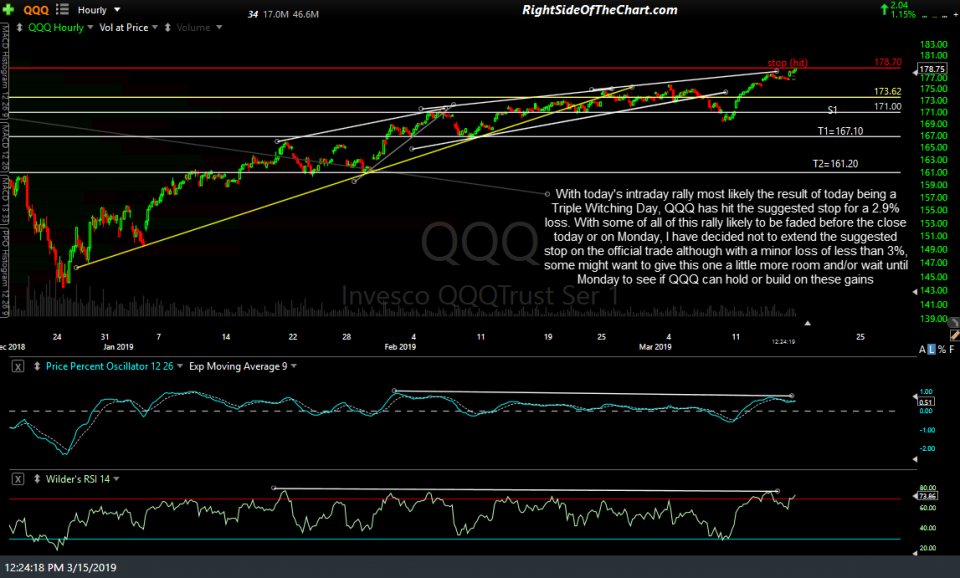

With today’s intraday rally most likely the result of today being a Triple Witching Day*, QQQ has hit the suggested stop for a 2.9% loss. With some of all of this rally likely to be faded before the close today or on Monday, I have decided not to extend the suggested stop on the official trade although with a minor loss of less than 3%, some might want to give this one a little more room and/or wait until Monday to see if QQQ can hold or build on these gains. Original & updated/final 60-minute charts on this trade below.

- QQQ 60-min March 6th

- QQQ 60-min March 15th

*Financial market movements can be erratic on days when options and futures contracts expire. This is especially true on triple witching hour days (or quadruple witching hour end-of-quarter days). It is therefore recommended that you not trade on the 3rd Friday of each month (in yellow on the calendar). source: forex-central.net

All related posts from this QQQ trade will be moved to the Completed Trade category but I will continue to actively post updates going forward, whether on not QQQ is added back as another official trade soon. Additionally, there are some recent short trades that also need to be re-categorized to the Completed Trades category as well. Updates on these trades were already covered in recent videos, front page posts or within the trading room but for archiving purposed, all previous posts associated with those trades will now be reassigned to the Completed Trades category for future reference.

DWT came within 14 cents of T1 before reversing & gapping below the suggested stop of 8.78 to open at 8.58, resulting in a 3.8% beta-adjusted loss. Original & updated 60-min charts:

- DWT 60-min Feb 7th

- DWT 60-min March 15th

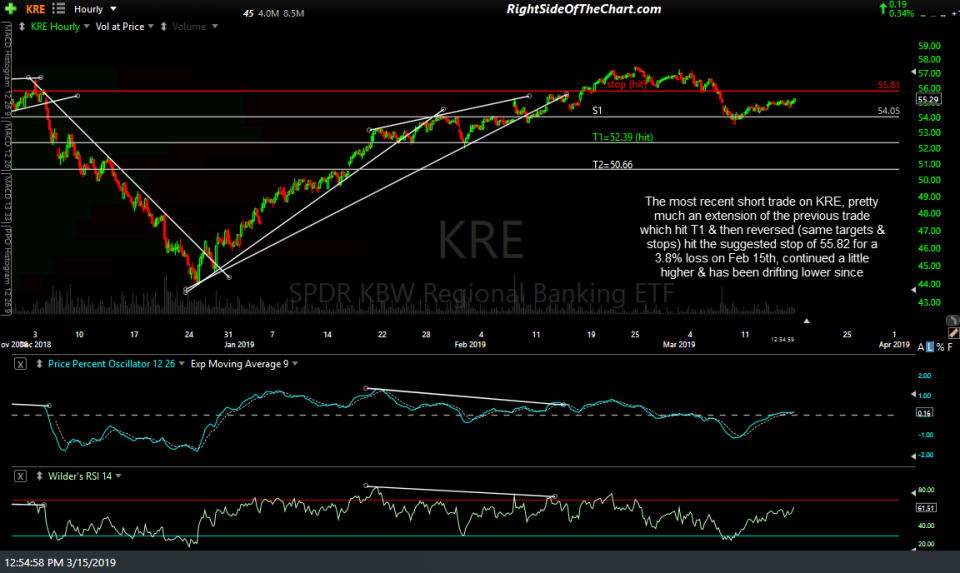

The most recent short trade on KRE, pretty much an extension of the previous trade which hit T1 & then reversed (same targets & stops) hit the suggested stop of 55.82 for a 3.8% loss on Feb 15th, continued a little higher & has been drifting lower since.

- KRE 60-min 2 Feb 7th

- KRE 60-min March 15th