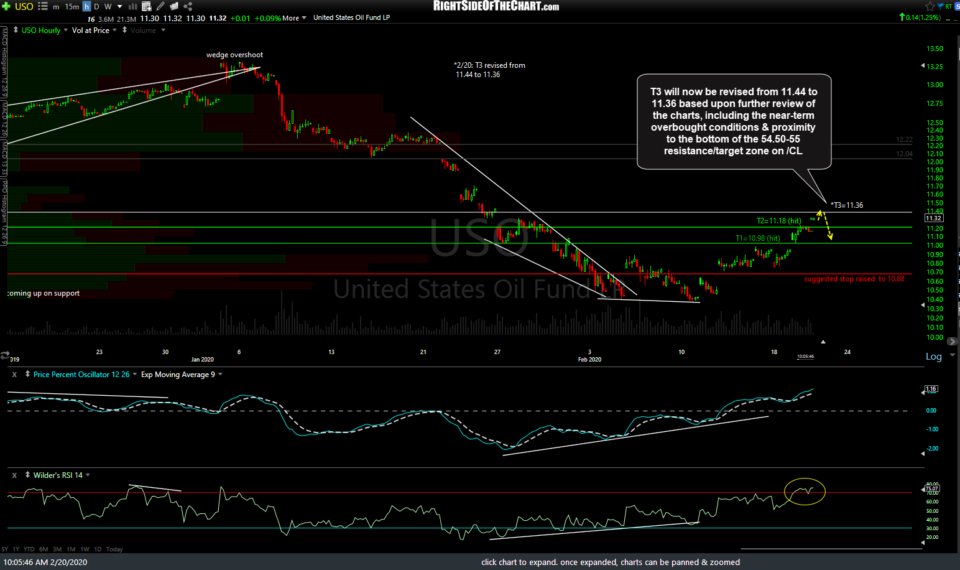

Based upon further review of the charts, including the near-term overbought conditions coupled with the proximity to the bottom of the 54.50 – 55.00 target/resistance zone on /CL, the final price target (T3) on the USO Active Long Swing Trade idea will now be lowered from 11.44 to 11.36. 60-minute charts of USO & /CL (crude futures) below.

- USO 60m Feb 20th

- CL 60m Feb 20th

Should crude reverse soon around this resistance zone, I may look to add it back as another official trade on a pullback although I’ll have to assess the charts as they develop. When this trade was entered a couple of weeks ago, the case was made that crude could be poised for a much larger rally/bullish trend and that case can still be made today, especially considering that crude has rallied impulsively off that key long-term support level. However, due to both the technical posture of crude oil as well as the US equity markets, I believe the odds for a significant pullback in crude soon is decent, hence my preference to close out this trade soon if/when that revised target is hit. I will add that one could certainly opt to just raise stops & let the trade run in lieu of booking profits soon, especially if that was/is their trading plan since taking crude off that long-term support level while at rarely seen oversold readings.