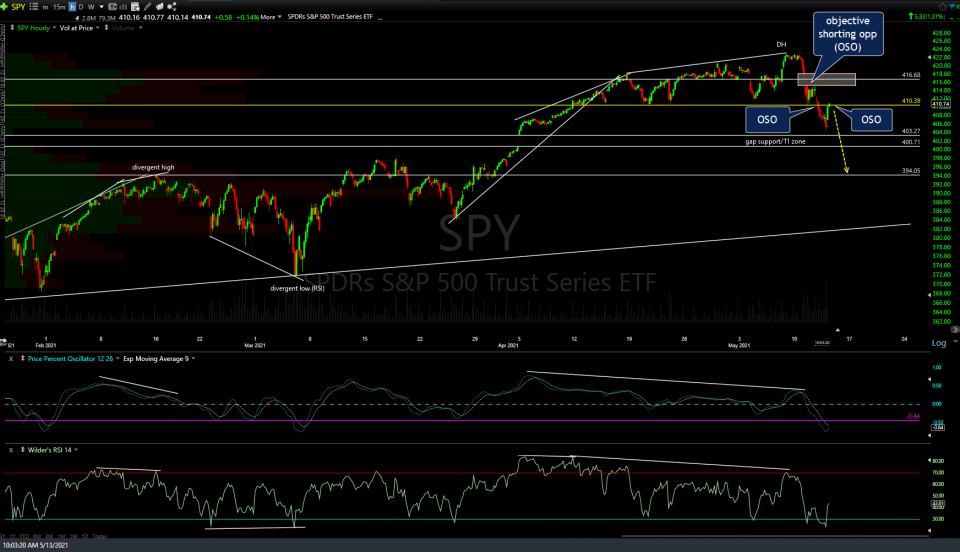

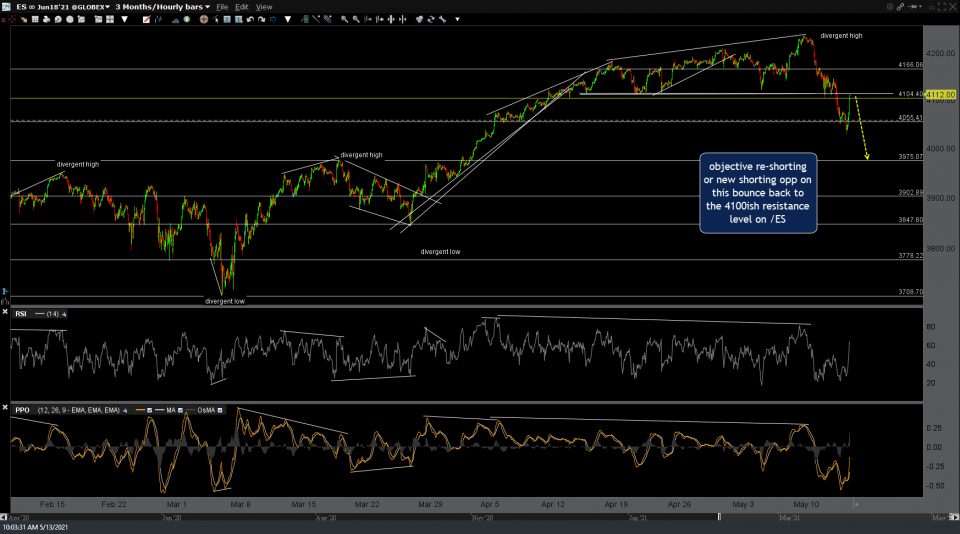

Today’s bounce off the first price targets/support levels on SPY & /ES has taken the S&P 500 back up to the former support, now resistance levels that were taken out yesterday. As such, this provides yet another objective shorting opportunity (OSO) with stops in line with one’s average cost basis and preferred swing target(s). One objective level for a stop on a typical swing position taken around current levels would be on a solid break or close above the top of Tuesday’s gap, which is the top of the recent bounce target zone indicated by the shaded box (roughly 418). Updated SPY & /ES 60-minute charts below.

SPY & /ES Bounce Back To Resistance

Share this! (member restricted content requires registration)

3 Comments