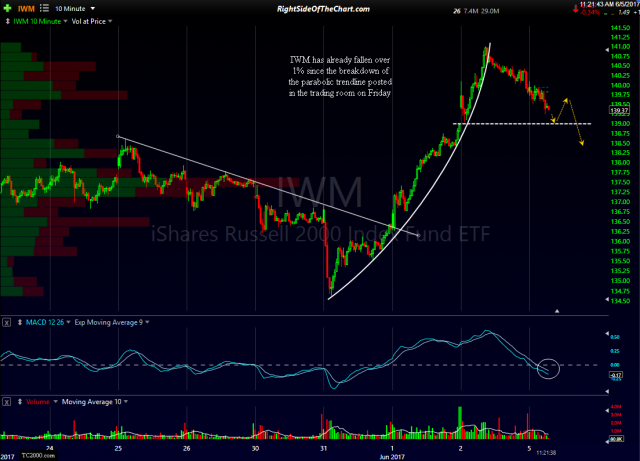

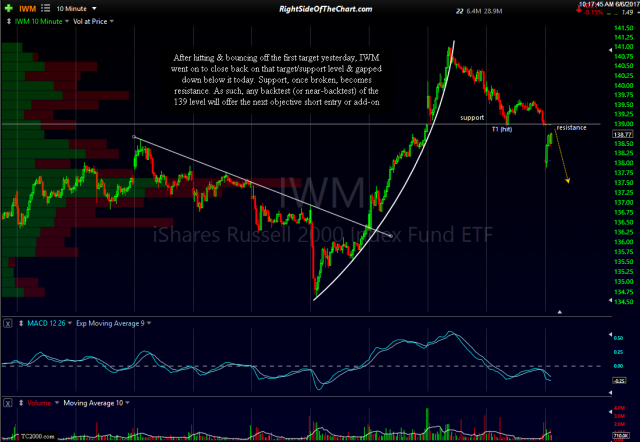

After hitting & bouncing off the first target yesterday, IWM went on to close back on that target/support level & gapped down below it today. Support, once broken, becomes resistance. As such, any backtest (or near-backtest) of the 139 level will offer the next objective short entry or add-on. Previous & updated 10-minute charts:

- IWM 10-min June 2nd

- IWM 10-minute June 5th

- IWM 10-min June 6th

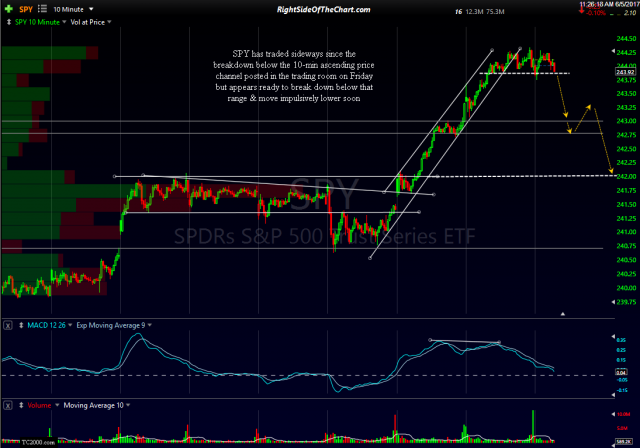

SPY gapped below the 2-day sideways trading range that followed Friday’s channel breakdown, reversing just shy of the initial target zone but now approaching the bottom of that range which should act as resistance if/when tested from below.

- SPY 10-min June 2nd

- SPY 10-minute June 5th

- SPY 10-min June 6th

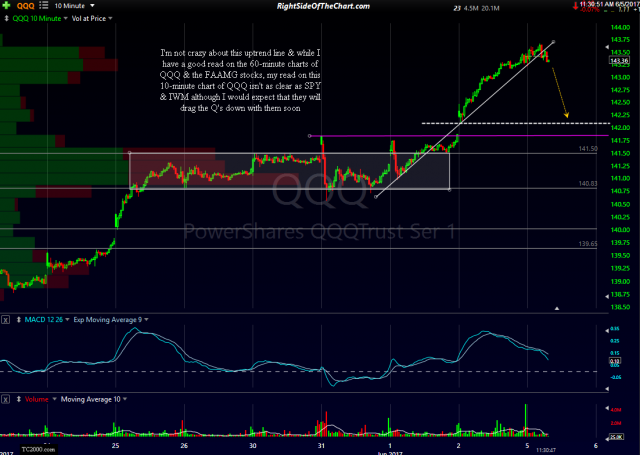

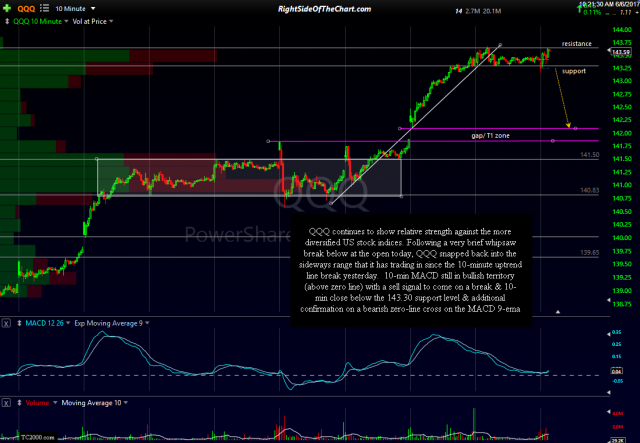

QQQ continues to show relative strength against the more diversified US stock indices. Following a very brief whipsaw break below at the open today, QQQ snapped back into the sideways range that it has trading in since the 10-minute uptrend line break yesterday. 10-min MACD still in bullish territory (above zero line) with a sell signal to come on a break & 10-min close below the 143.30 support level & additional confirmation on a bearish zero-line cross on the MACD 9-ema. Also on watch for breakdowns on the more technically significant 60-minute time frames on QQQ & the FAAMG stocks as per the video posted earlier today.

- QQQ 10-minute June 5th

- QQQ 10-min June 6th