QQQ, SPY, & NVDA have all hit my next long-term swing/trend trade price targets that were first laid out in this post on June 26th in today’s pre-market trading session. Additionally, several of the top components of the S&P 500 & Nasdaq 100, as well as those two leading large-cap indices themselves, have now fallen to those key 200-day moving averages that I’ve been calling for. As such, I am covering all of the short positions in my long-term accounts & going to a full long position in my trading account as the stock market & many leading stocks are at or in close proximity to key support levels with a pivot (rate cutting cycle to begin soon) from the Fed now all but guaranteed, which is likely to be the catalyst for nothing short of an explosive rally, likely starting today IMO.

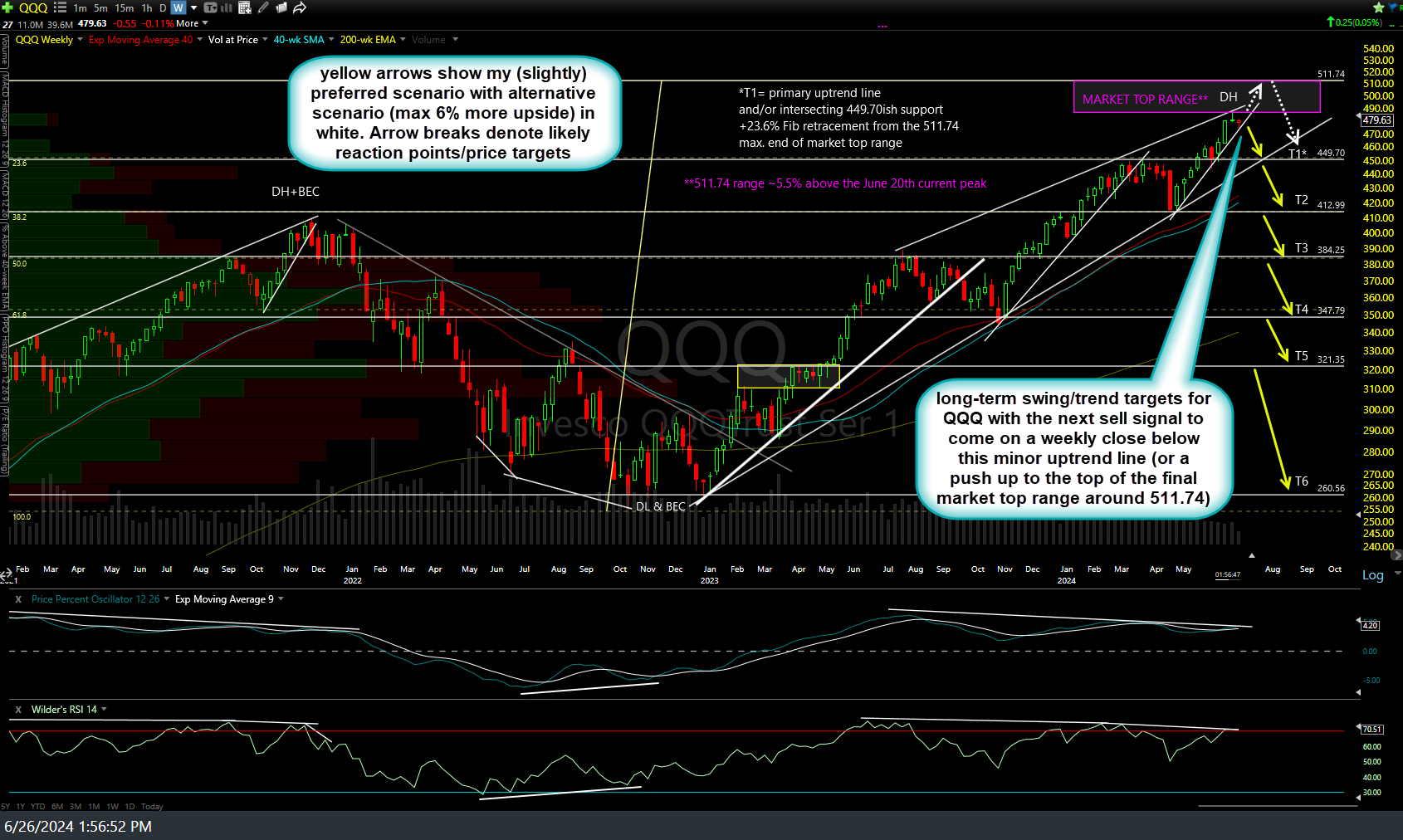

Those June 26th weekly charts of SPY, QQQ, & NVDA along with the updated weekly chart of each below (that June 26th post can also be viewed by clicking here).