Today marked the second consecutive red close following the recent 60-minute bearish rising wedge breakdown & backtest on QQQ (same uptrend line as shown on this daily chart). The initial leg of the new year rally stopped cold at the top of my “most likely” bounce target zone (first laid out around the start of the year) back in early February with this second leg & now divergent high also capped there so far.

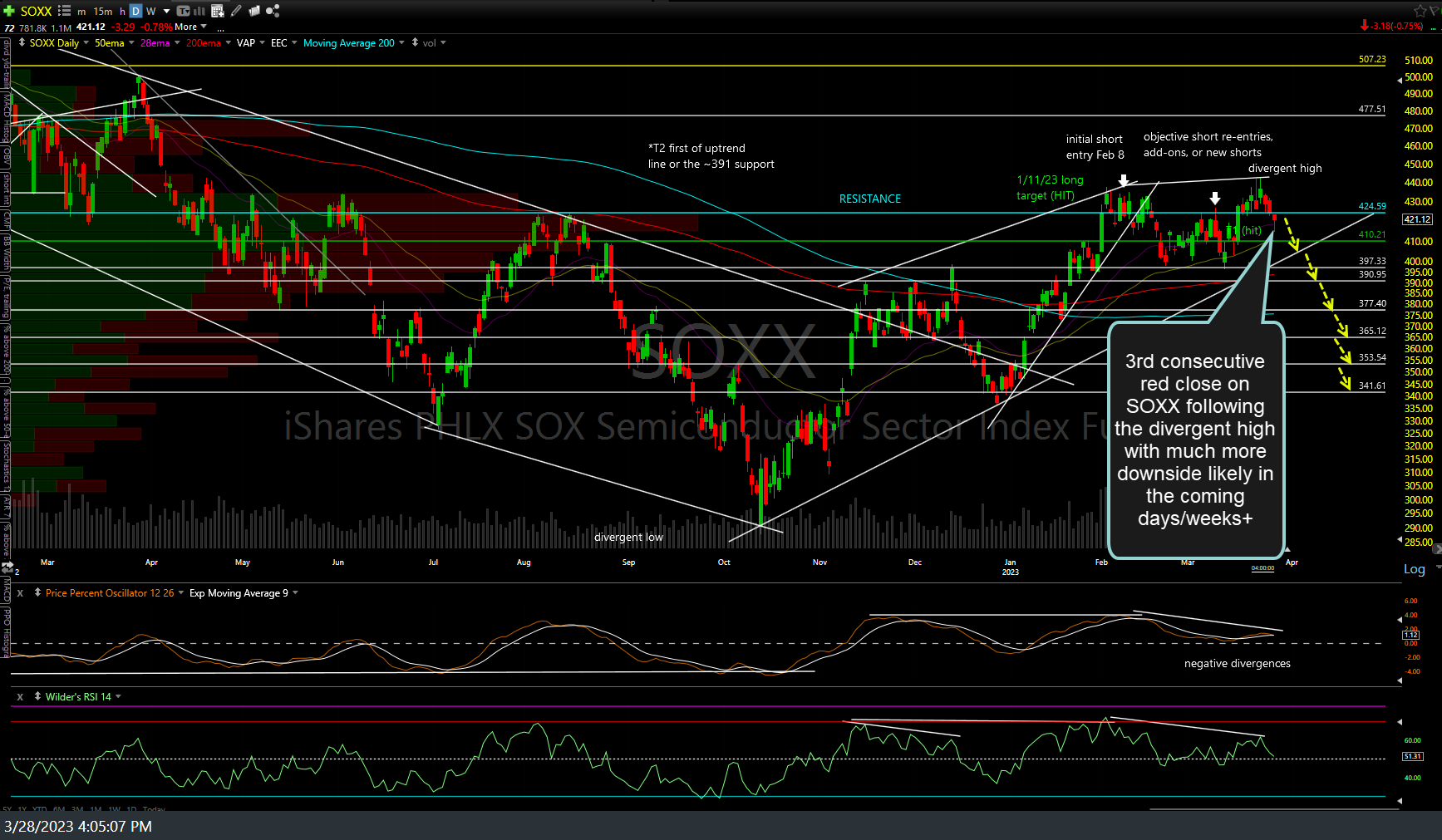

Today also marked the third consecutive red close on SOXX (semiconductor sector ETF) following the divergent high on the 60-minute & daily chart (below) with much more downside in the coming days/weeks+ still likely IMO.