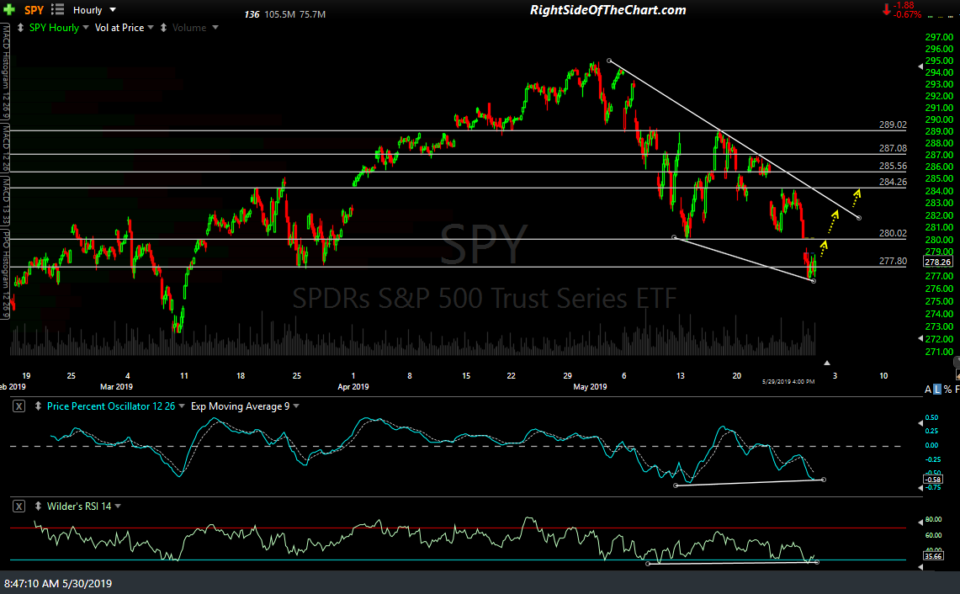

Any or all of the marked overhead resistance levels on these 60-minute charts of QQQ & SPY are potential bounce targets, should the indexes hold above the recent lows & rally today and/or tomorrow. We don’t have anything remotely close to a buy signal or indication of a reversal from the current bearish trend yet although a break above the falling wedge & intersecting 177.20ish resistance level is likely to spark a short-covering rally in QQQ and the broad market along with it.

- QQQ daily May 30th

- SPY 60-min May 30th

As my confidence on the bounce isn’t high enough right now, I’m only passing these along as unofficial trade ideas & again, best to wait for a break above the downtrend line & 177.20ish level on QQQ & ideally, an impulsive breakout. On a related note, I had a couple of inquiries in the trading room yesterday asking if I plan to revise the stops or any other trade parameters on the official long swing trades for AAPL & INTC and my answer was no. Both of those trades still look fine from a technical perspective and despite the fact that the stock market is in a downtrend & holding them back from rallying so far due to the forced selling that both AAPL & INTC incur as top components of both the Nasdaq 100 as well as the S&P 500, I prefer to stick with a trading plan until & unless I see something compelling that changes the outlook for a trade.