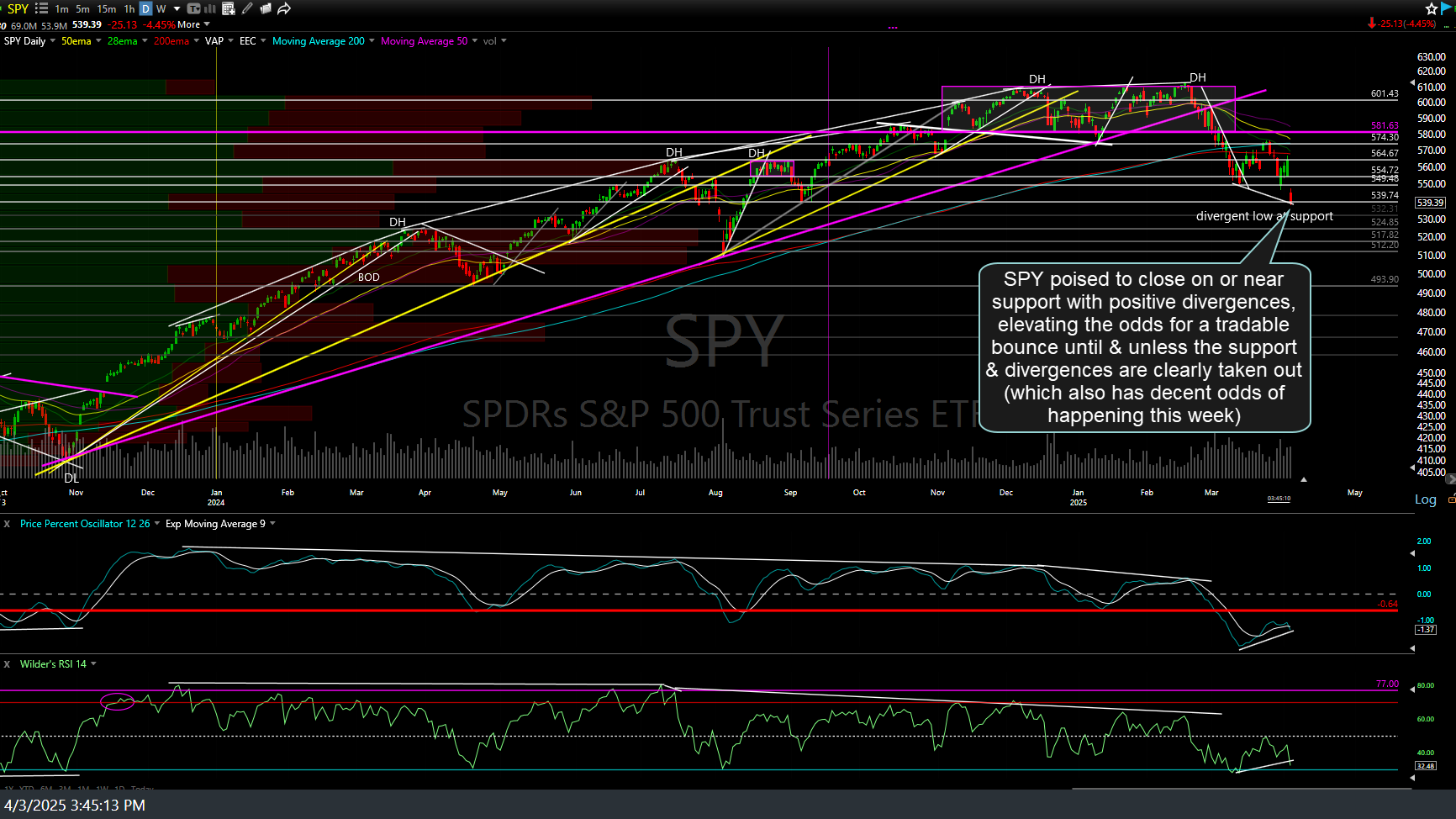

As we head into the final minutes of the trade day, both QQQ & SPY are poised to close on or near the support levels highlighted earlier today with positive divergences still intact for now, thereby elevating the odds for a tradable bounce until & unless the support & divergences are clearly taken out (which also has decent odds of happening this week due to the technical posture & recent bearish developments on the daily & weekly charts.)

Sorry but I can’t add much more than that other than, despite the fact the odds of my longer-term downside bear market targets being hit increased substantially last night when my “Lights Out” support level was taken out.. and then again today on the big drop from there, I can say that I do not believe that initiating (opening) new short positions at this time is very objective unless one can effectively manage the risk of a sudden & swift reversal, which could happen in the overnight futures session, with stops. (easier done with futures vs. ETFs).

Longer-term swing & trend traders that have been short since the weekly bearish engulfing candlesticks that have so far marked the top are in a very good position with substantial embedded profits and might opt to sit tight for now, lower stops to protect profits, and/or wait for the next objective opportunity to increase short exposure.

Active traders still short might consider setting relatively tight stops to protect gains while those going long here at support to game a bounce might consider stops not too far below, should the market blast down through those supports in an impulsive manner.