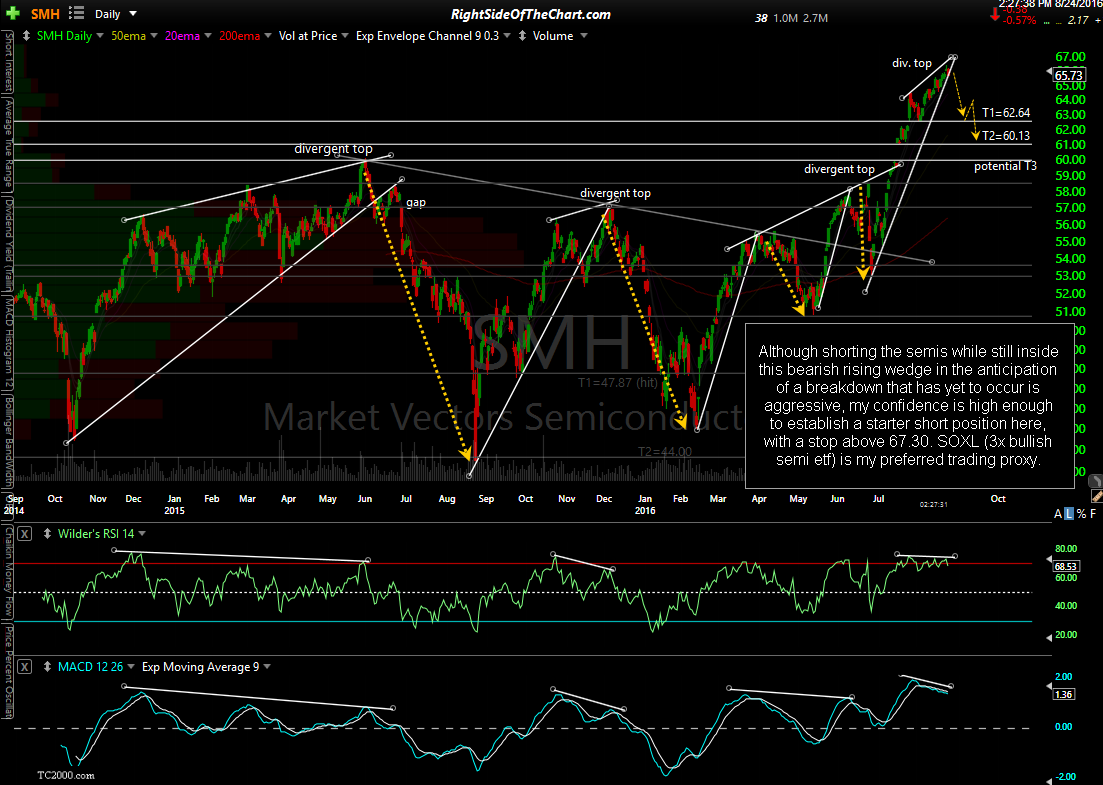

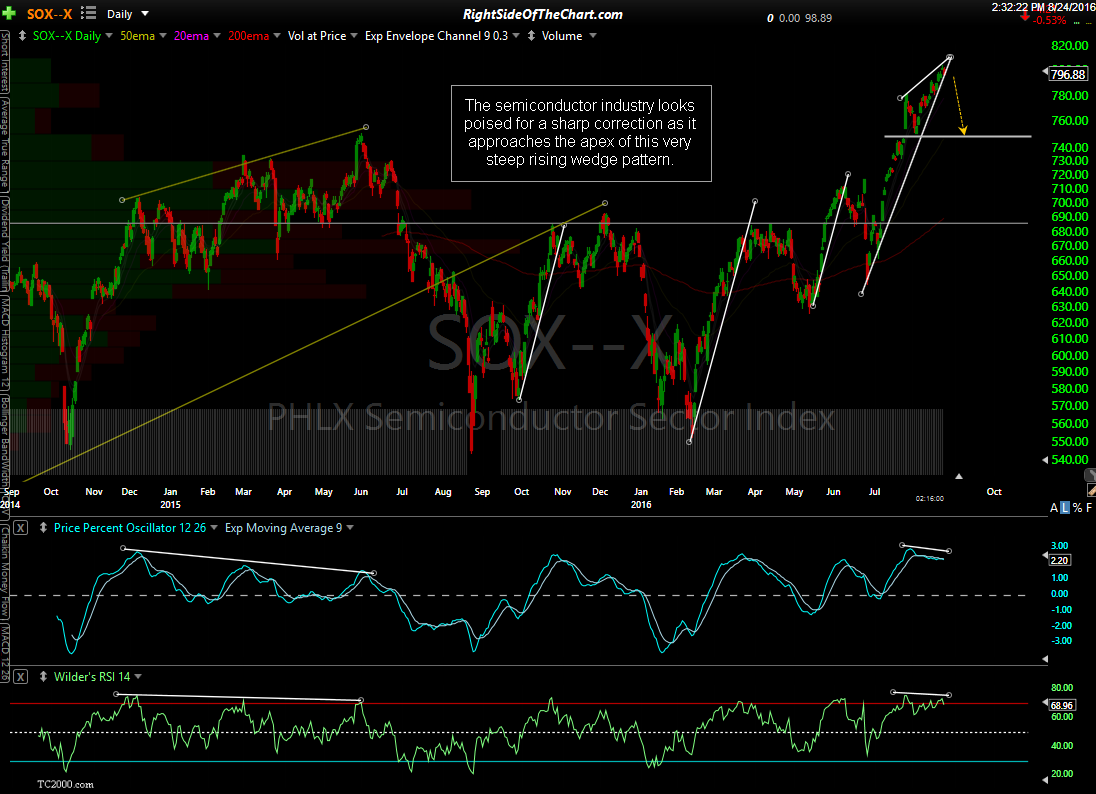

Although shorting the semis while SMH (1x bullish semiconductor ETF) still inside this bearish rising wedge in the anticipation of a breakdown that has yet to occur is aggressive, my confidence is high enough to establish a starter short position here, with a stop above 67.30. SOXL (3x bullish semi etf) is my preferred trading proxy.

For those unable to short SOXL, the following ETFs can also be used in lieu of an SMH or SOXL short: XSD (1x bullish semi etf), USD (2x bullish semi etf), SSG (2x bearish semi etf) or SOXS (3x bearish semi etf). To gain short exposure to the semiconductor sector, one would either go long (buy) one of the bearish etfs or sell short one of the bullish etfs. Keep in mind that although each of these etfs hold a basket of stocks related to the semiconductor industry, each tracks a specific index such as the Dow Jones US Semiconductor Index, the PHLX Semiconductor index or the S&P Semiconductor Select Industry Index. One potential benefit to shorting leveraged bullish etf, such as SOXL, would be to profit from both a correction in the semiconductor sector as well the potential to profit from a period of choppy, sideways trading, should the semis stall out here & move sideways for weeks or months, similar to the recent price action in the broad market over the last couple of months.