Last week I had updated the Long Trade Ideas by removing any trades that had either reached their final profit target or exceeded their maximum suggested stops. I am now turning my focus towards updating the Short Trade ideas by first removing the following trades that have either exceeded their suggested stops or no longer look compelling from a technical perspective.

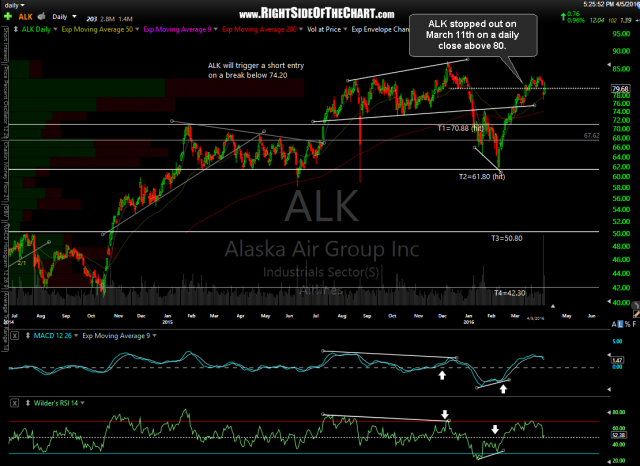

ALK- After hitting the second price target for a 17% profit on Feb 2nd, ALK immediately reversed and went on to exceeded the original suggested stop of a daily close above 80.00 on March 11th. For those still short or considering a new short position in ALK, I still believe this stock has considerable (25-50%+) downside in the coming months with the longer-term bearish case still well intact.

- ALK daily April 5th

- ALK weekly April 5th

NUGT/GDX: The NUGT/GDX short trade that was entered based off the 30-minute charts back on Feb 22nd went on to exceed the suggested stop above 55.60 the following day for a loss of 9.4% on NUGT or 3.2% on GDX.

TSLA: Exceeded the maximum suggested stop of a daily close above 239.12 yesterday for an 11.8% loss calculated on yesterday’s closing price of 246.99 (or less, if only targeting T1 or T2 as lower stops were suggested).

TSM: TSM was added as a short trade at 22.63 back on Nov 12th & failed to reach any profit target before exceeded the suggested stop on a daily close above 24.50 for an 8.2% loss calculated on the March 1st closing price of 24.58.

As with all Completed Trades, the trades above will be moved to the Completed Trades category where they will be archived indefinitely for future reference. At this time, all Active Short Trades listed on the site are still Active, meaning that they have yet to either hit their final profit targets or exceed their maximum suggested stops. Updates will follow as anything changes in the outlook for those trades and as always, please don’t hesitate to contact me via private message or publicly in the trading room if you would like an update on any of the trade ideas on the site.