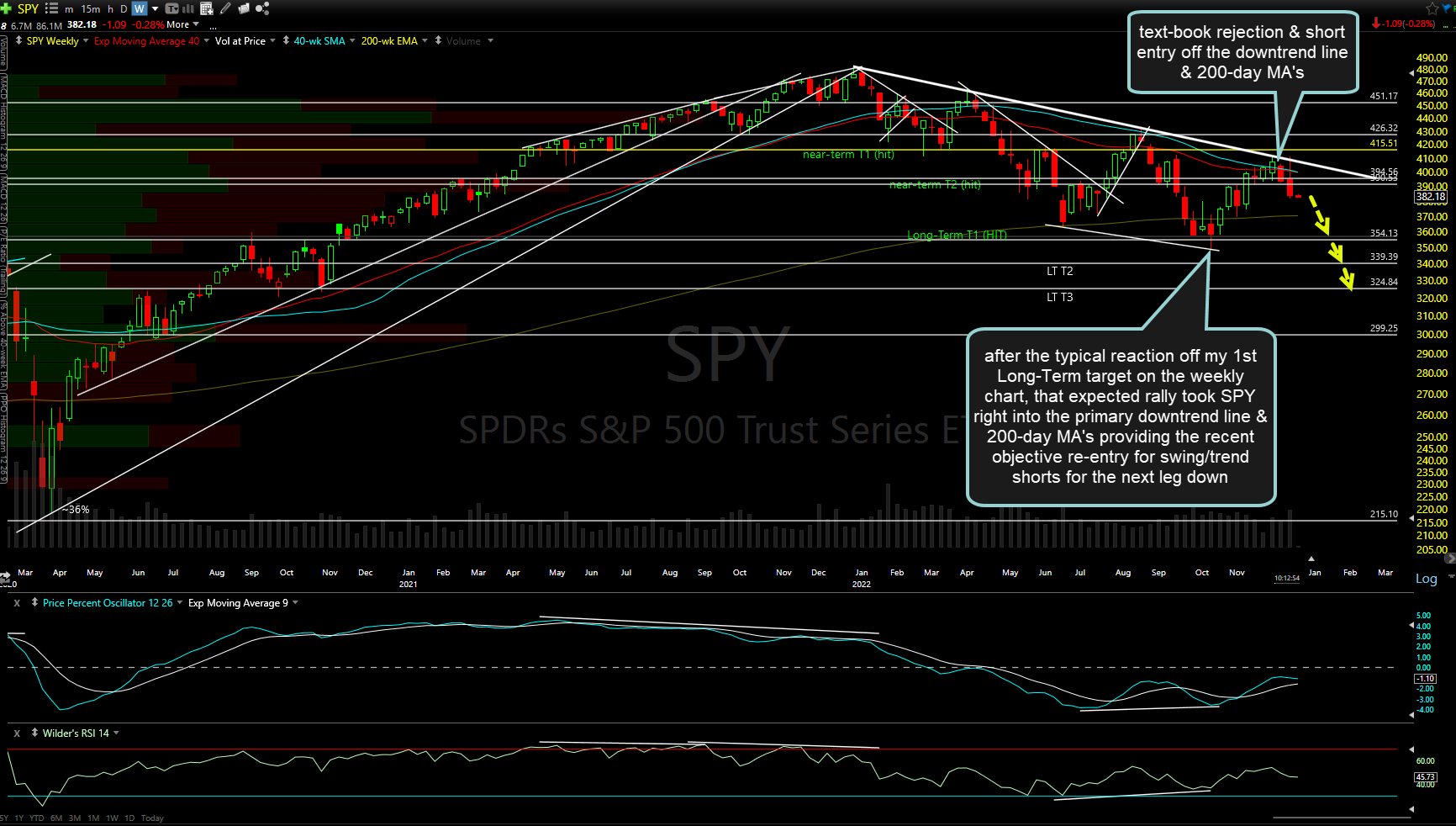

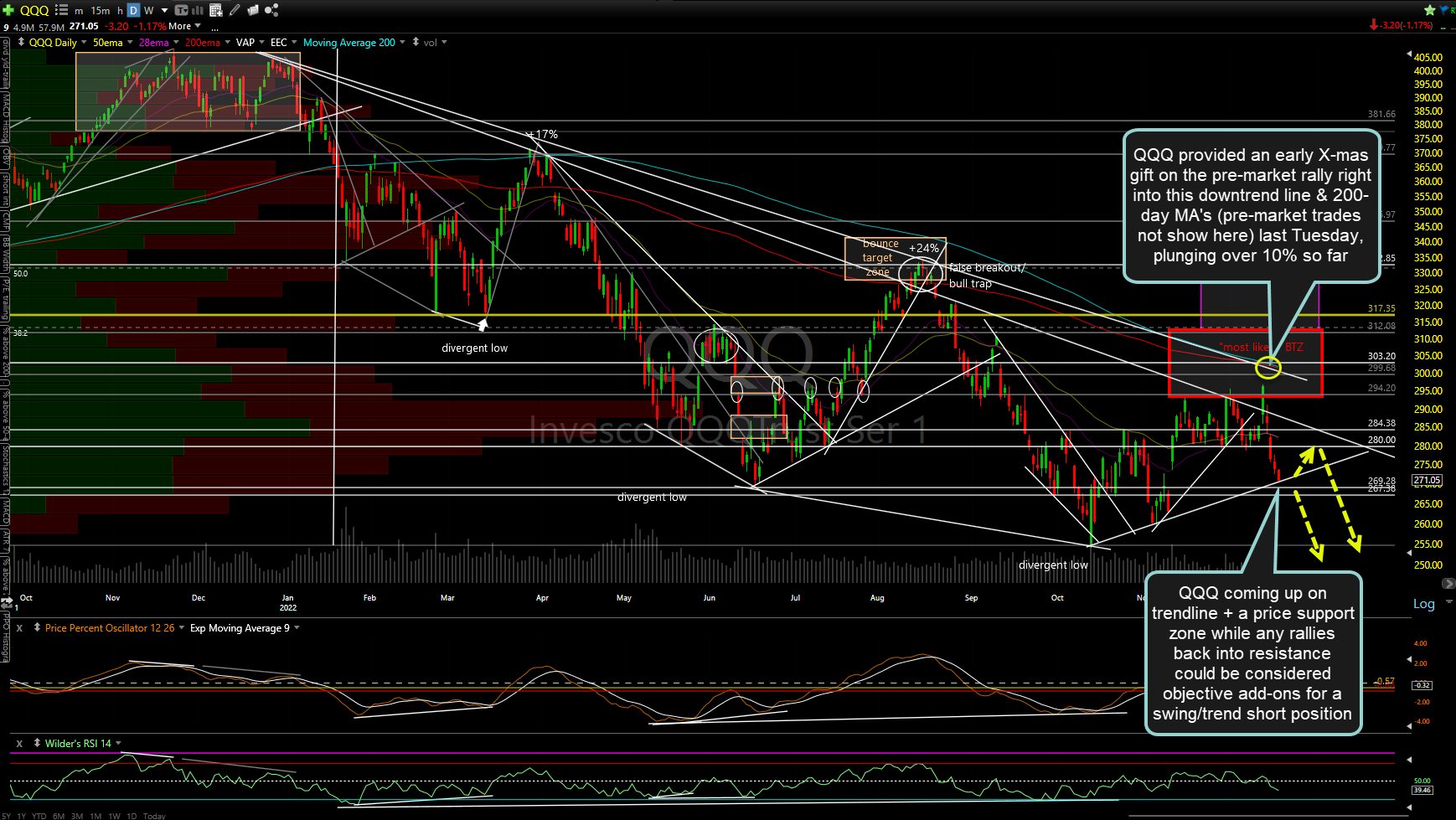

For longer-term swing & trend traders with their eye on the prize (my next & final targets on the weekly charts of SPY & QQQ, the price action over the past week has significantly bolstered the case that the bear market rally off the mid-October lows may have fully run its course with the next major leg down in the bear market now underway with text-book rejections & about the most objective short entries one can ask for off the downtrend line & 200-day MA’s last week. While that or really anything in the financial markets is a certainty, I can say that any rallies back into resistance and/or solid breaks below key support levels will provide objective add-ons for those still scaling into short positions. Weekly charts below.

Zooming down to the daily chart of SPY, with the next leg down in the bear market quite likely underway, any rallies back to resistance will provide objective add-ons to a swing/trend short position although the rallies are likely to get sold into at an accelerating pace if this current 380ish support is clearly taken out. Based on where I think we might be in the larger (bear market) scheme of things, I’m starting to & will continue to become less interested in trying to game any counter-trend rallies by covering shorts & going long for the bounce (in my active trading account…still sitting tight with core swing/trend short positions), especially if/when the support levels just below are clearly taken out.

QQQ coming up on trendline + a price support zone on the daily time frame where the odds for a reaction are elevated while any rallies back into resistance could be considered objective add-ons for a swing/trend short position, such as the early X-mas gift that was given to us on the pre-market rally right into this downtrend line & 200-day MA’s (pre-market trades not show here) last Tuesday, plunging over 10% so far. At this point, a rally back to just below the 280 resistance would be another ‘gift’, IMO.