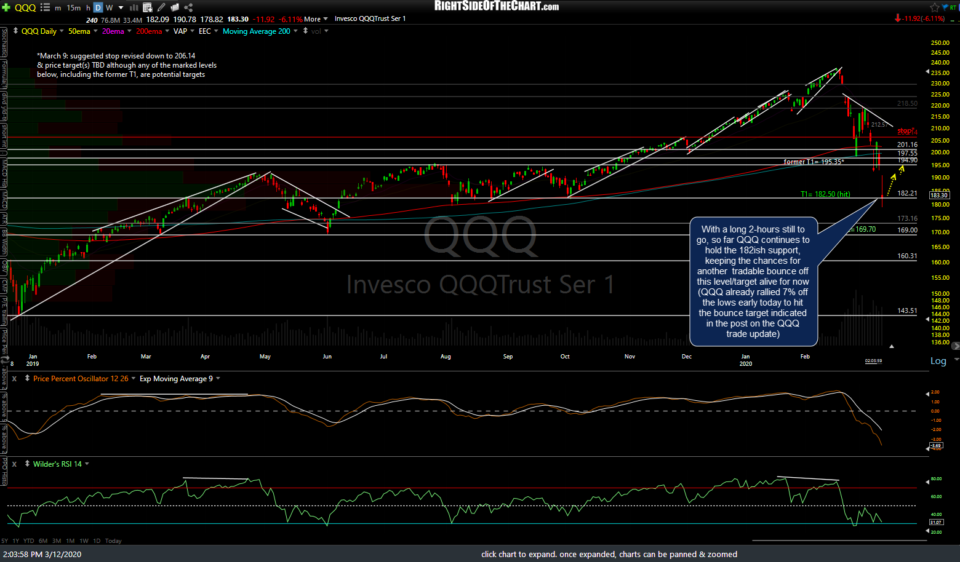

As we head in the final hour of trading, so far QQQ continues to hold the 182ish support, keeping the chances for another tradable bounce off this level/target alive for now (QQQ already rallied 7% off the lows early today to hit the bounce target indicated in the post on the QQQ trade update). Note: I had taken the screenshots below around 2 pm but worked on composing this post plus trading/entering orders across numerous accounts although the indexes are still around the same levels right now just after 3 pm).

While anything can happen in the last 2-hrs of the regular session today & then again in the after-hours & overnight Globex session, so far /NQ has tested & reversed off the 7350ish support level + 61.8% Fib retracement on the daily time frame.

Unlike QQQ, which has tested & held support so far today, SPY remains in a precarious technical position, well below the 262ish support which dampens the case for a swing-tradable snapback rally in the broad market & keeps alive the potential for even more downside to come (especially if/when QQQ & /NQ solidly take out today’s lows).

Bottom-line: I wish I could say with a high degree of confidence whether the next 5-10% move in the market from here will be up or down. If I did have such strong convictions, then I would be adding the index ETFs or some market-leading stocks such as AMZN or MSFT as official long trades. However, this market can just as easily take another big leg down from here as it can rally, should these support levels on QQQ & /NQ continue to hold (and with SPY snapping back above 262).

Trade it as you like or stand aside, let the dust settle & wait for the charts to set up with the next clearly bullish or bearish trade idea with an attractive R/R profile. What I can say is that the R/R to adding new short positions here at this time is not very favorable, even with the potential for an outright market crash that can take the indexes down another 10%+. The risk for a very sudden & sharp oversold snapback rally increases with each tick down from here & still remains decent as long as QQQ & /NQ continue to defend these support levels.

As always, I’m glad to share my thoughts FWIW. Although we already got that first 7% bounce in QQQ earlier today, which means that could be it with the market soon to take out today’s lows & start the next leg down. While the fact we already got a decent reaction off the initial tag of that support level does diminish the odds of it happening again, I think the odds are still fair, not great but OK, for another bounce up to the 192-194 level on QQQ. If so, that would likely start soon, as in the final hour or so of trading or in the overnight futures session. Less active swing traders & trend traders might opt to remain short & ride out any counter-trend rallies until the charts start to indicate a high probability of a reversal. Another strategy that can work well when the market is in meltdown mode is to continue to ride down a short position while starting to use increasingly tight stops at this point.

Those looking to get in early on what could prove to be another sharp bounce of 7-10% could go long here around those support levels on /NQ & QQQ with stops somewhat below and/or wait for some decent evidence of a near-term reversal such as some type of bullish candlestick pattern and/or a break above the 186 resistance level on QQQ & 260 on SPY. Certainly not a trade you want to get married to if it doesn’t work out (i.e.- stops are a must) but this is the type of market where you can make (or lose) in a single day what might normally take weeks or months to make during a normal trending market. Also, remember that the index ETFs (QQQ & SPY) are vulnerable to large opening gaps for or against your position when volatility is at extremes. Even futures run the unusually risk of being “trapped” lately, with 2 days so far this week where they hit the 5% lock-down limit.

Make no mistake about it: The trend is clearly bearish without any solid evidence of a reversal yet with macro/economic outlook that continues to rapidly deteriorate and will most likely get worse before it gets better. As such, it is more so a matter of “When/where will the next tradable rally start?” vs. “Are we at or near the end of the correction/bear market?” as by nearly all accounts, the market looks to be in the early stages of a much larger correction/bear market with more downside to come before all is said & done. Best of luck on your trades & remember: When in doubt, stay out (of the market).

-rp