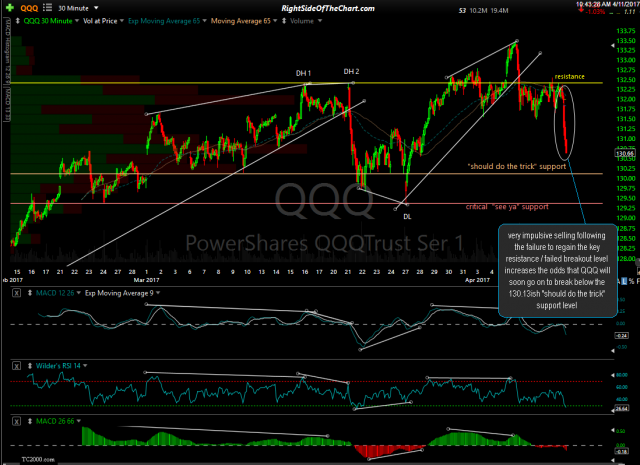

Very impulsive selling following the failure to regain the key resistance / failed breakout level increases the odds that QQQ will soon go on to break below the 130.13ish “should do the trick” support level. Yesterday’s & today’s updated 30-minute charts:

- QQQ 30-min April 10th

- QQQ 30-min April 11th

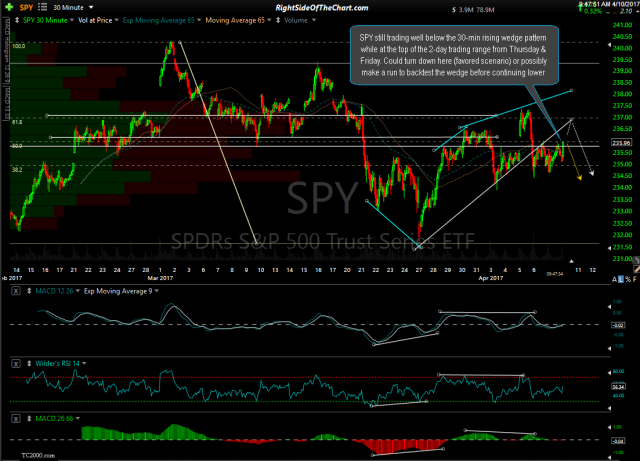

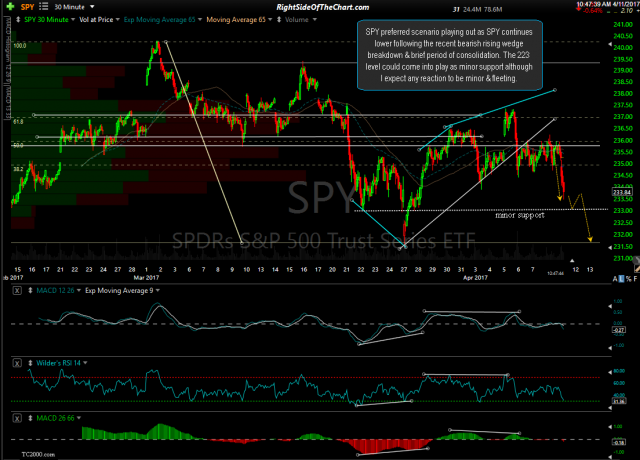

SPY preferred scenario playing out as SPY continues lower following the recent bearish rising wedge breakdown & brief period of consolidation. The 223 level could come into play as minor support although I expect any reaction to be minor & fleeting. Previous & updated 30-minute charts:

- SPY 30-min April 10th

- SPY 30-min April 11th

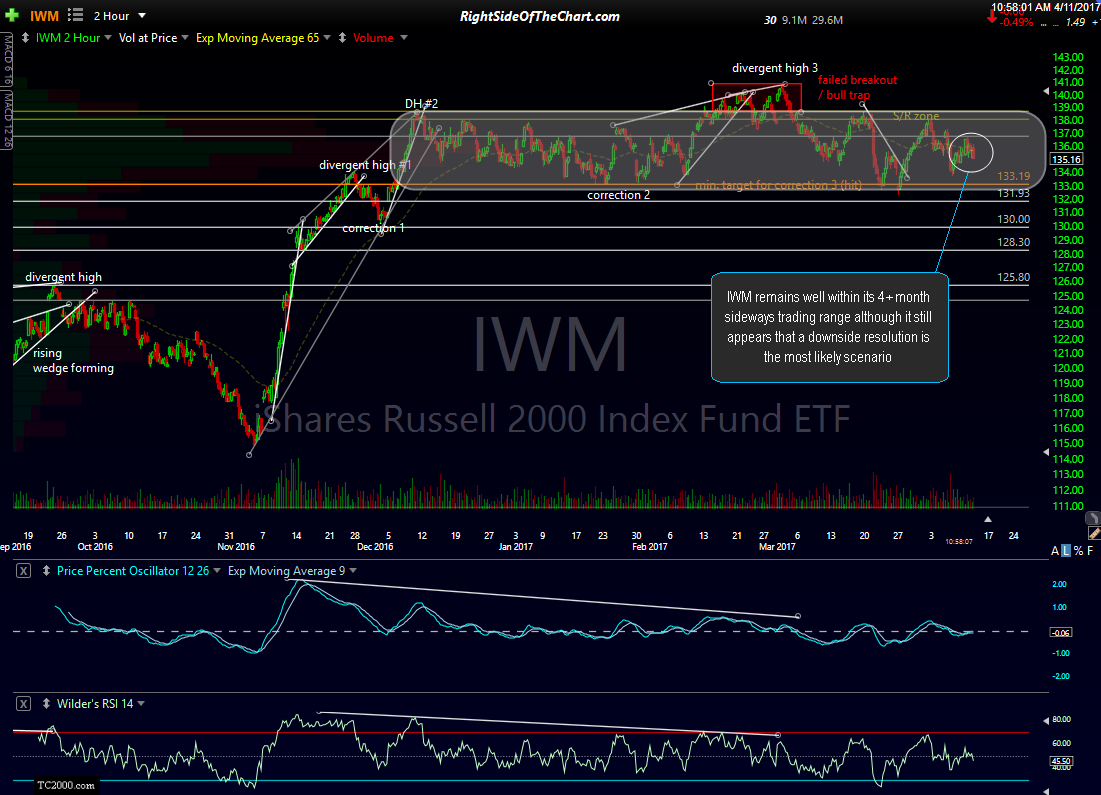

IWM remains well within its 4+ month sideways trading range although it still appears that a downside resolution is the most likely scenario. 120-minute period chart: