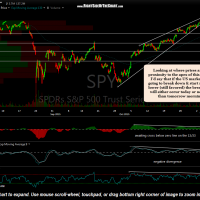

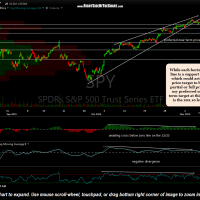

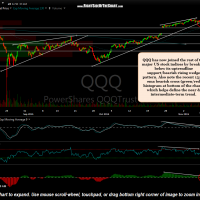

The SPY is approaching my previous stated preferred near-term price target of 202.10 while QQQ also approaches my minimum downside target of the bottom of the Oct 22/23rd gap. As such, the odds for a reaction (bounce and/or consolidation) are quite elevated at this time & while I am reducing some short exposure here to lighten up before the weekend, I do not plan to reverse (go net long) or fully hedge up at this time. If I see anything that convinces me otherwise before the close, I will communicate my thoughts here or in the trading room.

String of the recent 60-minute charts of SPY & QQQ give a quick pictorial of the anatomy of a rising wedge breakdown & subsequent selloff, with the updated chart at the end of each string.

- SPY 60 minute Nov 4th

- SPY 60 minute Nov 6th

- SPY 60 min Nov 13th

- QQQ 60 minute Nov 5th

- QQQ 60 minute Nov 6th

- QQQ 60 min Nov 9th

- QQQ 60 min Nov 13th