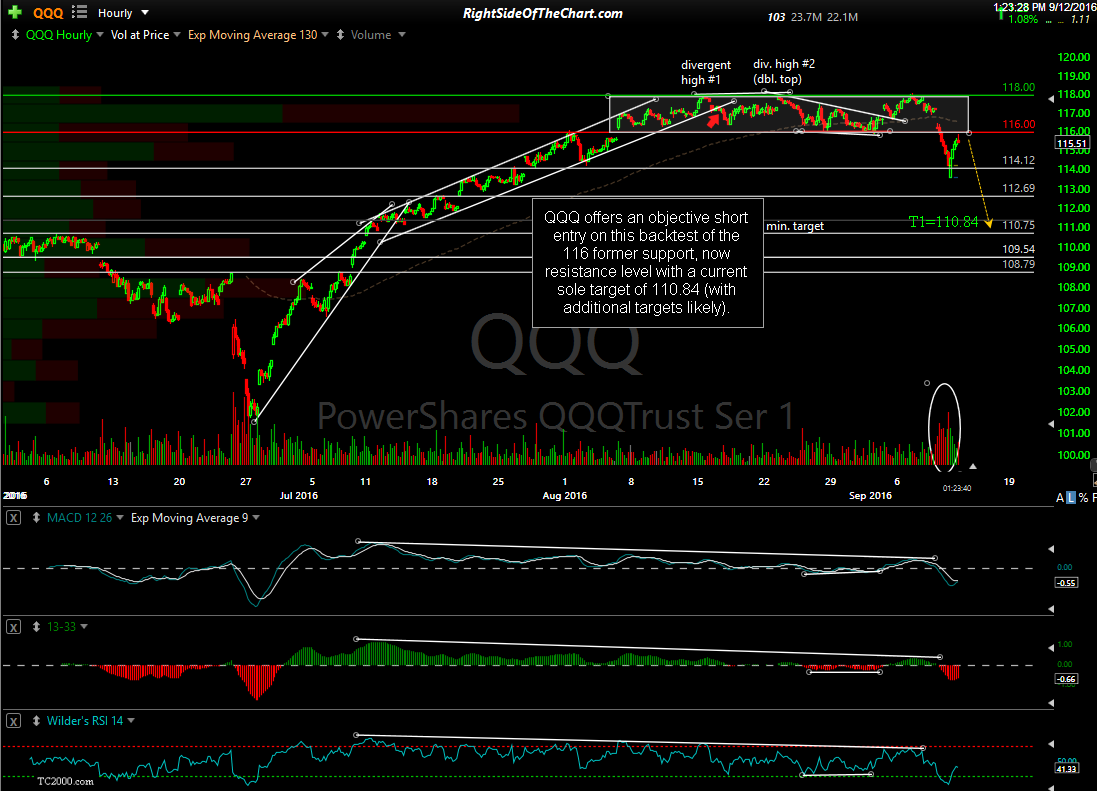

QQQ (Nasdaq 100 Tracking ETF) offers an objective short entry on this backtest of the 116 former support, now resistance level with a current sole target of 110.84 (with additional targets likely). Suggested stop on 60-minute close above 117.35.

As there are numerous proxies for shorting the Q’s such as NQ (e-mini futures), QID, QLD, PSQ, SQQQ, TQQQ, etc…, I’m going to leave it up to you to decide which vehicle to use, with QQQ as the official trade. Ideal entry range from 115.00 to 116.50 and a Suggested Beta-Adjustment of 1.00.