Short sellers are often vilified by the mainstream media, CEO’s of publicly traded companies & many institutional money managers which are forced, by prospectus or other security selection parameters, to maintain only long-side exposure to the market. I won’t go into all the benefits that short sellers provide, such as liquidity and sniffing out corporate malfeasance while the masses are content to turn a blind eye as long as a stock is in a bull trend, other than to mention that short sellers, at least when short interest is at normal or above average levels, often serve as a backstop in a stock or the broad market during selloffs as short sellers are the only guaranteed buyers in the market.

When the crap hits the fan & things get ugly, long-side traders & investors can simply stand aside and watch while every short seller must close their position at some point, i.e.- ‘buy’ the stock (buy-to-cover). Long-side traders don’t have to buy-the-dip, shorts, on the other hand, sooner or later must close out their positions & often do on the dips. This is why stocks with very high short interest often continue to rise (as existing shorts are gradually squeezed out) & when they do fall, the corrections are often limited as those shorts step in to cover their positions. Likewise, stocks with very low short interest don’t have that large portion of guaranteed buyers & are often prone to very swift & deeper corrections once it has become clear that a new downtrend is underway.

- QQQ short interest July 29th

- AAPL short interest July 29th

- GOOGL short interest July 29th

- GOOG short interest July 29th

- AMZN short interest July 29th

- MSFT short interest July 29th

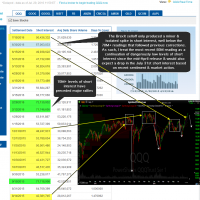

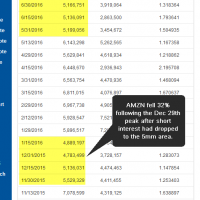

With that being said, here’s a look at the historical short interest (over the last two years) in QQQ as well as some of the top components/market leading stocks such as GOOG, AAPL, AMZN & MSFT . Just as overbought readings on a particular stock or the market isn’t a sell signal in itself, rather just a warning that prices may have gotten ahead of themselves, low short interest isn’t an exact timing indicator either as it could continue to drop or gradually edge higher. However, it is worth noting that the current extreme low short-interest readings coincide with the some of the other recently highlighted warning signs such as the large divergences on many of the indices & leading stocks; the recent deterioration in market breadth (fewer & fewer mega-cap stocks doing all the heavy lifting); the recent low-volume breakout in the $SPX while other key indices still trade below their 2015 peak; the recent plunge in oil prices (which had been trading in near-lockstep with equities until recently), etc…

If not a sell signal, then why share this information as it isn’t really “actionable” analysis? The reason for highlighting the unusually low short interest on these leading stocks ties in to what I’ve pointed out recently; the fact that these very companies are largely responsible for the recent gains in the market or, more recently holding the market up as the $SPX hasn’t gone anywhere in over two weeks now, trading at the same level early today as it was back on July 14th & trading in a very tight sideways range since then. It also tells me that, should the market start to fall before short interest in most of these leading stocks has rising to average or above average levels, the downside potential on these stock should be on the higher-end of what we’ve seen in recent years, as once again, these stocks are at or below the lower end of readings that preceded all the major corrections in recent years.

Taking that into account would help to determine my price targets & holding periods on my short trades when the next downtrend gets underway. Should the market trigger all of the sell signals that I’ve recently discussed soon, that would be my cue to rapidly & aggressively scale into swing short positions with expected holding periods measured in weeks or months (vs. days) & expected gain potential in the double-digits. Should the market continue higher with market breadth improving & short interest gradually building back to normal level, that would dissipate the bearish case which at this time, until & unless the recently discussed sell signals trigger, would just be another trade setup that failed to materialize.

short-interest source: Nasdaq.com