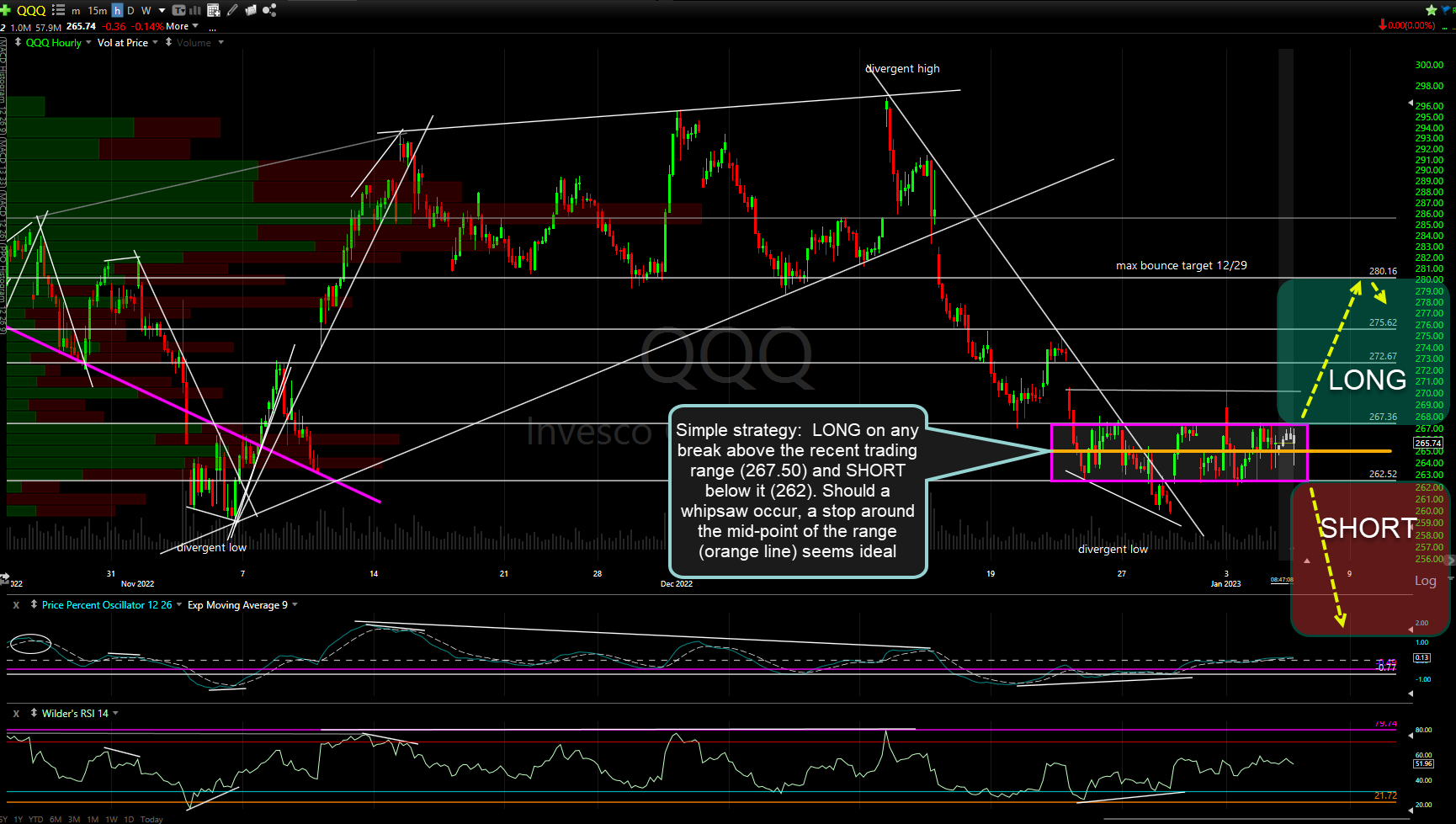

QQQ remains smack in the middle of the “X-mas Trading Range” so just to reiterate, here’s my trading plan in a nutshell: LONG on any break above the recent trading range (267.50) and SHORT below it (262). Should a whipsaw occur, a stop around the mid-point of the range (orange line) seems ideal.

I remain long the $NDX & $RUT for now but still plan to add to those positions on a break above the trading ranges (in all of QQQ, /NQ, IWM, /RTY, SPY, /ES, etc..) or closing the longs & going back into swing shorts on a solid break below the ranges. As whipsaws almost seem to be more the rule than the exception lately, should a whipsaw (false breakout above or below the range followed by a move back into it) occur, I will stop out of the existing long or short positions around the midpoint of the range as that would be a solid recovery back into it.

One thing I am noticing in pre-market that doesn’t help the near-term bullish case is impulsive selling in basically ALL the major asset classes that I closely monitor: Equities, Treasury bonds, crude oil, natural gas, gold, & silver. Each of those starting falling sharply immediately following the better-than-expected Jobless Claims release at 8:30 am today, with immediate broad-based selling in just about everything with a ticker (except the $VIX), likely due to the fact that only adds to the case for continued rate increases as the Fed’s primary inflation focus has shifted from asset prices to the labor market & potential wage inflation.

Sticking to the aforementioned trading plan for now as the 60-minute charts remain constructive for now & most or all of the market-leading big tech stocks remain below their recent lows in pre-market, despite their post 8:30am drops, at least so far.