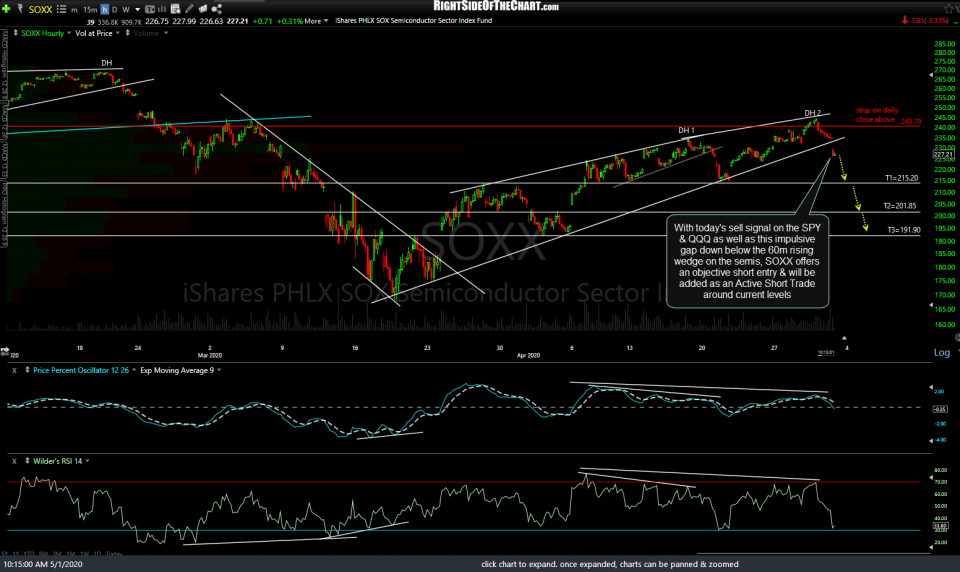

With today’s sell signal on the SPY & QQQ as well as this impulsive gap down below the 60m rising wedge on the semis, SOXX (semiconductor sector ETF) offers an objective short entry & will be added as an Active Short Trade around current levels.

The price targets are T1 at 215.20, T2 at 201.85, and T3 at 191.90 with the potential for additional targets, depending on how the charts of the semiconductor sector, as well as the broad market, develop going forward. The suggested stop is a daily close above 240.70. The suggested beta-adjusted position size for this trade is 0.90.

Other proxies for shorting the semiconductor stocks include SOXS (3x short) and SSG (2x short), which was an official trade that was recently stopped out after hitting the first price target back on April 1st. I’ll follow-up with some comparable targets for SOXS & SSG in the comment section below this post or in a new post asap.