fueled overshoot. The trendline “should” now act as support on any backtest from above as should the 7293ish S/R level with objective long entries on pullbacks to those levels as well as a break above this morning’s high A couple of the recent 60-minute charts, starting with Wednesday’s bull trap, which was the catalyst for the 12% rally off Wednesday’s lows so far, followed by today’s updated 60-minute chart posted below.

Multiple images in a gallery format as below will not appear on the subscriber email notifications but may be viewed on the site by clicking on the title of the post in the email. Click on the first chart to expand, then click the right arrow to advance to the next chart. Once expanded, charts can be zoomed & panned for additional detail.

- NQ 60m 2 March 18th

- NQ 60m 3 March 18th

- NQ 60m March 19th

- NQ 60m 2 March 19th

- NQ 60m March 20th

QQQ has made a pre-market (but not regular session) gap above the downtrend line to hit the 185.46 target/resistance. If the breakout sticks that could open the door for additional upside to T2. Potential support levels below are the downtrend line & 179.13 support level just below followed by the gap bottom of today’s (pre-market) gap as well as the regular session gap (i.e.- yesterday’s close of 177.66). Previous & updated 30-minute charts below.

- QQQ 30m 4 March 19th

- QQQ 30m March 20th

SPY also popped above the downtrend line in the early pre-market session today, effectively hitting T1 & reversing from there as expected as this was the initial tag of that target. While this could prove to be the end of the run, a solid break above the 250.50ish level should open the door to T2 (260.90ish level).