Immediately following the opening bell today, both of those small bullish falling wedge patterns that were posted in the pre-market update broke out with impulsive moves above the wedges. I’ve added two price targets above the bullish falling wedge on /NQ, slightly favoring a reversal here at T1 although I expect a lot of “noise” until Powell finished his 2 speeches tomorrow & Thursday.

Likewise, /ES (S&P 500 futures) has broken out above the small bullish falling wedge along with /NQ & I’ve added a likely price target/stopping point for the rally at 2978.

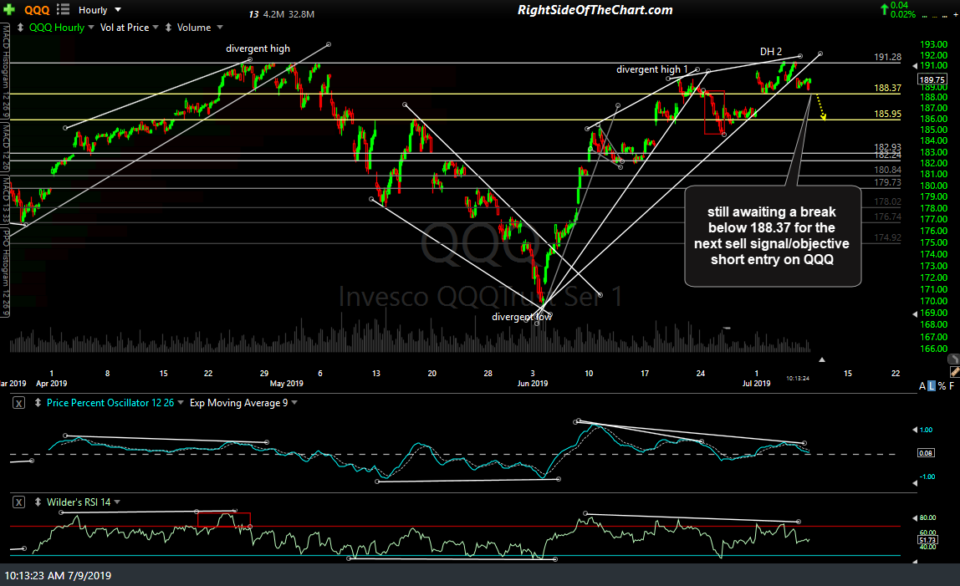

On the QQQ 60-minute charts, I’m still awaiting a break below 188.37 for the next sell signal/objective short entry on the Q’s.

Trading is likely to be choppy before & after J. Powell speaks later this week but my best guess is that SPY resumes the near-term downtrend anywhere from current levels to as high as a backtest of the recently broken rising wedge pattern so either way, the R/R remains skewed to the downside at this time. 60-minute chart below.