I received a request for an update on SLV (Silver ETF) within the trading room & I figured this would be another one worthy of an update on the front page for all to see as there is a lot has been a lot of movement within the precious metals & mining sector recently. Starting with the bigger picture with a look at the 10-year weekly chart of SLV, it still appears that the recent sell-off is the first major correction in the early stages of a new bull market although it would help to see SLV close this week back above the blue uptrend line which was taken out today. Note how the PPO signal line is still well above zero, indicating that the primary trend is still bullish at this time.

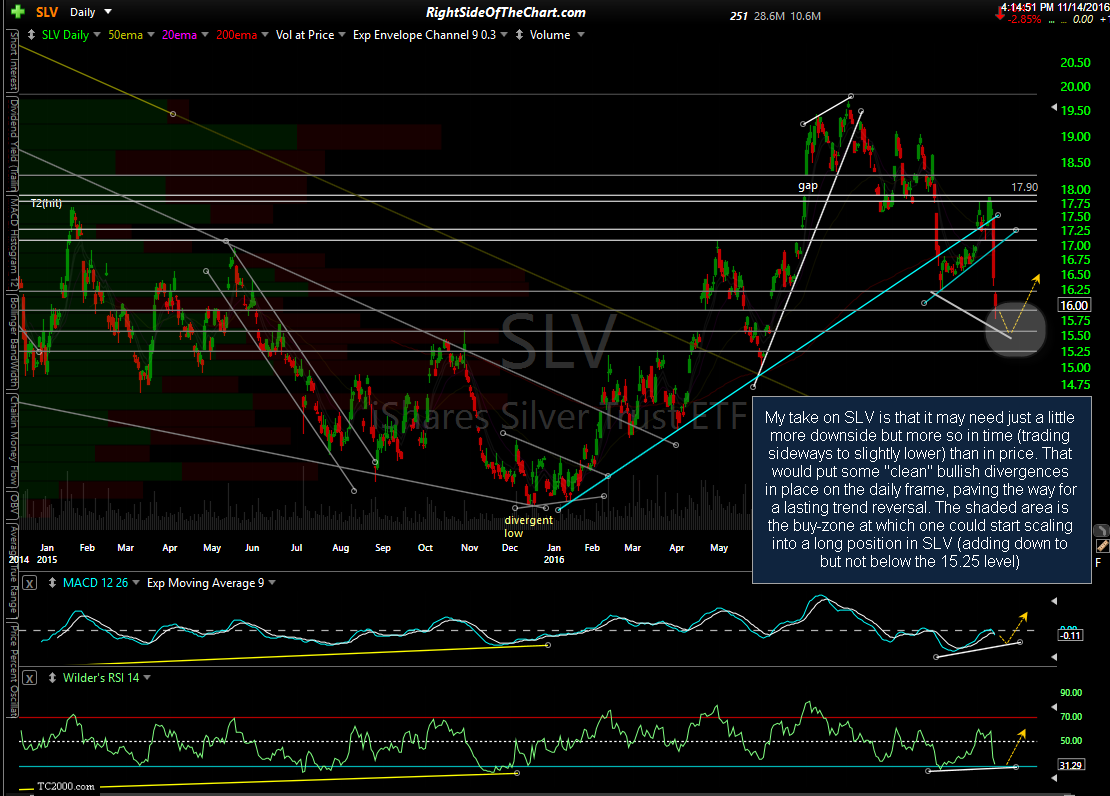

Zooming down to the 2-year daily chart, my take on SLV is that it may need just a little more downside but more so in time (trading sideways to slightly lower) than in price. That would put some “clean” bullish divergences in place on the daily frame, paving the way for a lasting trend reversal. The shaded area is the buy-zone at which one could start scaling into a long position in SLV (adding down to but not below the 15.25 level). Keep in mind that silver may or may not need a little more downside in price and/or time, hence the reasoning for a strategy of stating to scale in to a position in SLV around current levels.

Scaling in is similar to in concept to dollar-cost-averaging into a mutual fund for long-term investing except scaling in is done on more accelerated schedule when swing trading or positioning for a trend trade that might last months or even years. For example, one might take an initial position of about 1/4th their desired ultimate exposure to silver, adding three more lots of one-quarter position sizes strategically (i.e.- on pullbacks to support or breakouts above resistance) over the next 2-3 weeks, with the appropriate stops in place below.