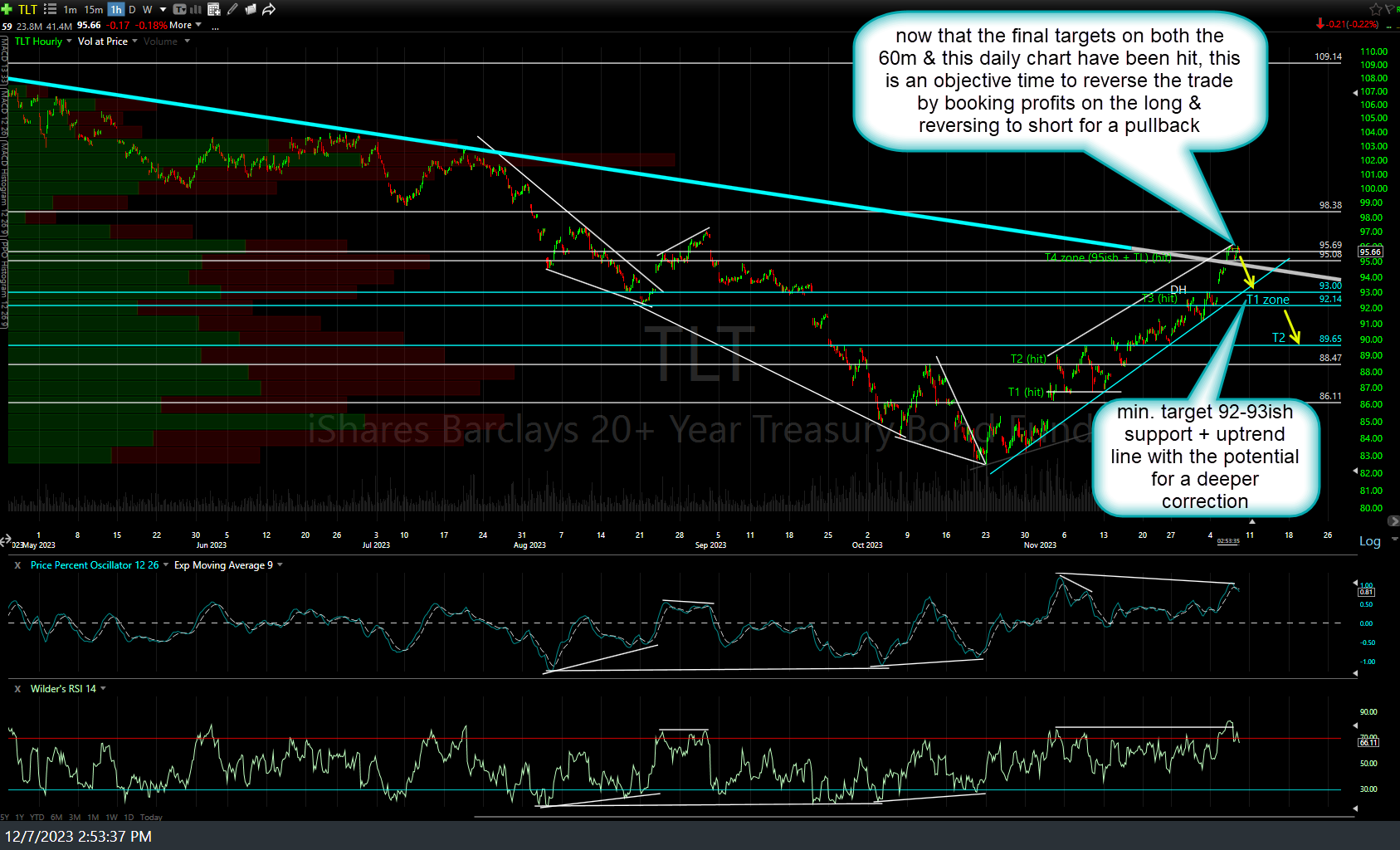

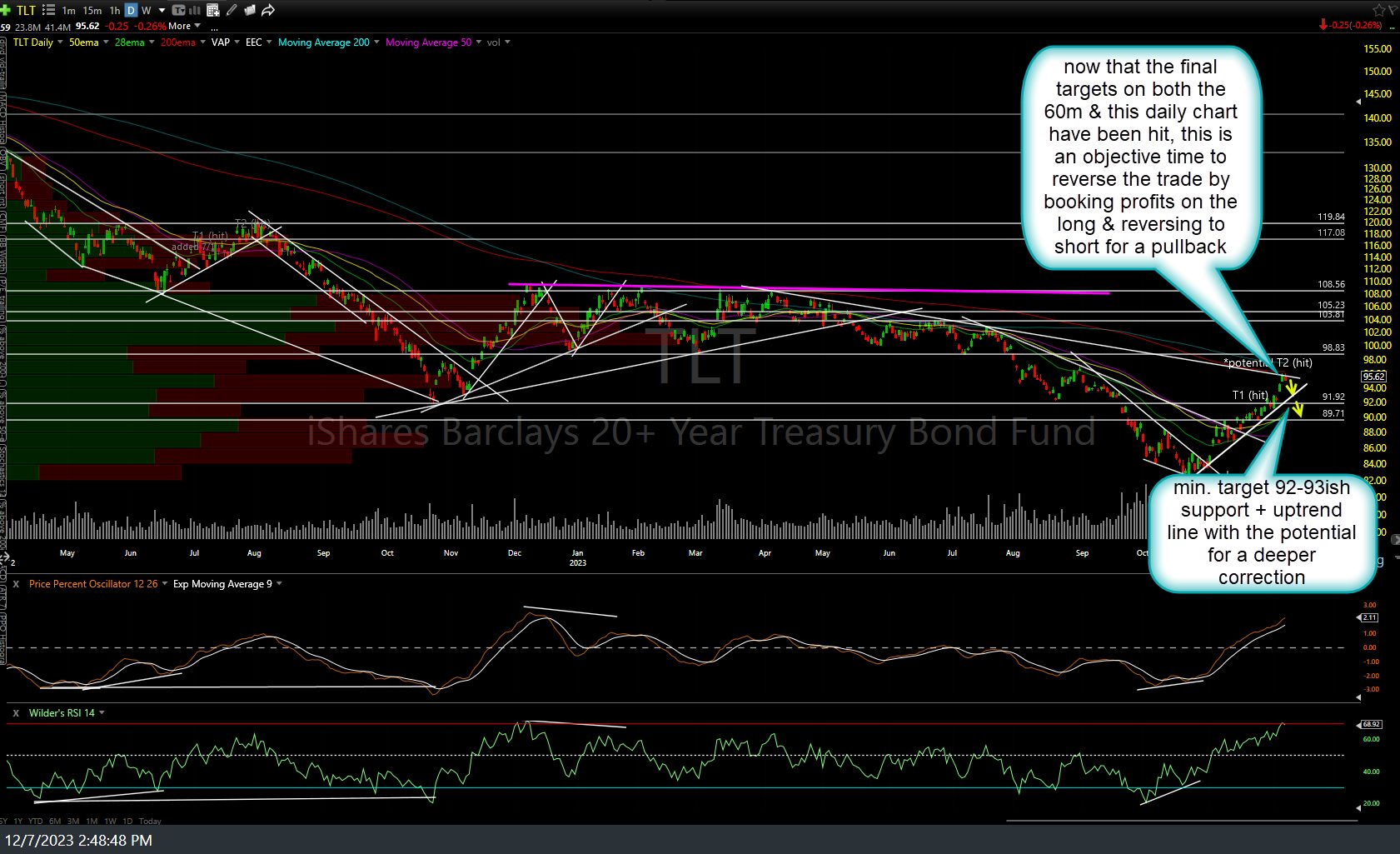

Now that the final targets on both the 60-minute & daily charts of TLT (20-30 yr Treasury bond ETF) have been hit, this is an objective time to reverse the trade by booking profits on the long & reversing to short for a pullback. Initial (trade setups) and updated 60-minute & daily charts below (I followed up with a daily chart listing only two price targets for less-active swing traders on Oct 26th, shortly after first posting the setup on the 60-minute chart of TLT on Oct 19th).

For those that prefer using inverse ETFs, TTT is the -2x (200% short) inverse 20-30 Yr Treasury bond ETF, which you can clearly see has fallen to dual support levels (uptrend line & 75.40ish price support).

SJB (-1x short high-yield bond ETF) also offers an objective long entry (to go short junk bonds) here with both JNK & HYG at resistance on the daily time frames and/or on a breakout above this 60-minute falling wedge pattern.

HYG (high-yield aka junk bond ETF.. basically identical to JNK but from another ETF issuer) offers an objective short entry here at resistance and/or on a solid break below the uptrend line/75 level. Daily chart below.