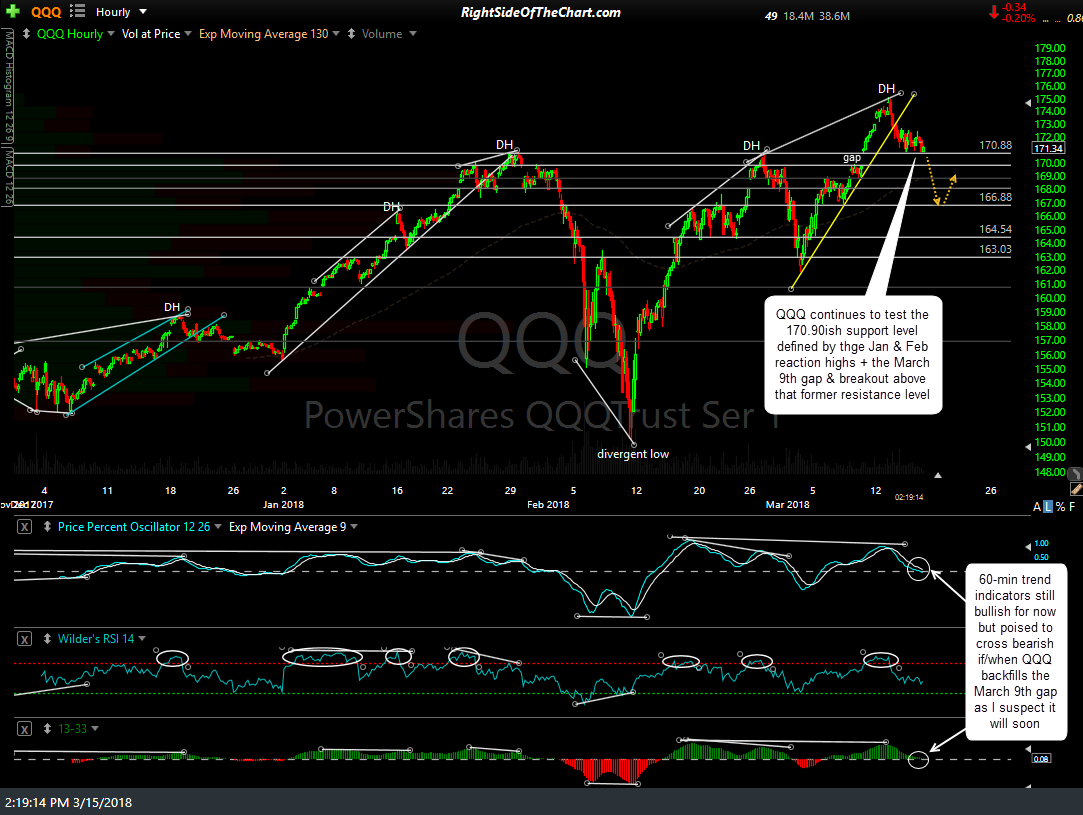

QQQ (Nasdaq 100 Tracking ETF) continues to test the 170.90ish support level defined by the January & February reaction highs as well as the March 9th gap & breakout above that former resistance level. The 60-minute trend indicators on the Q’s remain bullish for now although they are poised to cross bearish if/when QQQ backfills the March 9th gap as I suspect it will soon.

SPY (S&P 500 Tracking ETF) has now backfilled the March 8th gap, the bottom of which is both gap as well as price support, with the 60-minute trend indicators just starting to crack below their respective zero lines. At this point it would be prudent to wait for the 60-minute trend indicators on both SPY & QQQ to cross into bearish territory, all on a 60-minute closing basis, for those considering shorting one of the broad market ETF if they did not already establish a position on the recent trendline breaks. Essentially we have the markets testing some fairly significant support level following the recent breakdown below the 60-minute uptrend lines & divergent highs which indicates that this pullback has more downside to come with the next sell signals pending on a break & 60-minute close below today’s lows.