As a follow-up to the Solar Stock Trade Setups post from April 4th, the majority of those trade ideas have exhibited very bullish price action, which I’ll update below along with some additional long-side trade setups in the solar sector.

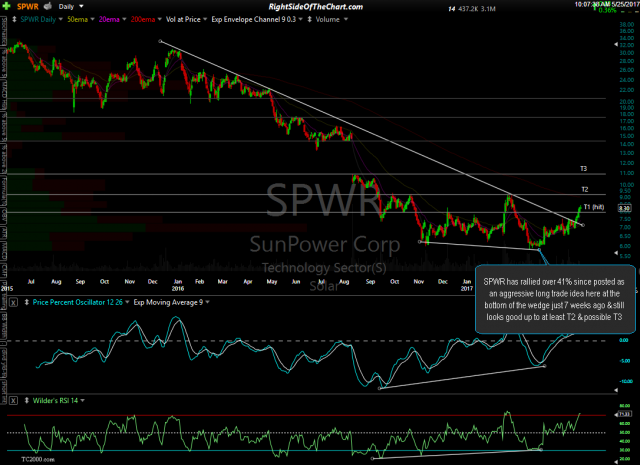

SPWR (SunPower Corp) has rallied over 41% since posted as an aggressive long trade idea here at the bottom of the wedge just 7 weeks ago & still looks good up to at least T2 & possible T3.

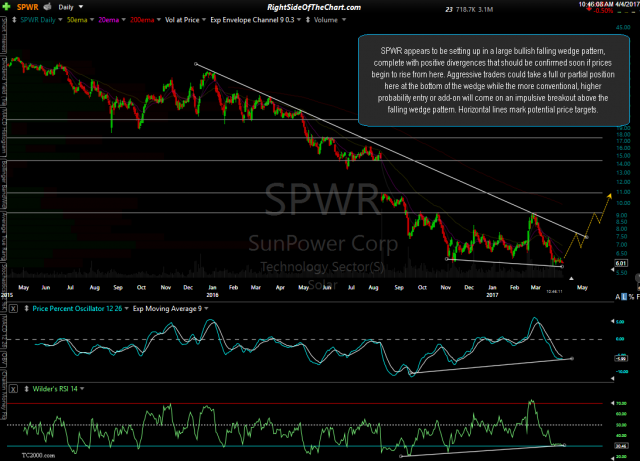

- SPWR daily April 4th

- SPWR daily May 25th

Trading around 1/10th of 1 cent, ASTI (Ascent Solar Technologies) is the most aggressive/speculative of all the solar trade setups that were highlighted on April 4th but also has one of the largest gain potentials with strong positive divergences continuing to build.

- ASTI daily April 4th

- ASTI daily May 25th

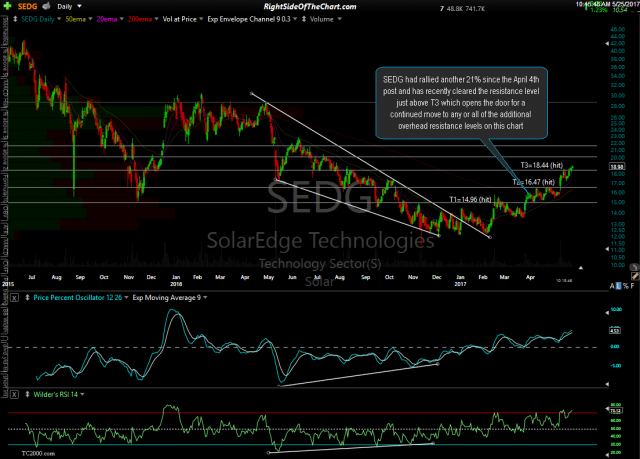

SEDG (SolarEdge Technologies) had rallied another 21% since the April 4th post and has recently cleared the resistance level just above T3 which opens the door for a continued move to any or all of the additional overhead resistance levels on this chart.

- SEDG daily April 4th

- SEDG daily May 25th

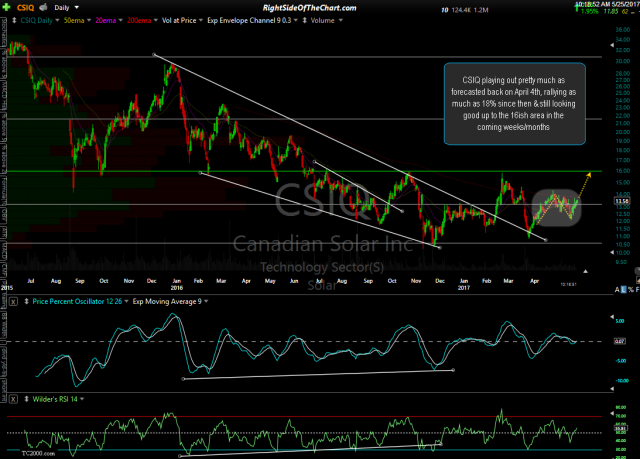

CSIQ (Canadian Solar) playing out pretty much as forecasted back on April 4th, rallying as much as 18% since then & still looking good up to the 16ish area in the coming weeks/months.

- CSIQ daily April 4th

- CSIQ daily May 25th

HQCL (Hanwha Q Cells) still looking good for a run up to the 9.80 area on a breakout above both the bullish falling wedge (downtrend line) and the 7.75 level.

- HQCL daily April 4th

- HQCL daily May 25th

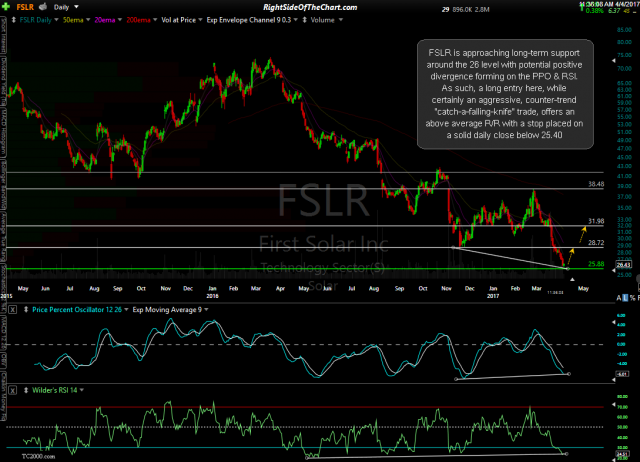

After the timely exit to close the FSLR (First Solar) official long trade out at 36.00, the stock fell over 10% followed by another thrust up to a price target from a previous trade which is still resistance. With FSLR extremely overbought & at resistance, the R/R, at least until a pullback or consolidation, is not very favorable on the long side at this time.

- FSLR daily April 4th

- FSLR daily 2- April 4th

- FSLR daily May 25th

A few more solar stocks that look to be setting up bullish that weren’t mentioned in that April 4th post, starting with VSLR (Vivint Solar), which could run to the 3.70 area on an impulsive breakout above the 3.20 resistance level (about a 15% gain, if so).

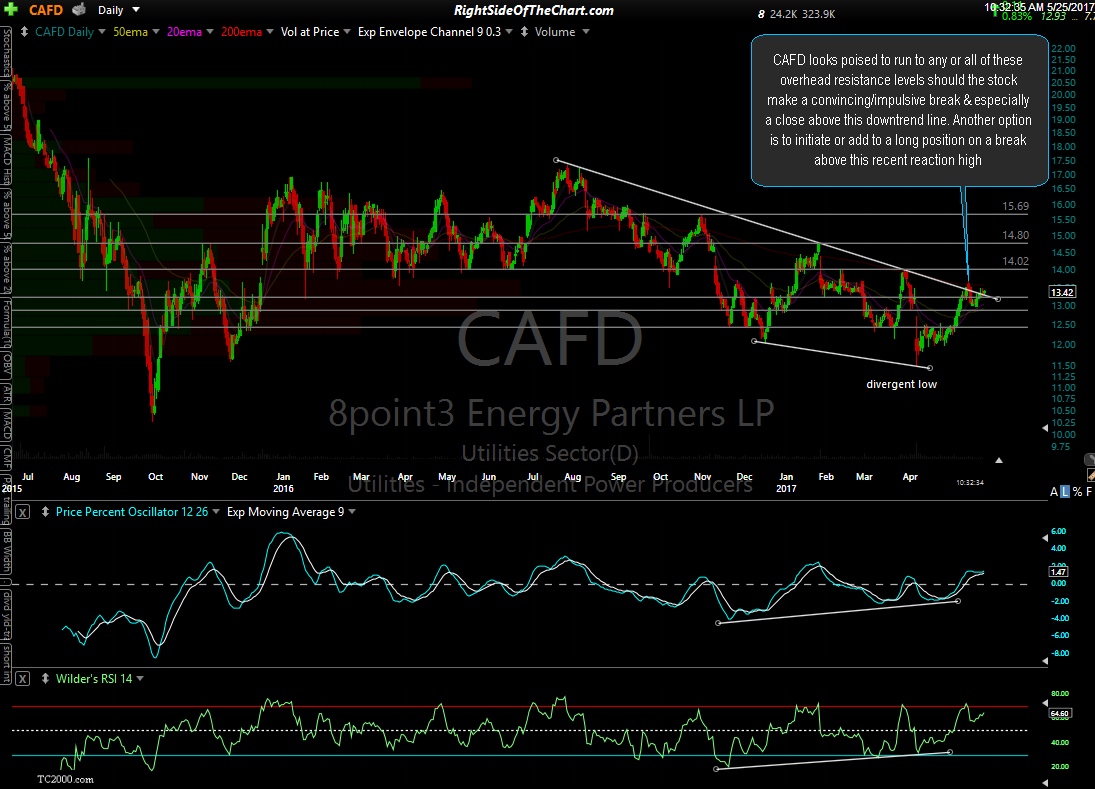

CAFD (8point3 Energy Partners LP) looks poised to run to any or all of these overhead resistance levels should the stock make a convincing/impulsive break & especially a close above this downtrend line. Another option is to initiate or add to a long position on a break above this recent reaction high.

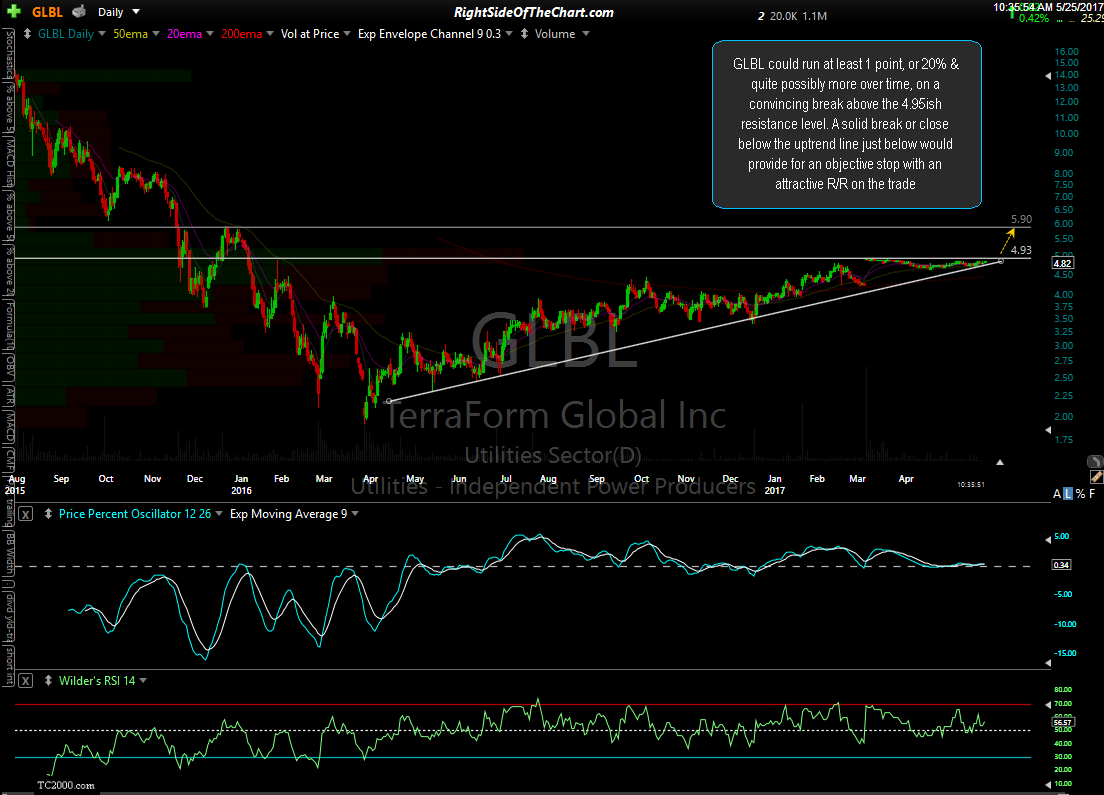

GLBL (TerraForm Global) could run at least 1 point, or 20% & quite possibly more over time, on a convincing break above the 4.95ish resistance level. A solid break or close below the uptrend line just below would provide for an objective stop with an attractive R/R on the trade.

SKYS (Sky Solar Holdings) is a low priced (i.e.- aggressive) solar stock that looks poised to rally 15 – 40%, should it take out this downtrend line with conviction, especially on a closing basis as you can see the history of false breakouts in the past year or so.