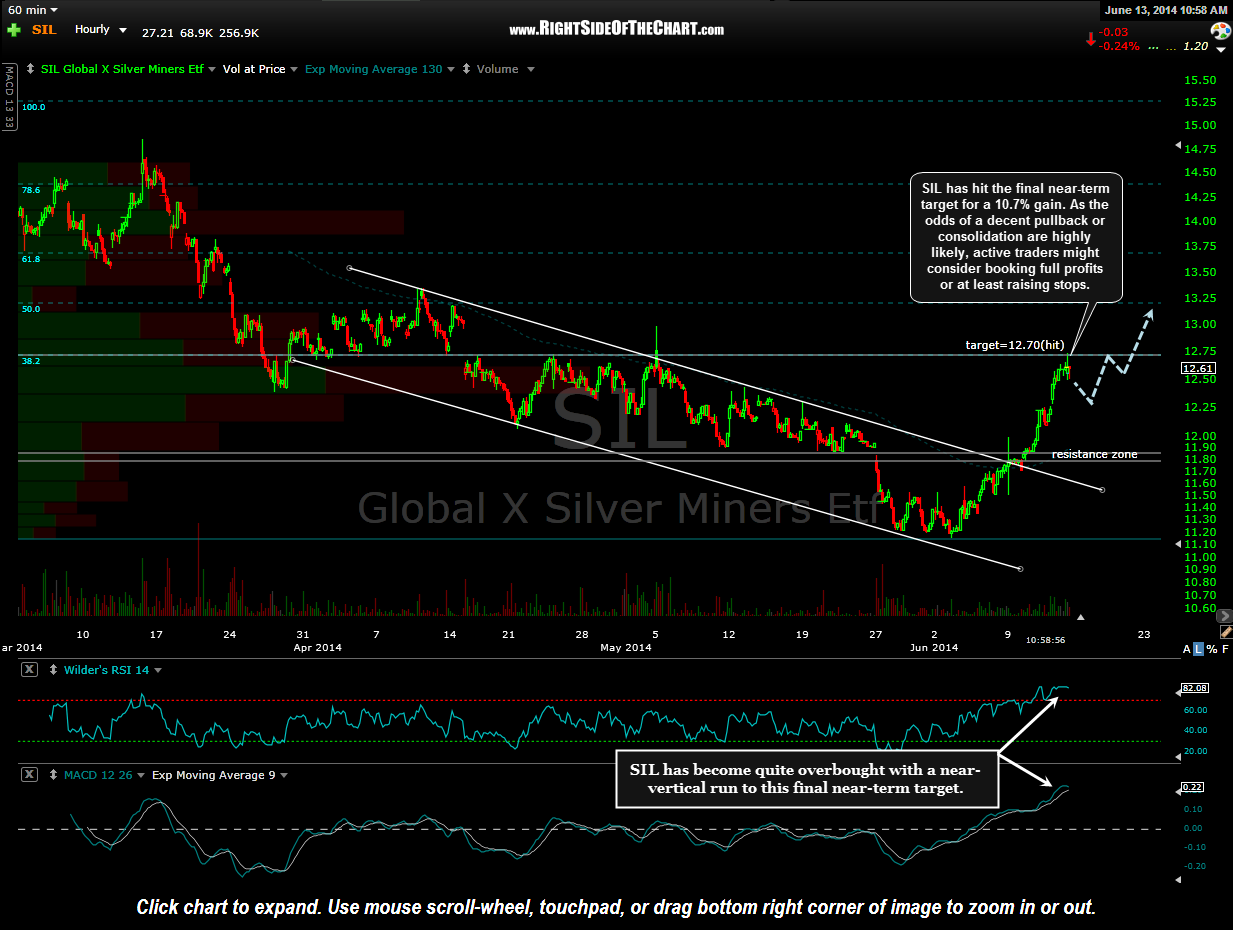

SIL (Silver Miners ETF) hit the second and final near-term target today for a 10.7% gain from entry. The initial entry on this most recent trade was triggered on last Thursday (June 5th) based off of the 15 minute chart. As the trade developed, this second target at 11.80 was added to the 60 minute chart and was hit shortly after the open today. With the silver mining sector now at resistance while very overbought in the near-term, the odds for at decent pullback or consolidation are elevated at this time. As such, active traders might consider booking full profits or at least raising stops while longer-term traders might choose to give their position some room.

Keep in mind that SIL, along with GDX, GLD, SLV and various miners remain Long-term Trade ideas in additional to the occasional shorter-term swing trades that have been posted on some of these positions since becoming bullish on the sector at the end of 2013. Long-term Trade ideas are trades with holding periods measure in months or even years (e.g.- investments or trend trades) vs. the typical swing trade ideas posted on RSOTC, which have holding periods typically measured in weeks. At times, the same stock or ETF may be listed as both an Active Long-Term Trade idea as well as a typical Long Trade idea (i.e.- swing trade), with different price targets and stop criteria depending on the time frame & expected duration of each trade.