Based on my preferred scenario that SPY & QQQ would break out above the top of the August-Sept trading ranges, which they are currently poised to do on an opening gap today as the stock futures (/ES & /NQ) broke out above their respective ranges last night & remain above in the pre-market session so far today, I am revising the suggested stop on the QQQ Active Short Swing Trade from 189.85 to a daily close above 190.70. Original & updated (as of yesterday’s close) daily charts below.

- QQQ daily Aug 13th

- QQQ daily Sept 5th

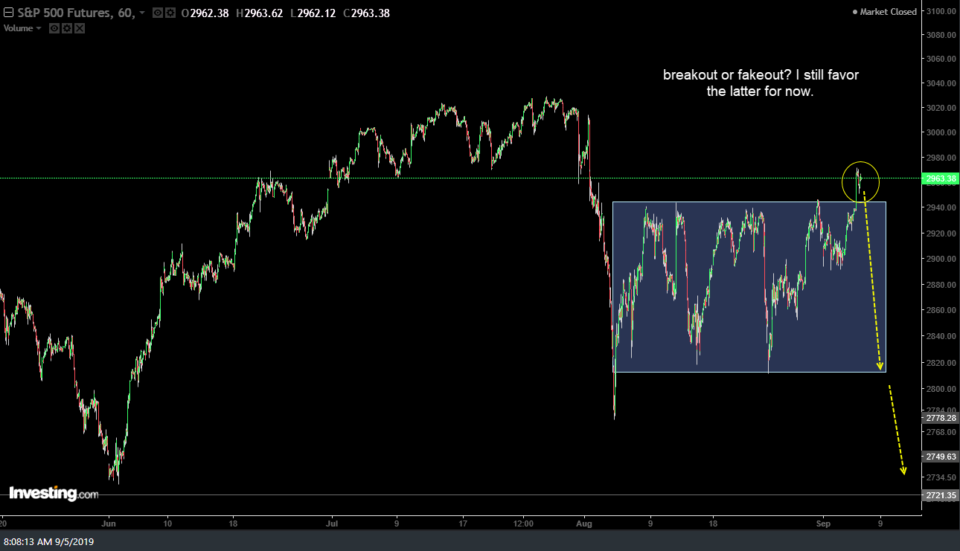

The original entry on the QQQ short trade was at 188.65 back on Aug 13th with the stop set at 194.35 which I had later lowered down to 189.95 on Aug 14th. So while setting a stop on a daily close brings in some degree of uncertainty for the exact stop level, it is all but a certainty that if this trade is stopped out, it will be at a smaller loss than the original stop, which still had a very attractive R/R, allowed for. In fact, this revised stop is only 1% above the entry price so depending on what I see today, I might even bump it a bit higher. 60-minute charts of /ES & /NQ futures showing the potential bull traps/false breakout scenarios below.

- ES 60-min Sept 5th

- NQ 60-min Sept 5th