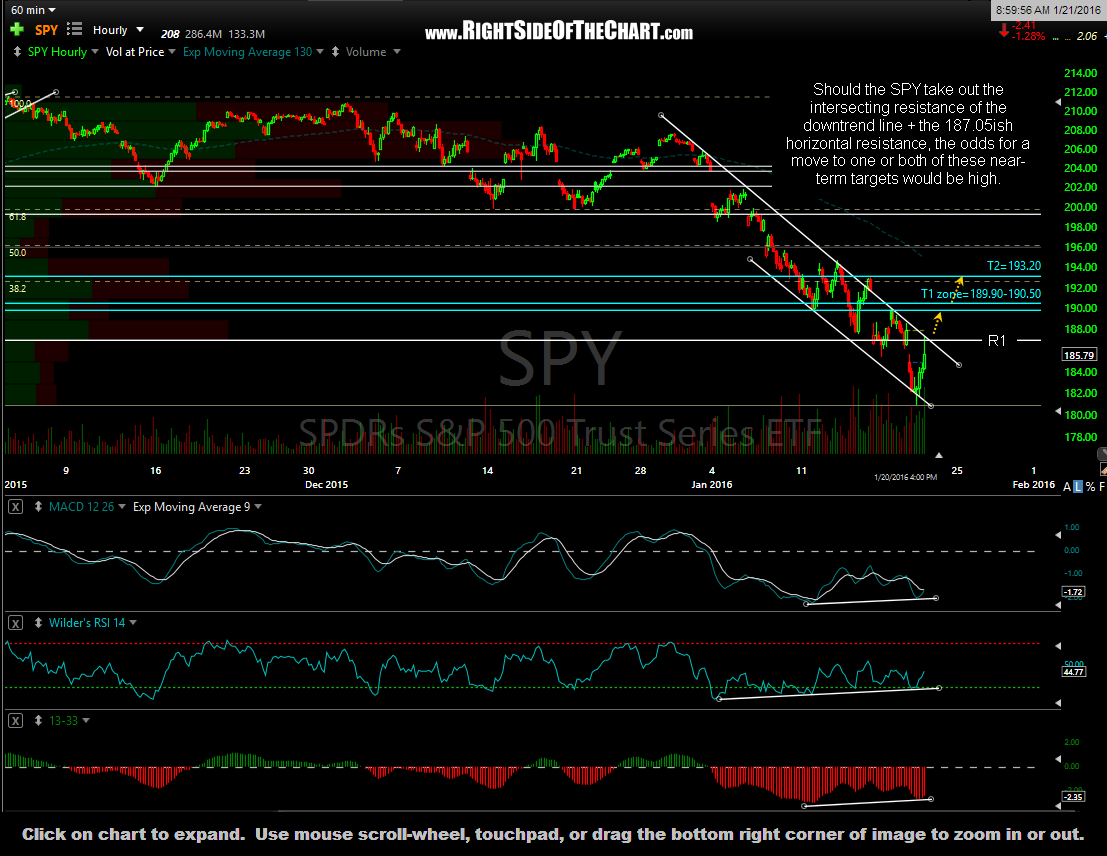

I really don’t have much to add since my comments yesterday. Although the major US stock indices closed down moderately ($NDX -0.26%) to sharply ($SPX -1.17% & the $DJIA -1.56%), I view the overall price action for the day as bullish & continue to believe that there is a good chance that yesterday’s lows will mark the end of the selling for at least the near-term. With that being said, essentially all short & intermediate-term trend indicators remain solidly bearish at this time & the markets still have some work to do in order to help firm up the near-term bullish case.

Should the Q’s take out this intersecting downtrend line & horizontal resistance (R1), my expectation is for a move up to at least the 103.90 level.

In summary, I do believe that chances are good that the aforementioned resistance levels on these charts will be taken out with both the QQQ & SPY reaching at least the first price targets within the next week. However, resistance is resistance until broken so should the markets fail to surmount these levels (or even if they do), further downside, including new lows, can’t be ruled out at this point.

I still maintain a net long bias since positioning aggressively long just off the lows yesterday but will continue to manage my risk accordingly by strategically increasing my market exposure during trading hours & reducing my overnight exposure before the close, as to minimize the risk of being caught on the wrong side of an opening gap. Feel free to direct any questions to the trading room or in the comment section under any post, if the question or comments pertain to the content in that specific post. As always, trade ideas & market commentary are also encouraged & welcomed as well. Best of luck on your trades. -RP