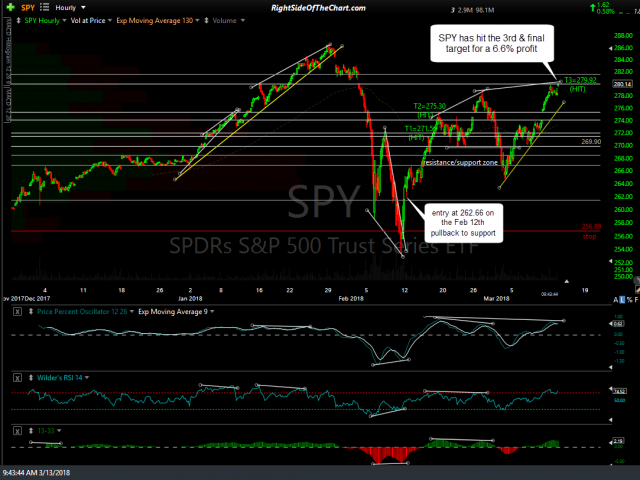

The SPY (S&P 500 Tracking ETF) long swing trade idea has hit the final target, T3 at 279.92, for a 6.6% profit. Consider booking partial or full profits and/or raising stops if holding out for additional gains. Previous & updated 60-minute charts:

click on first chart to expand, then click anywhere on the right of each chart to advance to the next expanded image or pinch zoom on mobile & tablets

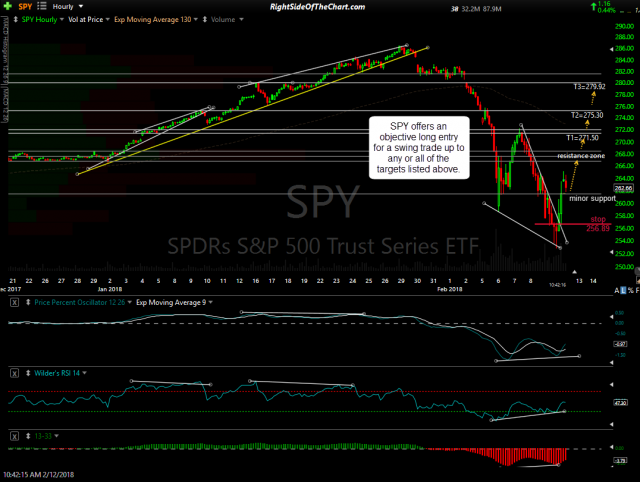

- SPY 60-min Feb 12th

- SPY 60-min Feb 15th

- SPY 60-min Feb 16th

- SPY 60-min March 13th

I have no desire to reverse this trade from long to short as I still favor a continued move to new highs in the S&P 500 before the next major correction in the market but at this point, the R/R to remain long is no longer clearly favorable IMO. As this was the final target, this trade will now be moved to the Completed Trades archives along with all associated post since the entry on February 12th.