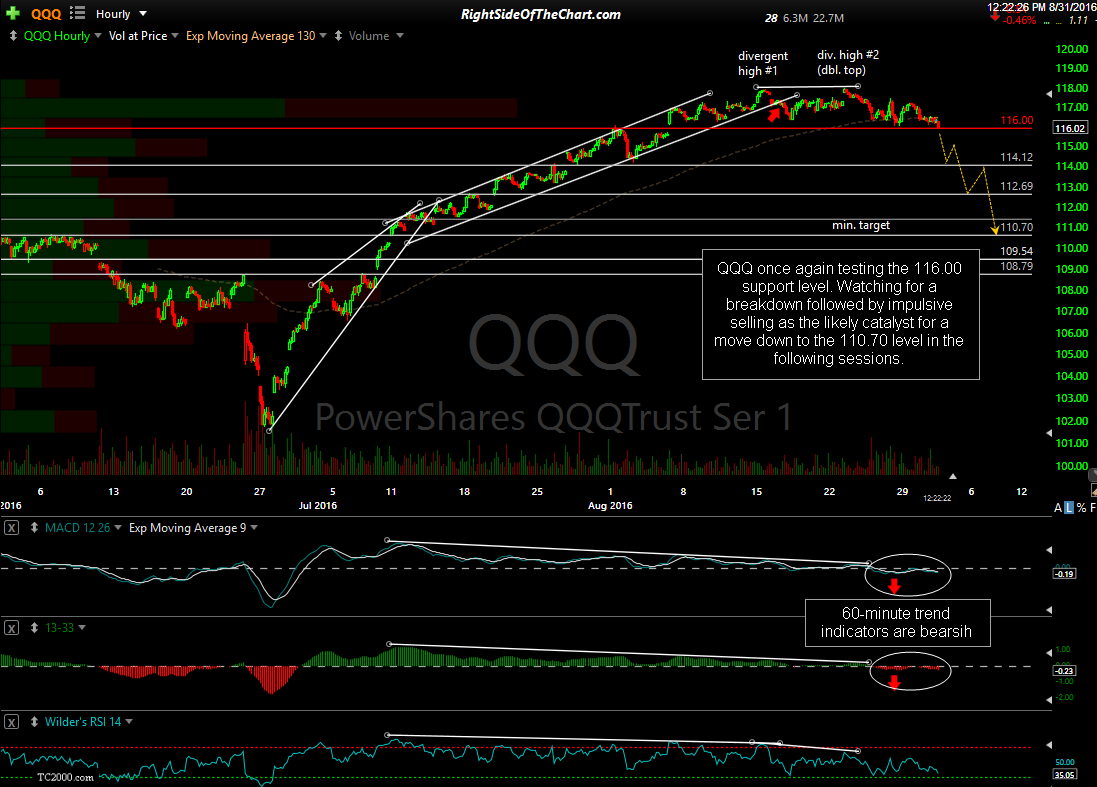

QQQ (Nasdaq 100 tracking ETF) is once again testing the potentially important 116.00 support level with both of the 60-minute trend indicators recently flipping to bearish for the first time since June. Watching for a breakdown followed by impulsive selling as the likely catalyst for a move down to the 110.70 level in the following sessions.

QQQ Testing Key Support

Share this! (member restricted content requires registration)

7 Comments