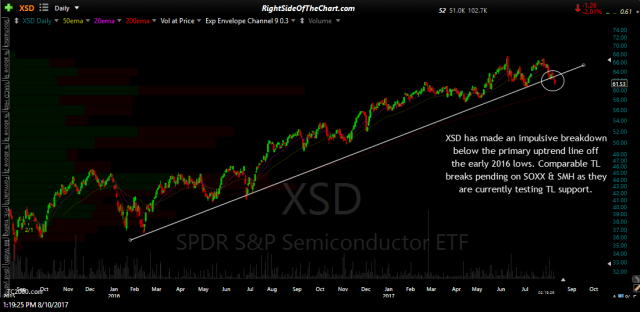

XSD (SPDR S&P Semiconductor ETF) has made an impulsive breakdown below the primary uptrend line off the early 2016 lows. Comparable trendline breaks are pending on SOXX (iShares PHLX SOX Semiconductor Sector ETF) & SMH (VanEck Vectors Semiconductor ETF) as they are currently testing TL support. A break & close below the trendlines on both SOXX & SMH will greatly decrease the odds that today’s breakdown in XSD will prove to be a whipsaw (false) sell signal.

- XSD daily Aug 8th

- SOXX daily Aug 8th

- SMH daily Aug 8th

Semiconductor stock trade ideas to follow asap but one could always use any of these ETFs as a proxy to short the sector. I will also likely follow up with one of the ETFs above as an official trade idea which will include price targets & other suggested trade parameters.