Based upon further review of the charts & continued deterioration in both the fundamentals (economic outlook) as well as technicals (charts), the suggested stop will be lowered to a daily close above 206.14 with the price target(s) TBD in order to provide the potential for additional gains on the QQQ Active Short Swing Trade/potential trend trade idea.

Although a lot can & will change after the opening bell at 9:30 today, as of 8:30 am EST, QQQ is currently poised to gap below the former T1 price target of 195.35 which was set just above the support line at 194.90. QQQ has been trading between 194-195.41 since 8:00 am, essentially right on that key support level with the lock limit down prices of 8903.25 on /NQ & 2819 on /ES still in effect.

Whether or not the buyers step in around the 195ish support on QQQ or the stock market drops like a rock following today’s virtually inevitable large gap down is yet to be seen although the first level of circuit breakers would kick in if SPY essentially drops just below today’s pre-market low (so far) of 275.67. Details on the circuit breakers, which apply to regular trading hours only, are as follows:

- Level 1: If the S&P 500 drops 7%, trading will pause for 15 minutes. (This would occur today if the S&P falls 208 points).

- Level 2: If the S&P 500 declines 13%, trading will again pause for 15 minutes if the drop occurs on or before 3:25 p.m. ET. There will be no halt if the drop happens after that. (This would occur today if the S&P falls 386 points).

- Level 3: If the S&P 500 falls 20%, trading would halt for the remainder of the day. (This would occur if the S&P falls 594 points).

Should QQQ take out the confluence of trendline, price, & moving average support that runs from about 204 down to 195 with conviction, that could be the catalyst for a much larger drop in the coming weeks to months with some potential swing/trend targets on the QQQ weekly chart below, including my “next bear market” target of the 115ish level on QQQ (another 45% or so below Friday’s close).

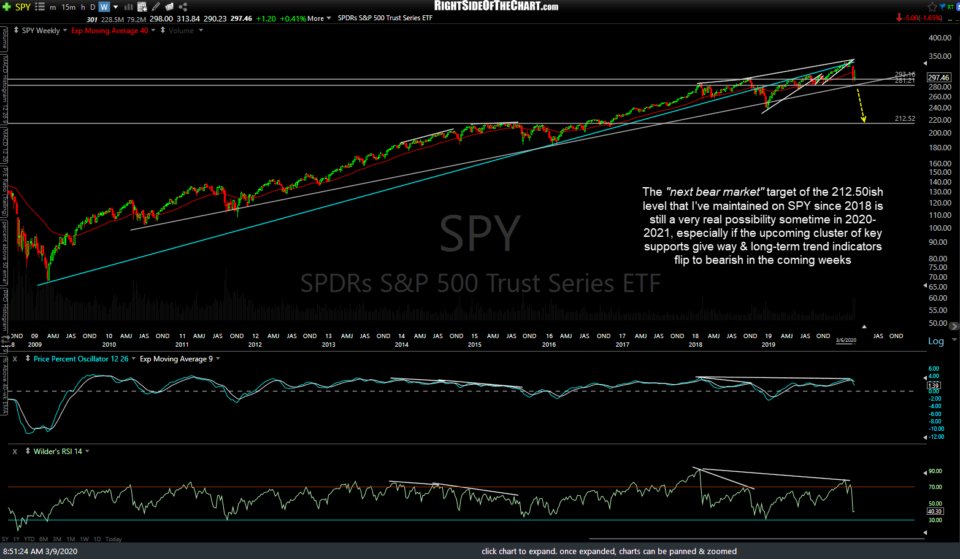

Likewise, the “next bear market” target of the 212.50ish level that I’ve maintained on SPY since 2018 is still a very real possibility sometime in 2020-2021, especially if the upcoming cluster of key supports give way & long-term trend indicators flip to bearish in the coming weeks.

Bottom line: My preference is to sit tight on the QQQ official short trade & other related swing trades at this time to allow for the potential for additional gains. However, I will continue to assess the charts as they develop and do my best to communicate any significant developments or potential trading opportunities asap. Best of luck on your trades this week!

-rp