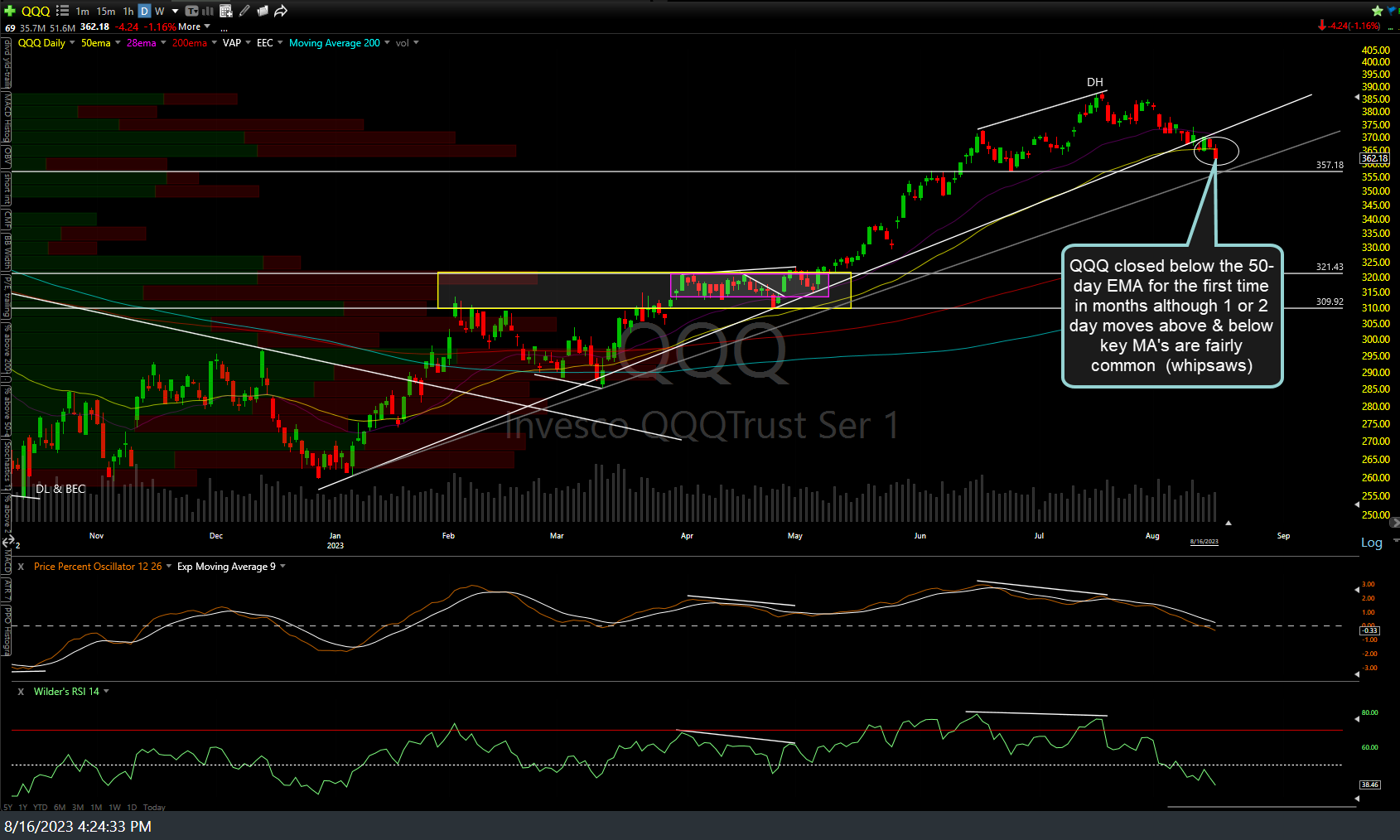

The title of this post pretty much sums it up: On one hand, shortly after the last update (video) posted earlier today, both SPY & QQQ broke below & then went on to close the day below their respective 50-day exponential moving averages (EMA). That one particular development is bearish although it is quite common to see the stock indices briefly move below (or above) a key moving average on an intraday or even a closing basis for a day or so, only to see that level recovered followed by a rally (or drop).

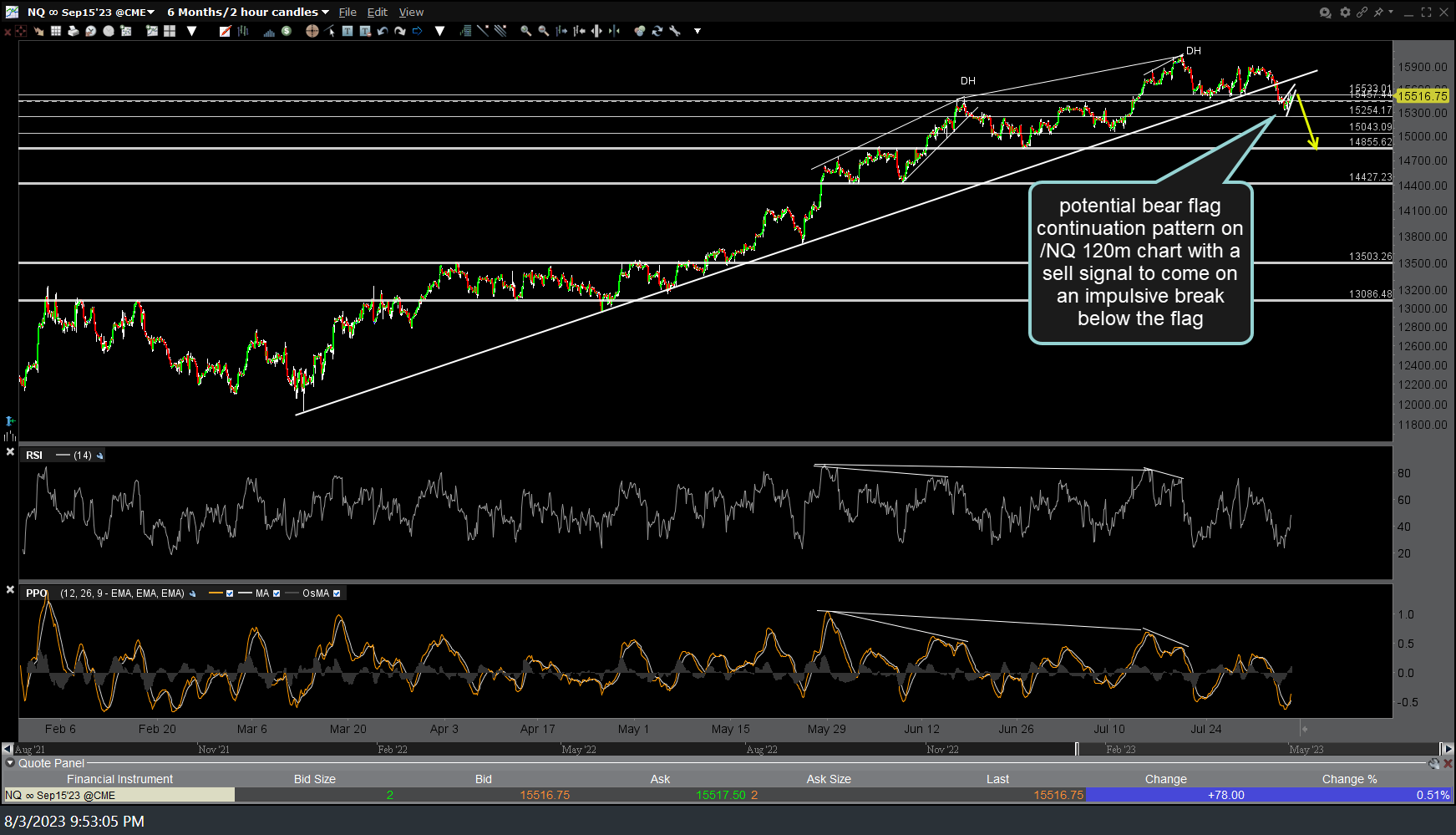

On the other hand, /NQ (Nasdaq 100 futures) has now fallen to within mere basis points (a fraction of a percent) of my initial swing target first posted on back on August 3rd. On that (and subsequent) 120-minute chart, I highlighted the more significant support levels/price targets with the thicker lines, stating the thinner lines were minor support levels which could potentially trigger minor bounces for active traders.

So the bottom line is that /NQ is now within basis points of that initial swing target where a tradable bounce is still likely before the next leg down, especially with the positive divergences in place. August 3rd & updated 120-minute charts below.

With the both SPY & QQQ closing below their 50-day moving averages today, less active swing & trend traders that are current short could certainly remain short as I still favor considerable more downside in the coming weeks to months. Those still short looking to protect profits might consider a stop on a solid recovery back above the 50-day EMAs on both SPY & QQQ as that would be a near-term bullish technical event (making today’s close below a whipsaw or potential bear trap). Likewise, active traders or even long-term traders looking to go long could use a solid recovery back above the 50-day as a buy trigger with stops below today’s lows.

As of now, I still favor a tradable bounce in the coming days despite the fact that the large caps took out the 50’s today although personally, I don’t plan to add any long exposure in my active trading account until & unless the 50’s are taken back. As stated recently, I also continue to hold core short swing positions across my longer-term accounts although I did reduce short exposure (booked some profits) there as I recently stated & even started scaling into some hedges against the remaining shorts via $NDX longs which I plan to remove soon whether or not a decent bounce materializes or not. Also worth noting is the fact that AAPL (Apple Inc.) continues to trade on my initial downside target of 176.15 (key support), also closing a hair below its 50-day EMA today as well so one to continue to closely monitor this week.