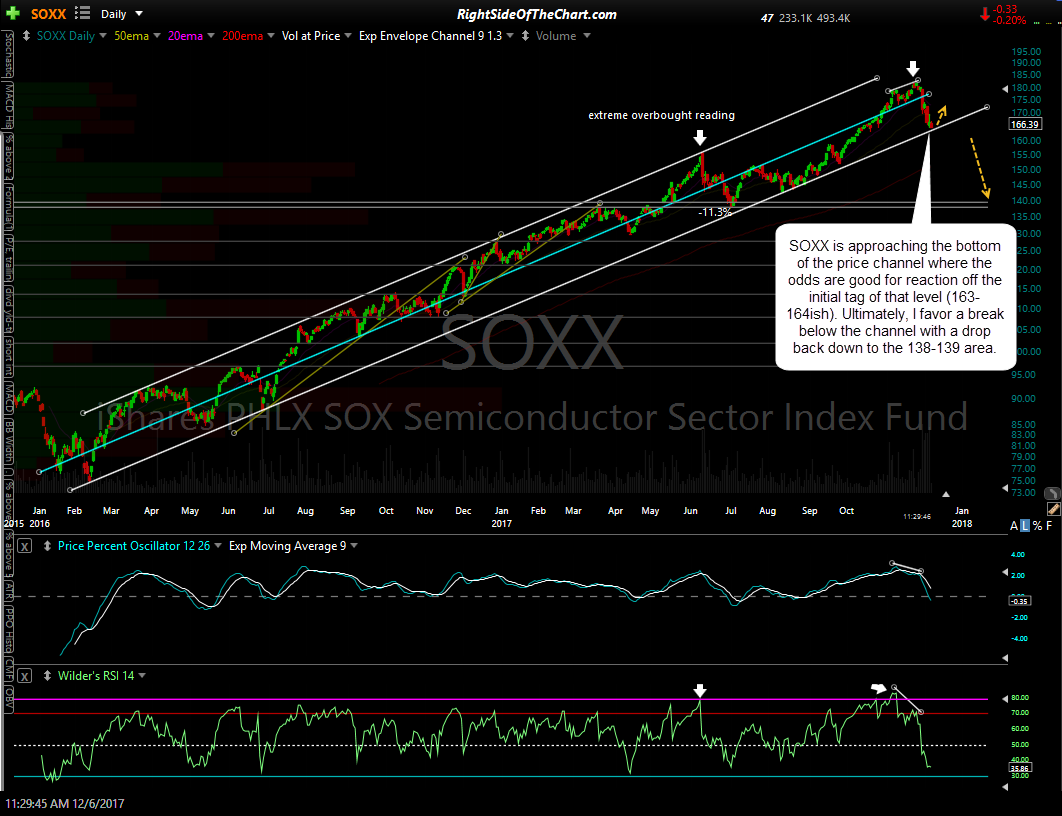

SOXX (PHLX SOX Semiconductor Sector ETF) is now approaching the bottom of the price channel, which was my first target on the daily time frame as covered in the November 27th Semiconductor Sector Analysis video. The odds for a reaction on the initial tag of that trendline, which comes in around 163.35ish, are good but I’m on watch for a solid break and/or daily close below the channel in the coming days/weeks for a more powerful sell signal in the semiconductor stocks.

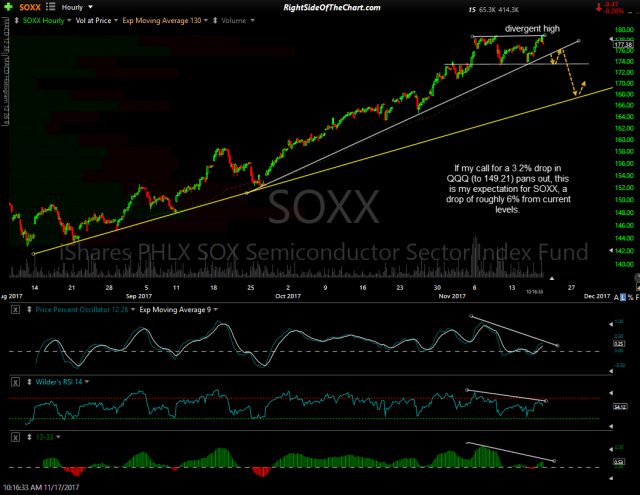

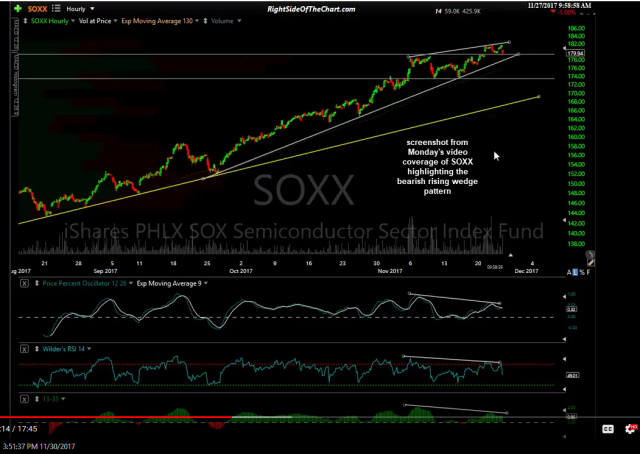

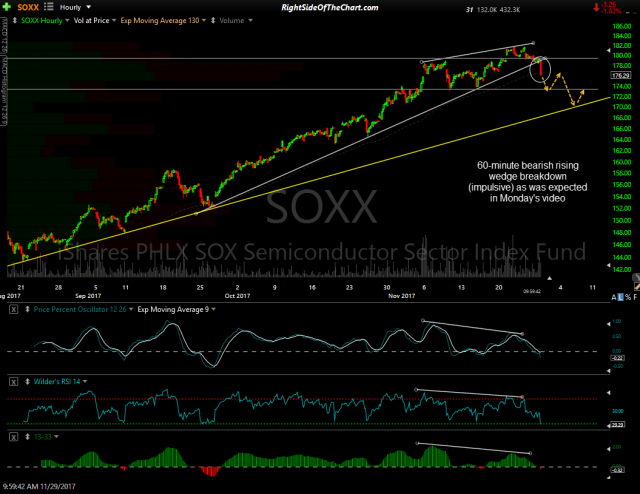

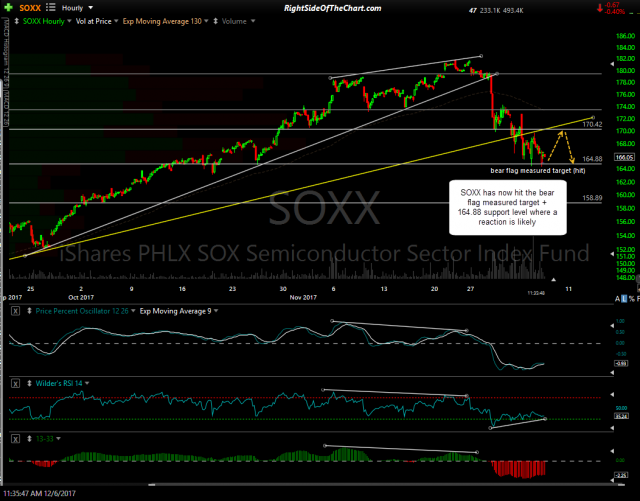

SOXX has also now hit the bear flag measured target + 164.88 support level from my recently posted 60-minute charts where a reaction is likely. Previous & updated 60-minute charts below illustrate how well the semis have traded off the technicals in recent weeks, starting with the divergent high & subsequent breakdown below the rising wedge pattern. Keep in mind that should my call for at least a short-term bounce in the semis relatively soon pan out, that would most likely provide some tailwinds to the rest of the tech sector along with QQQ as well. However, should the semis fail to bounce here & make an impulsive breakdown below the daily price channel, that would exert continued pressure on tech & QQQ.

- SOXX 60-min Nov 17th

- SOXX 60-min screenshot Nov 27th

- SOXX 60-min Nov 29th

- SOXX 60-min Nov 30th

- SOXX 60-min Dec 1st