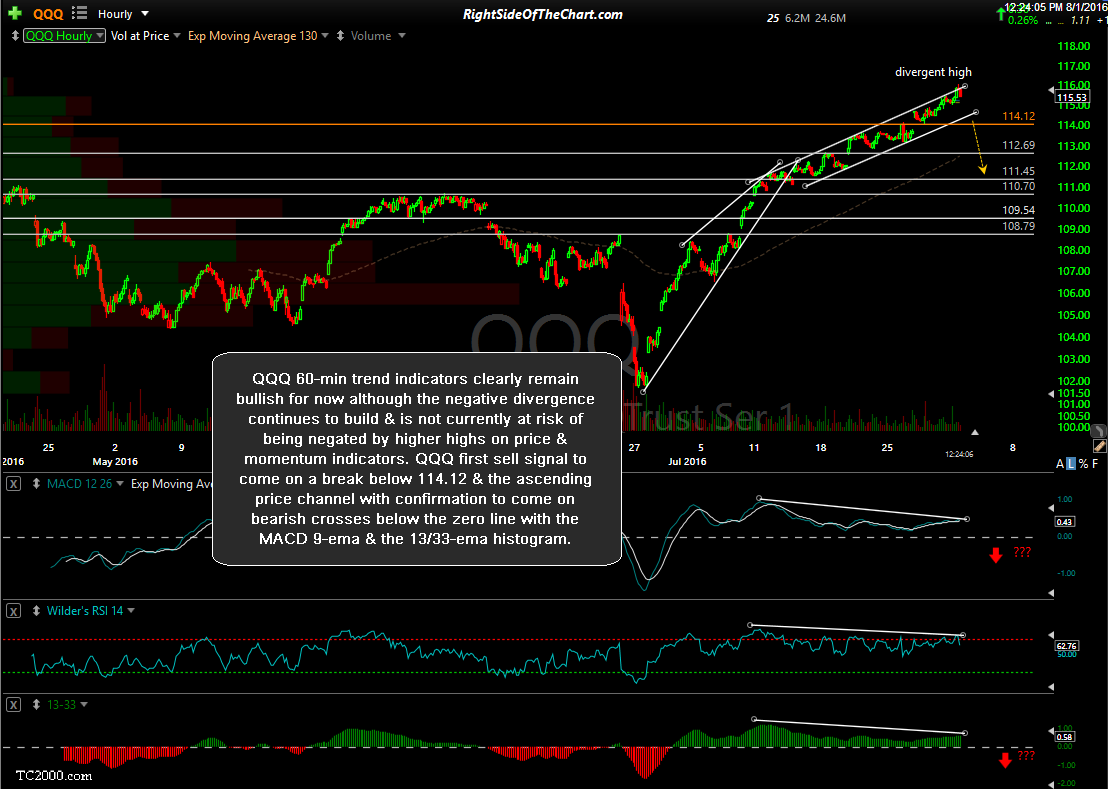

QQQ 60-min trend indicators clearly remain bullish for now although the negative divergence continues to build & is not currently at risk of being negated by higher highs on price & momentum indicators. QQQ first sell signal to come on a break below 114.12 & the ascending price channel with confirmation to come on bearish crosses below the zero line with the MACD 9-ema & the 13/33-ema histogram.

Nice ‘goal-line’ defense at the zero lines on the 60 minute trend indicators for the SPY. Still awaiting a break below this uptrend line & the 215.30 level as well as zero line crosses on the MACD 9-ema & 13/33-ema pair. Highest probability short entry will come on 60-minute closing candles below both of the aforementioned levels on the SPY & QQQ. With the recent extreme low short interest levels in many of the leading stocks, my expectation is for a relative swift move down once these support levels break & very little, if any reaction at the first support level shown below on these charts as there won’t be the usual amount of traders already positioned short looking to book profits or exit a losing position on the first pullback.

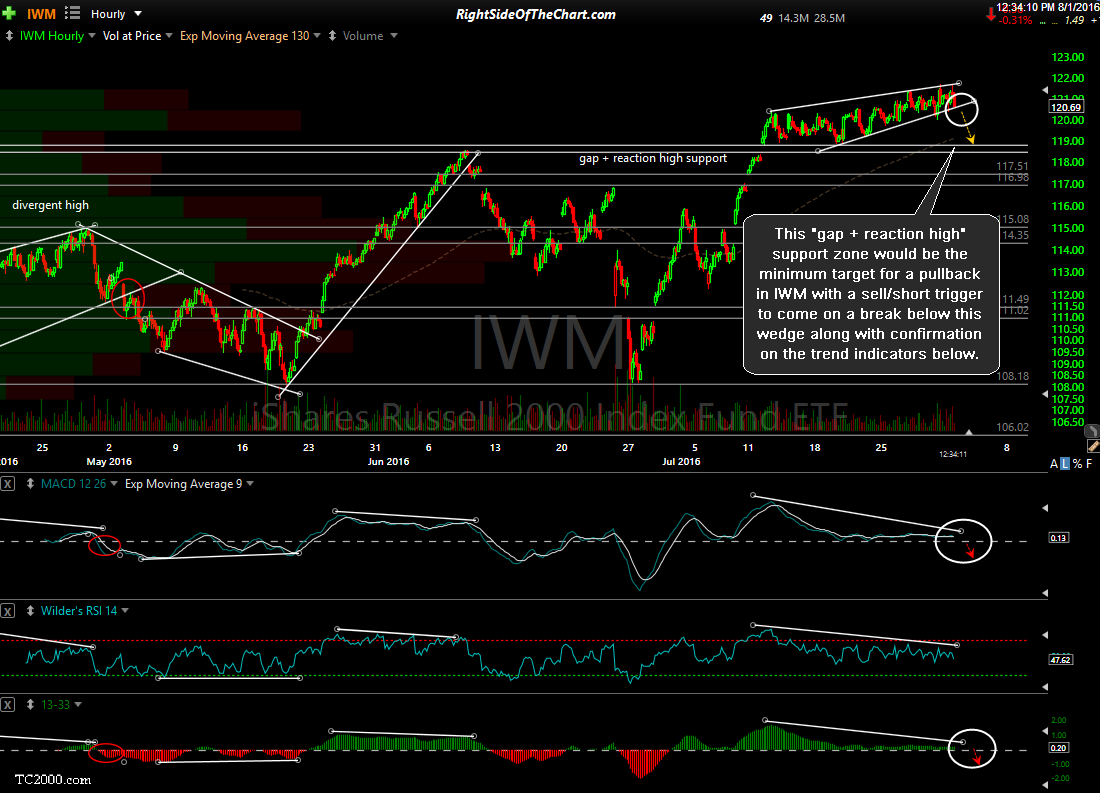

This “gap + reaction high” support zone would be the minimum target for a pullback in IWM with a sell/short trigger to come on a break below this wedge along with confirmation on the trend indicators below. Until then, the trend remains bullish as the markets continue to grind sideways to slightly higher on waning momentum.