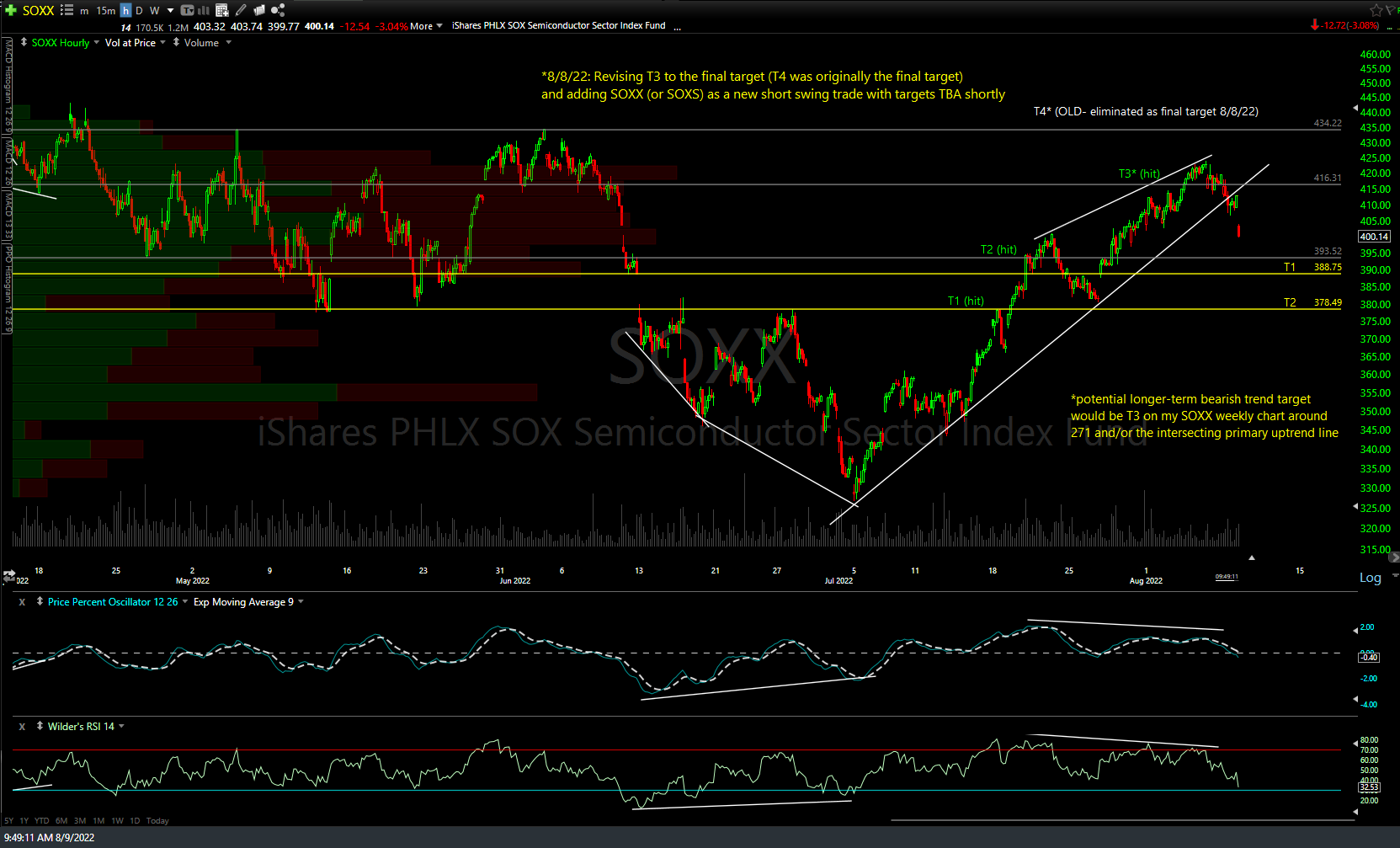

The price targets for yesterday’s swing short trade entered yesterday when the SOXX (semiconductor ETF) long swing trade hit T3 and was closed & reversed to a short trade will be T1 at 388.75 & T2 at 378.50. As those are the actual support levels where a reaction is likely upon the initial tag from above, best to set your sell limit order(s) slightly above your preferred target(s) to avoid missing a fill, should the buyers step in early. Previous & updated 60-minute charts below.

For those in the SOXX or SOXS short trade that think the bear market rally may have run its course (or will very soon), I still believe that my 2nd long-term target of ~271 and/or the primary bull market uptrend line will still be hit in the coming months+. As such, one could set stops accordingly, which would be about 12% above yesterday’s short entry if so (a 3:1 R/R based on the 36% downside/profit potential).