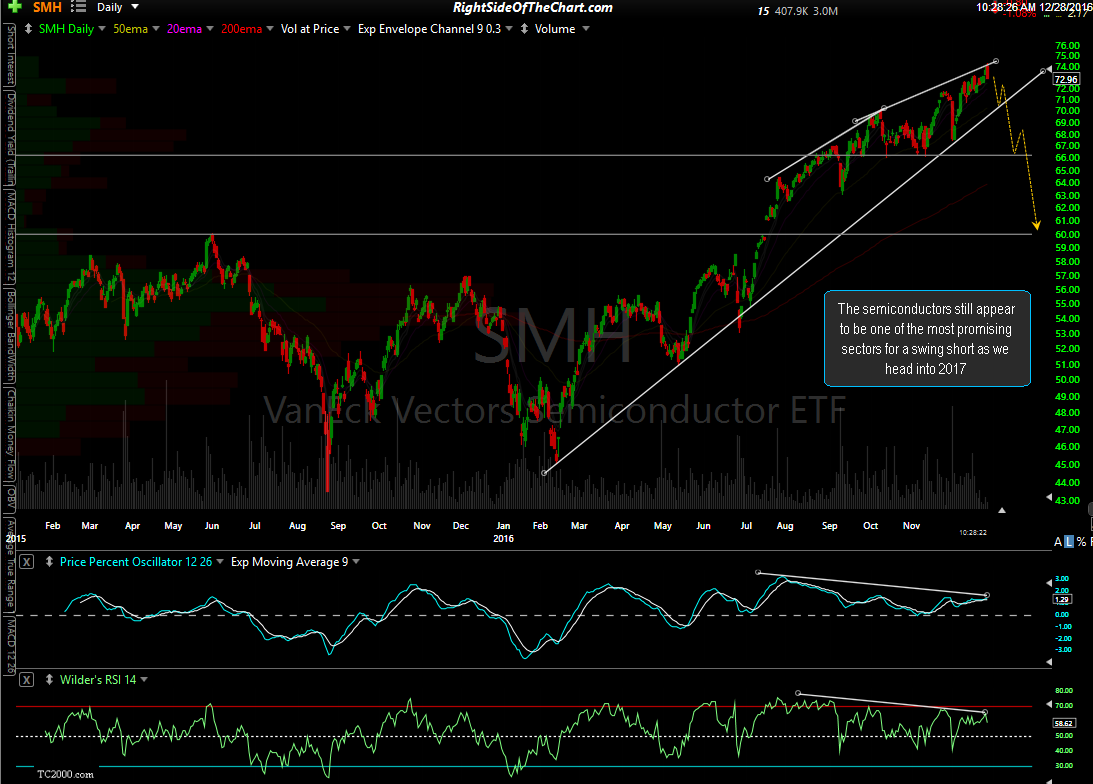

The semiconductors still appear to be one of the most promising sectors for a swing short as we head into 2017 as shown by the large bearish rising wedge pattern, confirmed with negative divergences, on this daily chart of SMH (semiconductor ETF).

- SMH 60-minute Dec 28th

- SOXX 60-minute Dec 28th

- XSD 60-minute Dec 28th

- AMD 60-minute Dec 28th

For those that want to hit the ground running next week, any of these semiconductor ETFs or the AMD short trade setup could certainly offer objective short entries soon, ideally with all of these 3 semiconductor ETFs printing a 60-minute close below their respective uptrend lines. Official trade ideas on both one or more semiconductor ETFs & individual semiconductor & chip equipment stocks, including price targets & suggested stops will follow soon. Until then, I just wanted to share these setups for those that might want to start positioning in advance of the new year.