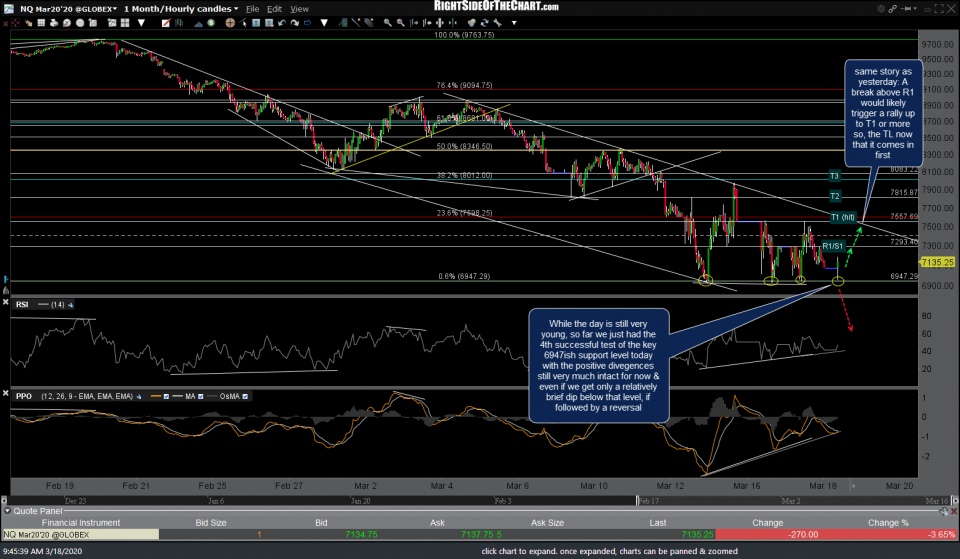

I was waiting to see how the stock index futures would trade once the lock-limit down was lifted at the opening bell (it was hit last night again for what has recently become a fairly common occurrence). As of shortly after the opening bell, there haven’t been any material changes in the technical posture of the major index-tracking ETFs & futures although that can certainly change in a New York Minute in this market. Essentially, the same positive divergences that highlighted yesterday are still intact, as of now, and although /NQ did cross back down below the 7293.40 support/resistance level yesterday late-afternoon (triggered the subsequent drop), that sent /NQ for yet another successful test, at least so far, of that key 6947ish support level with the 4th test & reversal off that level since last Thursday.

While four successful test of a support level in no way guarantees it will hold, that forth test helps to validate that an important level to watch as a solid break below (other than a brief, stop-clearing whipsaw followed by recovery) would likely open the door to the next wave of selling. Basically, same story as yesterday: A break above R1 would likely trigger a rally up to T1 or more so, the trendline now that it comes in first, while a solid break below the 6947 level would likely usher in more selling (after the first circuit breaker is trading halt is hit & then removed).

No change in the technical posture of QQQ despite another wild ride in the futures overnight other than the gap down below the R1/S1 level (~179). Positive divergences still intact, for now, with a solid break below 169 bearish & a break back above R1 likely to send QQQ back up to the downtrend line/T1 level. 30-minute chart below.

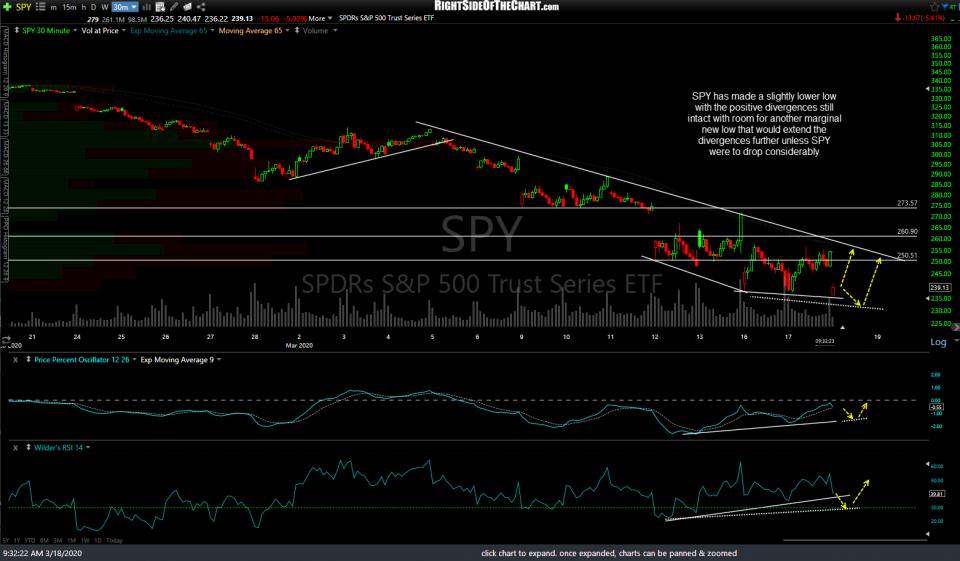

SPY has made a slightly lower low with the positive divergences still intact with room for another marginal new low that would extend the divergences further unless SPY were to drop considerably.