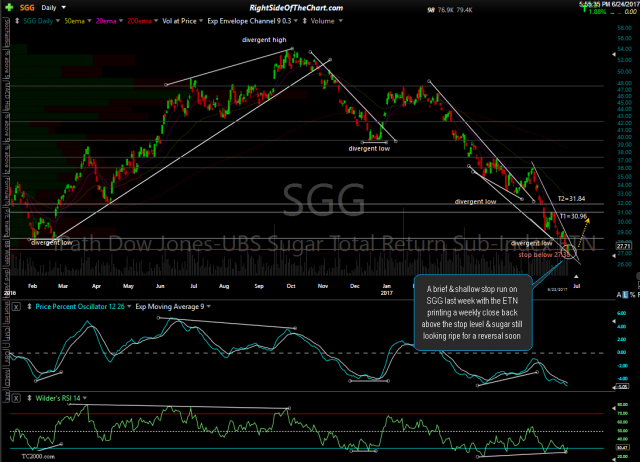

We had a brief & shallow stop run on the SGG (sugar ETN) Active Long Swing Trade last week with the ETN printing a weekly close back above the stop level & sugar still looking ripe for a reversal soon. That resulted in a relatively minor loss of 3.6% as I was keeping stops tight on this one. As $SUGAR (sugar continuous contract) is approaching support with very powerful bullish divergences below the steep falling wedge pattern, sugar is likely to rally sharply following a breakout of the wedge soon, just as it has typically done follow previous sharp downtrends in the past. For those still long that gave this position a little more room, a stop below 1.26 on $SUGAR or somewhat below Friday’s lows on SGG seems objective. Daily charts of SGG & $SUGAR below:

- SGG daily June 24th

- $SUGAR daily June 24th