On the daily charts, QQQ hit a low of 178.06 yesterday, essentially kissing the 178 support level where I expect a reaction from followed by more downside while SPY closed right around the 281 support yesterday where I also continue to expect a bounce from.

- QQQ daily May 14th

- SPY daily May 14th

The 60-minute charts below show my updated bounce target zones with the purple resistance levels (and uptrend line) on QQQ & SPY. Also, note the RSI divergence on both QQQ & SPY in place at yesterday’s lows (potentially near-term bullish). Should these bounce scenarios fail to materialize with at least my new minimum bounce targets being hit with the indexes instead impulsively breaking below yesterday’s lows, that would be quite bearish & likely open the door for a continued slide down to the next support levels on the daily charts above… a very real possibility.

- QQQ 60-min May 14th

- SPY 60-min May 14th

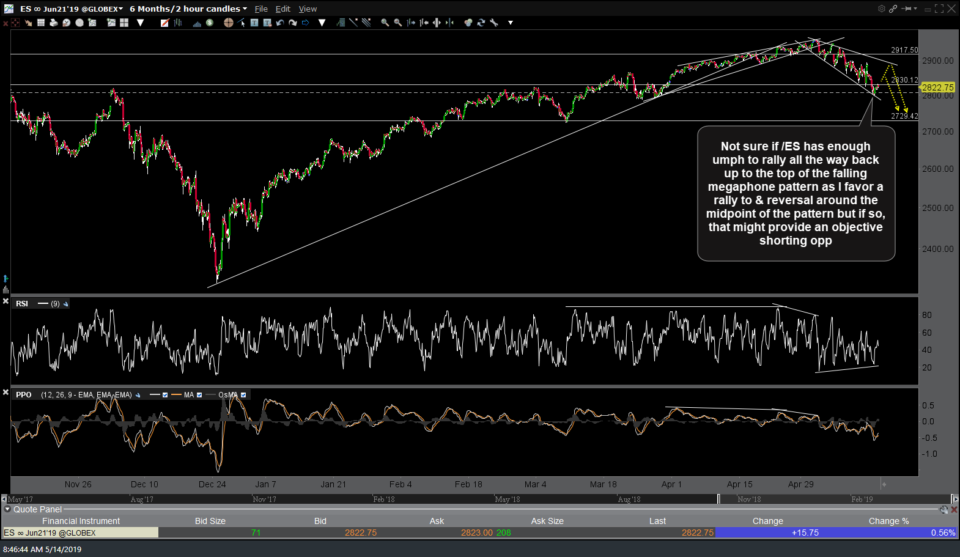

Looking at the 60-minute charts of the index futures, my 7275 target on /NQ effectively hit in the overnight session, followed by the expected reaction/bounce so far. Not sure if /ES has enough umph to rally all the way back up to the top of the falling megaphone pattern as I favor a rally to & reversal around the midpoint of the pattern but if so, that might provide an objective shorting opportunity.

- NQ 60-min May 14th

- ES 60-min May 14th