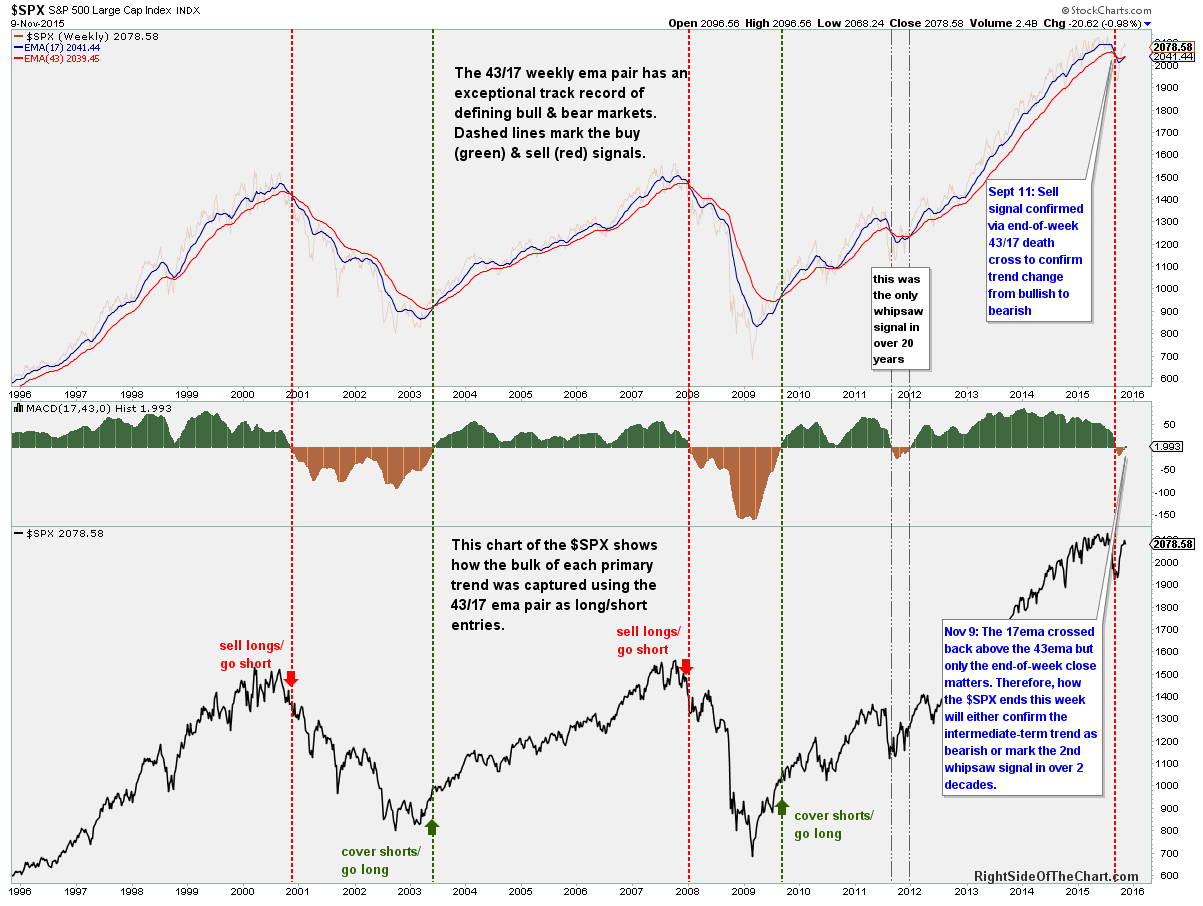

Over the past several months I’ve highlighted one of the most simply, yet effective means to determine the intermediate-to-longer-term trend in the S&P 500, the 43 & 17-week ema pair. The posture of these two exponential moving averages has done an exceptional job of defining the larger trend for many years, capturing the bulk of every bull & bear market with only one relatively brief whipsaw signal in over two decades.

The 17-week ema most recently printed a weekly close below the 43-week ema on the week ending September 11th, signaling a new downtrend in the $SPX since then. However, the 17-week ema is currently trading slightly above the 43-ema by a small margin and as such, how the $SPX trades for the remainder of the week will either keep this trend indicator on an intermediate to longer-term sell signal (bearish) or cross back into bullish territory, thereby making the recent sell signal the second whipsaw signal in over 20 years.

A couple of points worth reiterating: First of all, no single stand-alone buy or sell indicator is 100% effective… not even close. Nor should any one trend indicator be used alone, rather bullish & bearish trend signals should be confirmed or used in conjunction with other buy & sell signals.

This same 43/17-weekly ema pair has also done an excellent job of defining intermediate to longer-term bull & bear trends in the other major diversified US equity indices as well and as stated several times recently, the leading index, the Nasdaq 100, has remained on a solid buy signal using this 43/17 ema pair since July of 2009, without a single bearish crossover. Currently, the Wilshire 5000 ($WLSH), Dow Jones 65 Composite ($DJA), S&P 400 Midcap Index ($MID), & Russell 2000 ($RUT) all remain on sell signals with the 43/17 weekly ema pair. However, until/unless the $NDX follows suit, it is still too early to say with a high degree of confidence that a new bear market is likely underway.

Bottom line: I continue to believe that the markets are at a very critical technical juncture and how the market trade over the next few weeks could determine whether the next major trend in US equities is up or down.