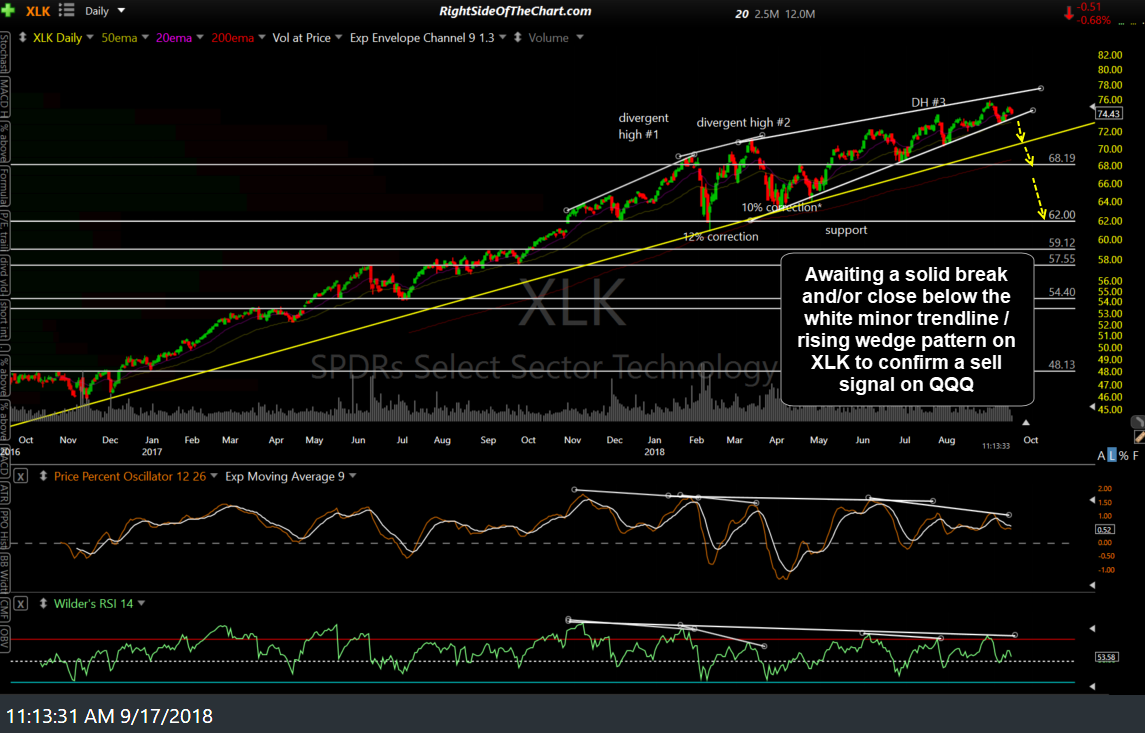

QQQ (Nasdaq 100 Tracking ETF) appears poised for a substantial correction in the coming weeks & months and is under consideration to be added as swing short trade idea. In addition to the recent trendline break & backtest on the QQQ daily chart, which puts QQQ on a sell signal at this time, I am still waiting for a few other key stocks & sectors to confirm with breakdown below their respective trendlines, primarily AMZN & XLK to firm up the case for a substantial correction in QQQ.

I believe that the chances of a swift sell-off in the markets are substantially elevated at this time so I wanted to get this setup, along with the charts, out in advance for both those that might already be short or would like to short at this time, as well as those that would like to wait for a little more evidence before shorting.

AMZN (Amazon Inc.) has broken below its nearly year-long uptrend line/bearish rising wedge so far today & while the highest probability short entry for AMZN would be to wait for a solid daily close below the trendline, I suspect that a confirmed breakdown & correction in the stock, which will almost certainly drag the stock market down with it, is quite likely & imminent at this time. Again, I am referring to an impulsive breakdown & a solid daily close below the uptrend line, not just an intraday break slightly below, such as we have so far today.

Likewise, a breakdown in XLK, which remains slightly above its trendline/wedge off the early April lows appears likely soon. Price targets & suggested stops are usually provided with a trade setup but in this case, I will follow up with the exact price targets & suggested stop(s) levels soon. I will say that the minimum price target will be around the 175ish support level with a final target at least around the 166.76 support level & possibly the 156.35 level. As such, the minimum suggested stop would be any daily close above the recent all-time intraday high of 187.52.

The suggested beta-adjusted position size for this trade would be 1.0. Inverse ETF proxies for shorting QQQ include PSQ (1x short), QID (2x short) & SQQQ (3x short), although the appropriate position size adjustment to account for the leverage should be factored in.