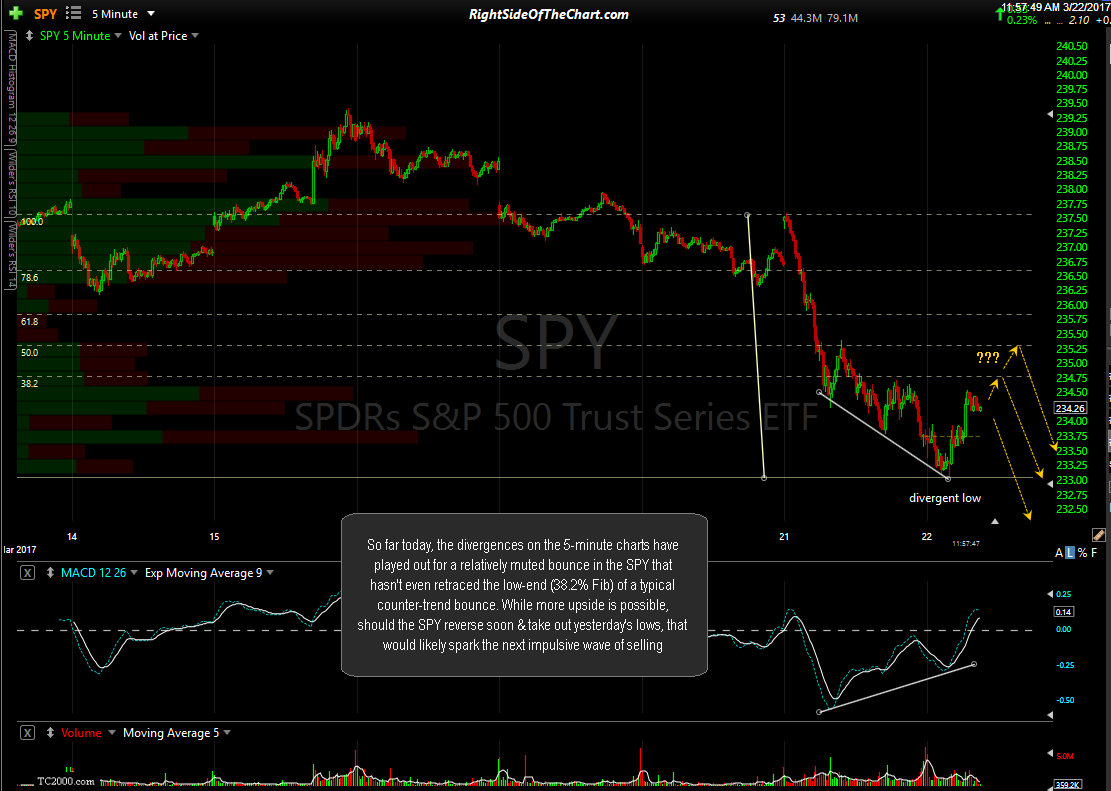

So far today, the divergences on the 5-minute charts have played out for a relatively muted bounce in the SPY that hasn’t even retraced the low-end (38.2% Fib) of a typical counter-trend bounce. While more upside is possible, should the SPY reverse soon & take out yesterday’s lows, that would likely spark the next impulsive wave of selling.

The bullish divergences on this 5-min QQQ chart have played out for a bounce roughly commensurate with the scope of the divergences so far. My expectation is that any bounce today will be sold into soon, followed by a resumption of the downtrend. As QQQ has now hit the 38.2% Fib retracement level of yesterday’s drop plus this reaction high, this is an objective level to add or initiate short exposure.

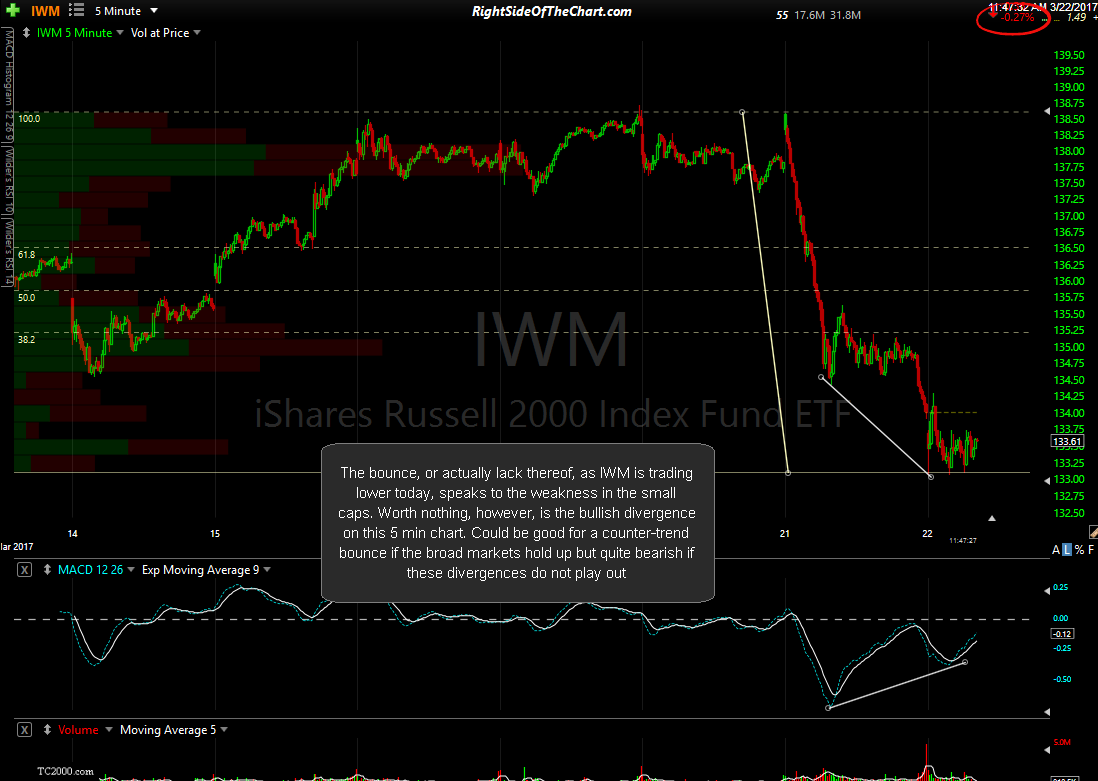

The bounce, or actually lack thereof, as IWM is trading lower today, speaks to the weakness in the small caps. Worth nothing, however, is the bullish divergence on this 5 min chart. Could be good for a counter-trend bounce if the broad markets hold up but quite bearish if these divergences do not play out.