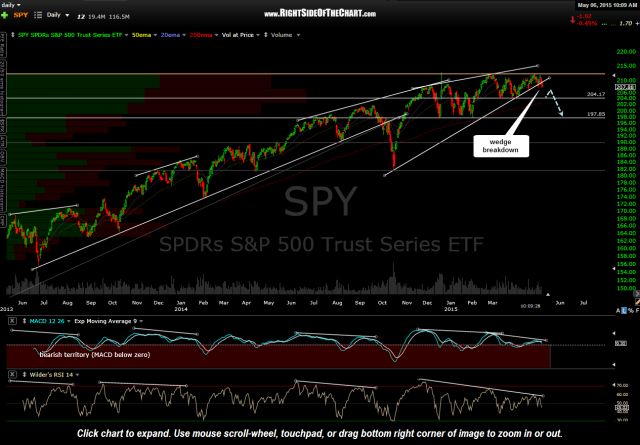

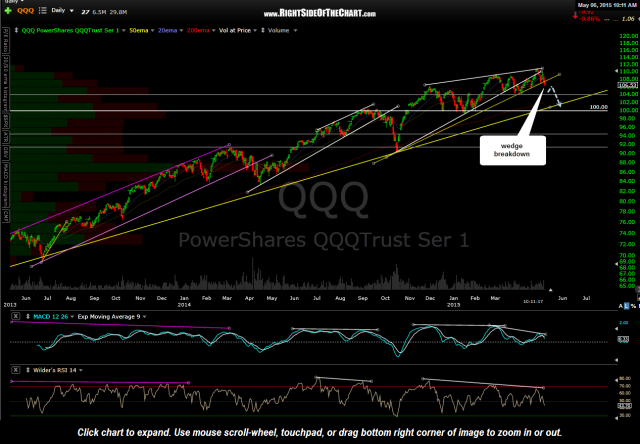

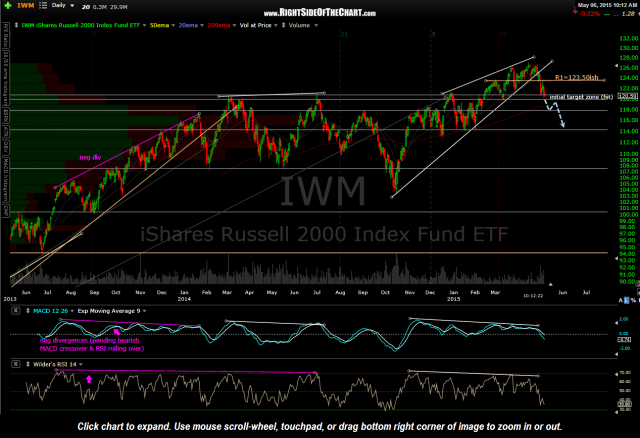

Both the SPY & QQQ have now broken below their bearish rising wedge patterns with IWM already well ahead of them. As always, when trading the daily time frames, it’s all about where prices close the day. Although the major US equity indices certainly have a shot at regaining those wedges and sparking a short-covering rally + new longs stepping in once/if those support levels are regained, I continue to favor a sharp thrust lower to at least the first support levels shown on these charts (SPY 204.15ish, QQQ 104.00ish, & IWM 117.90ish).

- SPY daily May 6th

- QQQ daily May 6th

- IWM daily May 6th