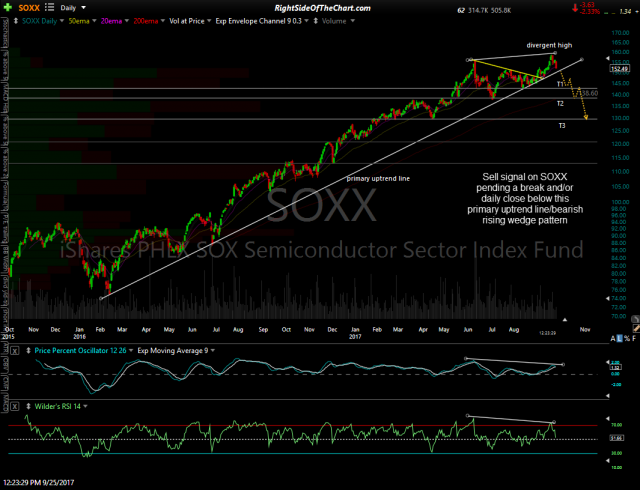

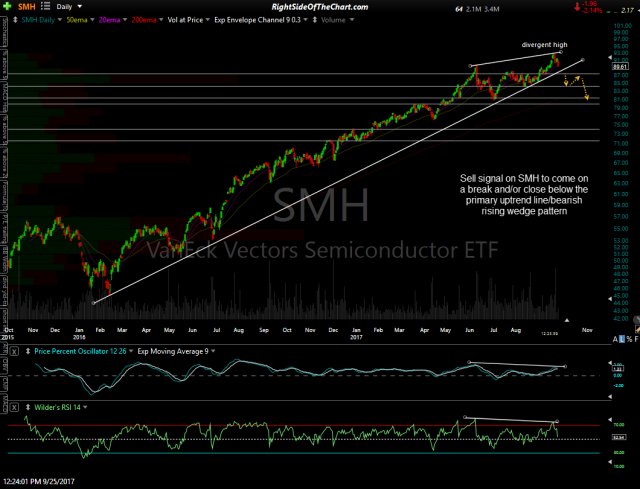

The semiconductor sector is approaching the key primary uptrend line support following the recent divergent high. The sector still looks poised for a significant correction with a sell signal to come on a break & close below these respective trendlines on the following three semiconductor ETFs; SOXX, SMH & XSD.

- SOXX daily Sept 25th

- SMH daily Sept 25th

- XSD daily Sept 25th

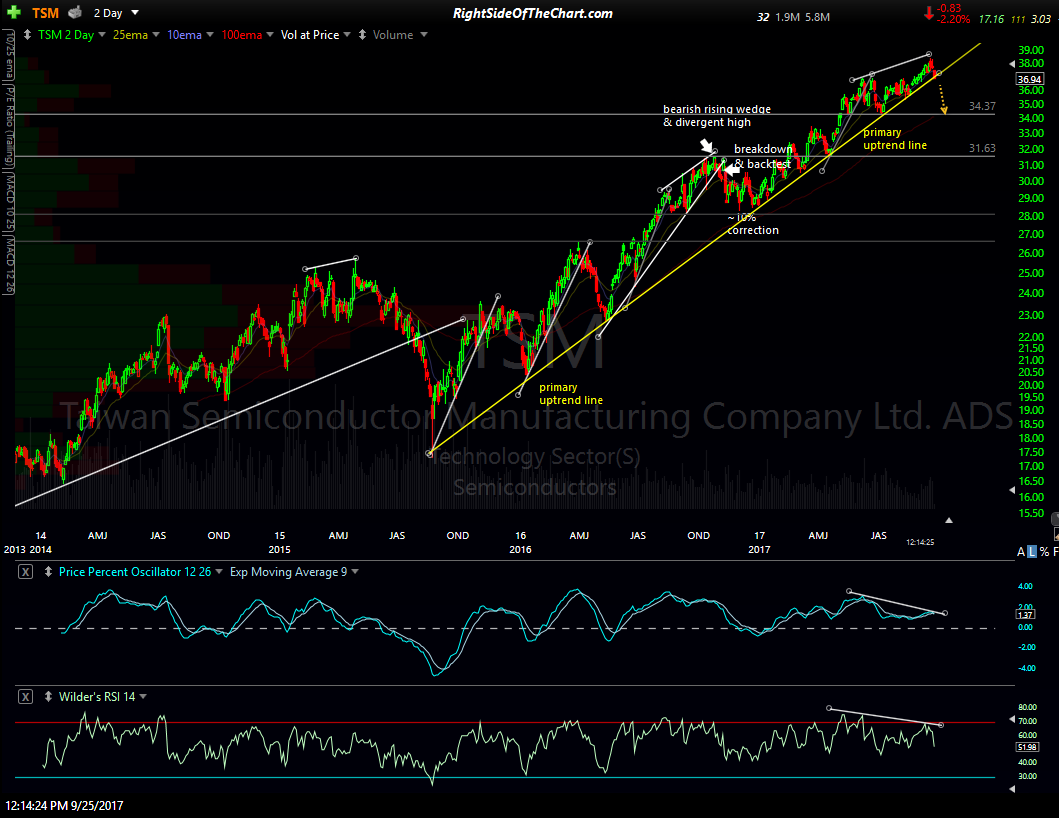

Additional confirmation for a sell signal on the semiconductor sector will come on a breakdown of the largest semiconductor stock, TSM (Taiwan Semiconductor Manufacturing Co.). TSM is currently sitting precariously on its 2+ year, very well-defined primary uptrend line, also following a divergent high/bearish rising wedge formation & will most likely drag the semiconductor sector down with it.