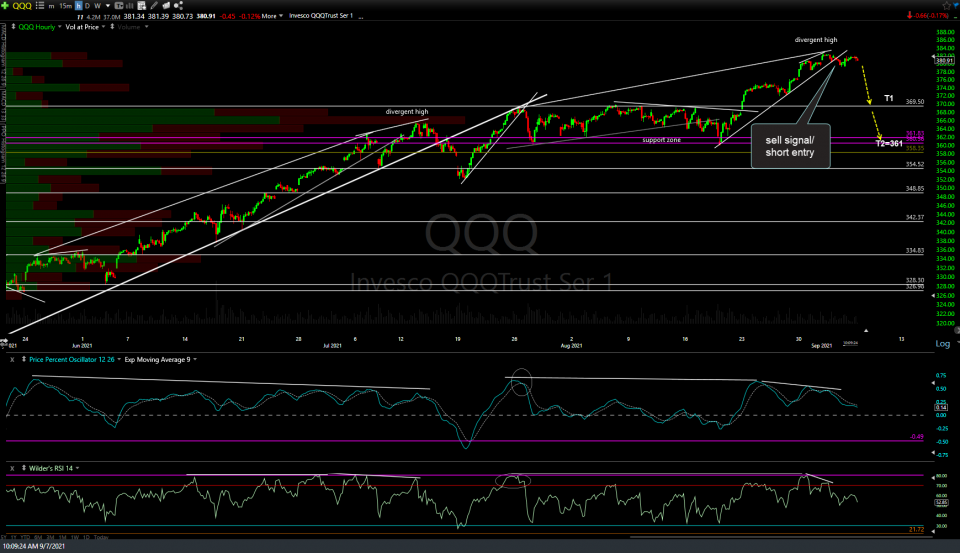

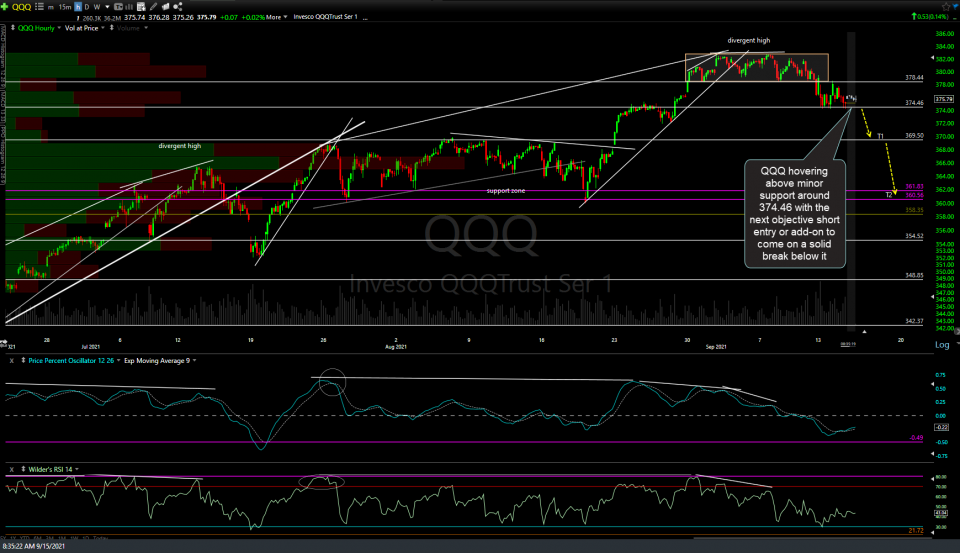

QQQ has been hovering above minor support around 374.46 with the next objective short entry or add-on to come on a solid break below it. Previous & updated 60-minute charts below.

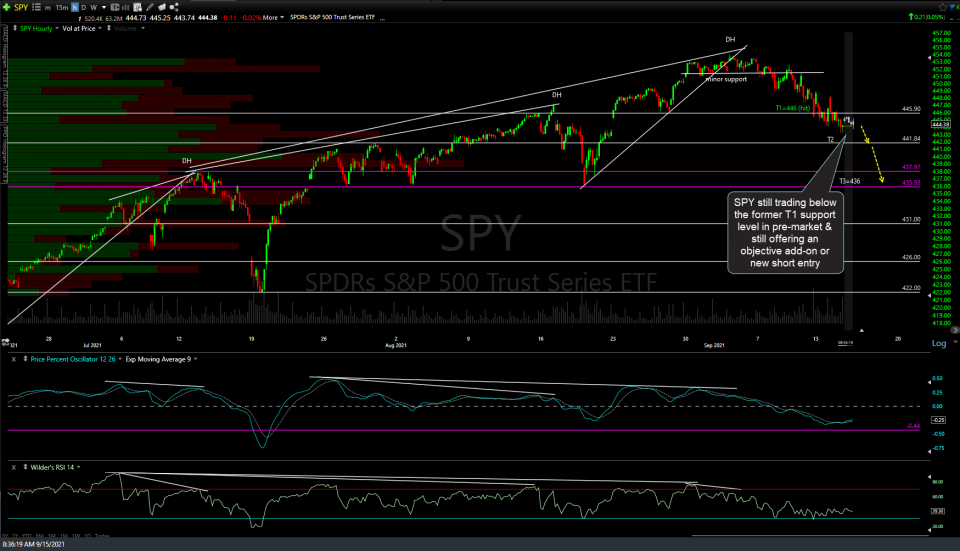

SPY is still trading below the former T1 support level in pre-market & still offers an objective add-on or new short entry although it would be preferable to wait for the next aforementioned sell signal on QQQ.

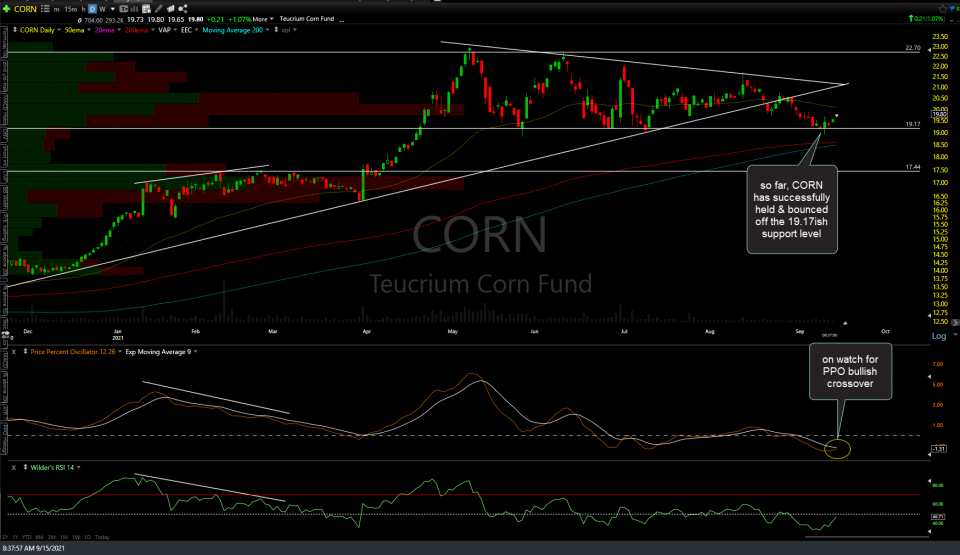

So far, CORN (corn ETN) has successfully held & bounced off the recently highlighted 19.17ish support level. Daily chart below.

The first chart of AMC below was posted in the comment section under yesterday’s Stock Market Analysis & Swing Trade Ideas 9-10-21 post, highlighting the stock trading at resistance with a sell signal to come on a break below the uptrend line.

From there, AMC was rejected off the top of the resistance zone & closed below the trendline yesterday, & currently appears poised for more downside today. If this morning’s pre-market losses stick, that should help to solidify the sell signal & provide another objective short entry or add-on for a swing down to my next price target (T2 zone).